Q1 2025 Industry Update

by Bibiana Rais | 05 Apr 2025

Q1 2025 Industry Update

DOGE, MAJOR PROGRAMS, M&A: THE FUTURE OF GOVCON IS BEING SHAPED TODAY.

We have been writing this newsletter since 2019, and every quarter has seemed truly disruptive at the time (Afghan withdrawal, Ukraine invasion, government shutdowns, elections, etc.). The first quarter of 2025 has brought historical transformation to the defense and government contracting landscape. Shifting policies, evolving global dynamics, and major structural changes are reshaping how agencies operate and how companies position for the future. In this environment of disruption and opportunity, Precision Talent Solutions (PTS) is pleased to present our Q1 Industry Update - an informed overview of the key trends, contract activity and market shifts defining the GovCon space. With a decade of experience, PTS continues to serve as a strategic partner to government contractors, offering specialized expertise in executive search, talent management, and competitive market intelligence. This report highlights the forces driving changes across defense, diplomacy, foreign assistance, and acquisition, helping industry leaders make informed decisions in this evolving landscape.

Key Trends Shaping Government Contracting:

- Cut the fat, grow the muscle! — Defense Secretary Hegseth has launched a sweeping reform initiative to repurpose 8% of the defense spending—approximately $50B over five years, beginning in FY26 from non-lethal programs to the initiatives impacting the warfighter. There is discussion of combining COCOM’s to significantly reduce general officer and SES headcount while creating other synergies. Will this be a shift from the military to outsourcing to contractors, or will this cut deep into contracting opportunities?

- Federal Workforce Talent Migration — The Trump administration imposed a March 13 deadline for agencies to finalize workforce reduction plans. The Pentagon aims to reduce by 8%, impacting up to 60,000 positions, including 21,000 voluntary exits. Broader implications for contractor talent pipelines are expected across DOD and other federal and civilian agencies. Meanwhile, agencies in the Washington DC area are being asked for plans to relocate to less costly locations. Refer to the Government Executive’s tracker for details. Will these displaced professionals go into government contracting, SLED positions, or enter the private sector workforce?

- USAID Shutdown & Realignment of US Foreign Assistance — The White House initiated a freeze on foreign aid and a structural review that led to the shutdown of USAID and the termination of 5,200 out of 6,200 USAID programs (83%; $60B). Remaining programs are being absorbed by the State Department, signaling a fundamental shift in foreign assistance priorities. What happens to thousands of international workers around the world who have spent their careers supporting US foreign policy?

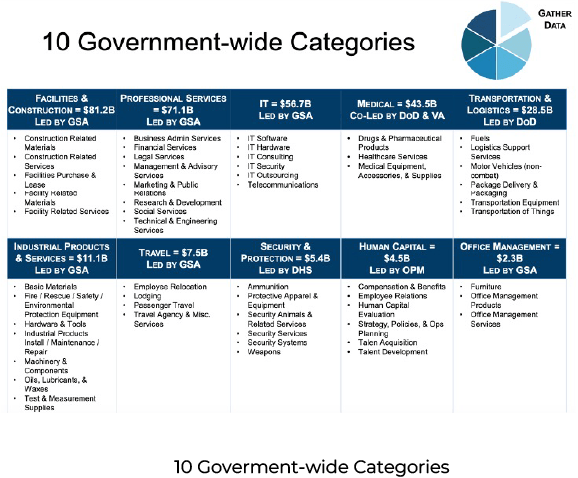

- GSA Procurement Consolidation — GSA is expected to quadruple in size and take on an expanded role in 2025, managing up to $400B in federal procurement, including consolidation of major IT GWACs and domestic acquisition vehicles. What are the implications for primes targeting this contracting agency and how does this impact Small Businesses as contracting opportunities consolidate?

- Transatlantic Divide & Ukraine Peace Talks — The US has clearly signaled a shift in policy to European self-reliance for Defense. Meanwhile, the US spearheaded direct negotiations with Russia resulting in a preliminary Black Sea ceasefire and halts on attacks against energy infrastructure. The limited roles of Ukraine and European allies in talks has sparked controversy and underscored a growing rift in transatlantic strategy – signaling a broader redefinition of the European security order. What is the impact on OCONUS programs for the US and the European Defense Industrial Base capacity?

GovTech: Navigating Disruptions & Strategic Shifts

The GovCon landscape is shifting rapidly—delays, cancellations, and restructuring. Programs like MAPS ($50B), MSD ($10B), and ARDAP ADP 2.0 ($1B) have been delayed or cancelled, creating pressure while also presenting opportunities. Contractors are responding with a dual-track strategy: capturing near-term task orders while positioning for long-term growth. Vehicles like RS3 and ITES-3S continue to support on-contract growth in RDT&E and IT services. Government contractors are also expanding across trusted contract vehicles such as GSA MAS, Alliant 2, OASIS+, DISA ENCORE III, and specialized vehicles like LOGCAP V, ATSP4, ADMC-3, and MTCCS II.

Alternative acquisition pathways are gaining traction – including flexible acquisition strategies such as contract support orders with 2–4-month award cycles, Small Business Innovation Research (SBIR) with over $3.5B in funding, and Other Transaction Authority (OTA) worth over $7.7B+ in fast-track, FAR-exempt opportunities.

PTS has expanded our GovTech recruiting bench to deliver specialized talent across Cloud, Cyber, Software, and AI. Whether you need executive leadership or technical depth, we deliver transformative talent. As the market shifts, so should your strategy. PTS’ partners at Red Team Consulting offer expert guidance to help you with growth, capture, and proposal development. Contact Blake Harvey for tailored support.

MAJOR PROGRAMS

ARMY

LOGCAP V — As of the end of 2024, LOGCAP V reached its midpoint with approximately $9.3B (12%) of its $82B ceiling utilized across 35 awarded task orders. A major development was the attempted integration of Army Prepositioned Stock (APS) support – covered in our2024 Year-in-Review. Looking ahead, the APS consolidation has been delayed by protests and changes in the Administration. As we hit the mid-point for this pace-setting program, the Army Sustainment Command faces a strategic decision: recompete all TO under a potential “LOGCAP 5.5” or begin planning for LOGCAP VI? As time goes by, it seems that the strategy will default to the latter option. Additional growth is anticipated in the NORTHCOM AOR, with potential tasks including comprehensive immigration-related logistics, camp support, and mass deportation infrastructure and services. The footprint in EUCOM would seem to be in retreat, while focus continues to INDOPACOM as the Army postures for the Pacific Deterrence Initiative.

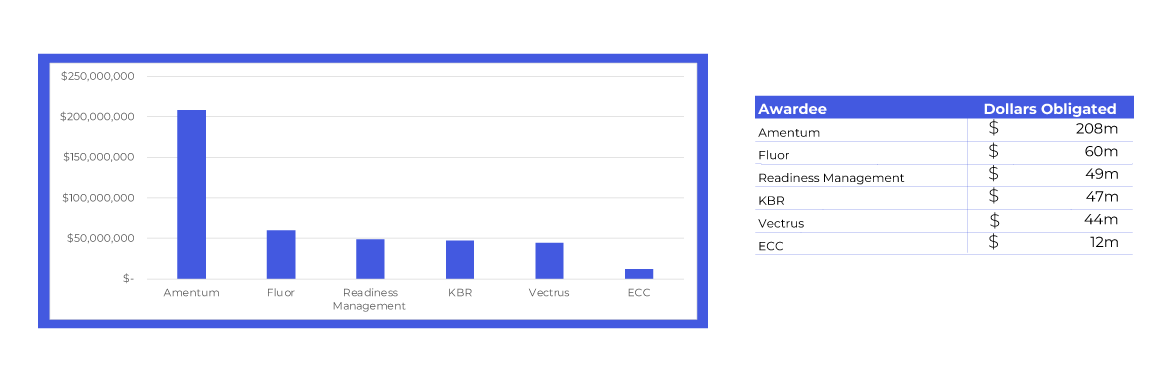

LOGCAP V - Spending to Date (Q1 2025)

LOGCAP V - Spending to Date (Q1 2025)

PTS continues to support LOGCAP primes with cleared high-impact talent – from PMO leadership to technical staff – ensuring speed, scalability, and mission alignment.

USACE — Now in its 250th year, the USACE manages a $95B portfolio spanning military construction, civil works, and disaster response. FY25 Spend Plan is under development, with enterprise and MILCON opportunities under review.

- MFSS IIIb: $210M awarded to 8 vendors for Defense Health Agency medical facility support, following the $738M MFSS IIIa award in late 2024.

- MRR: $260M contract awarded to 17 vendors for design-build and renovation of critical medical infrastructure worldwide.

- (IMCOM-E) custodial services MATOC: JJWWS awarded a $220M contract for custodial support at Army Garrisons in Germany, Belgium, Luxembourg, Bulgaria, and Romania.

- INDOPACOM Support: Tetra Tech won 3 contracts totaling $416M for civil works and infrastructure services in the INDOPACOM region.

- MAPS: The fourth and final draft RFP for the $50B IDIQ dropped in March, RFP on hold and expected to be delayed to Q4.

- DEWESoft: RFOs for Sirius Data Acquisition System were collected on March 25; RFP anticipated in Q3.

- Nett Warrior: ACI secured a $276M contract to support dismounted soldier situational awareness.

- Simulation Systems: ACC awarded 10 companies a $921M, 10-yeat contract for tactical simulation maintenance and lifecycle support.

- SETAF: Peraton was awarded a $121M contract for strategic mission support to the Southern European Task Force-Africa.

PTS continues to deliver top-tier engineering, construction, environmental, and architecture talent to USACE and NAVFAC programs worldwide, leveraging a global network of licensed engineers across discipline (ME, EE, CE, etc.).

NAVY

WEXMAC 2.0 –In December, NAVSUP awarded the $2.85B, 10-year Worldwide Expeditionary Multiple Award Contract (WEXMAC 2.0) to 87 vendors for expeditionary logistics and operations. Several task orders were released in Q1, with more expected in support of southern border operations. As with most large MATOC’s, it will be interesting to see which primes focus to consolidate workshare, even attracting non-Navy customers to this flexible contracting vehicle.

MACC—RFP is out for the Multiple Award Construction Contract (MACC), a $8B IDIQ for large-scale infrastructure projects in the U.S. and abroad; proposals due April 15.

OCONUS NAVY BOS Update

- Diego Garcia: RFI responses were collected in July 2024; RFP delayed to Q2.

- Sigonella: RFI issued April 2024; RFP significantly delayed, now expected Q3.

- Souda Bay: Proposals submitted in January; award anticipated Q3.

- Djibouti: KBR continues services under $100M contract; recompete began Q2, award expected Q3.

- Poland: V2X is executing a $98M contract.

- Singapore: Centerra is delivering services under the $54M contract (through 2032).

- NSA Naples: Valiant/Alca JV awarded $78M to support over 50+ commands and ~8,500 personnel.

PTS brings a proven legacy of support to Navy BOS programs worldwide, leveraging a deep bench of licensed engineers, former Navy CECs and Seabees, and seasoned PMO task order management.

- NAVFAC Southeast awarded a 5-year, $249M IDIQ MACC to five firms—including RQ Construction, Centerra, and King and George—for construction services at NAVSTA Guantanamo Bay, covering new buildings, renovations, and infrastructure upgrades.

- SeaPort NxG added 1,023 vendors under its 2nd rolling admissions to a 4-year IDIQ worth ~$5B annually, supporting engineering, program management, logistics, R&D, and other professional services across 23 functional areas.

- RMC 2021 secured a $95M IDIQ to provide mission assurance and infrastructure assessments for Navy facilities worldwide, including facility-related control systems.

- V2X received a $100M contract to support the Navy’s Aegis Ashore operations in Poland.

- Cherokee won a $175M contract for logistics support to the Marine Corps, awarded competitively via SeaPort-NxG.

AIR FORCE

AFCAP V– AFCAP continues to be a contracting vehicle of choice for the Air Force to support Engineering, Airfield Operations, and Life Support around the world. KBR secured an $85M TO to deliver AM-2 matting repair kits for global airfield operations. Services include procurement, assembly, and door-to-door delivery to USAF sites worldwide.

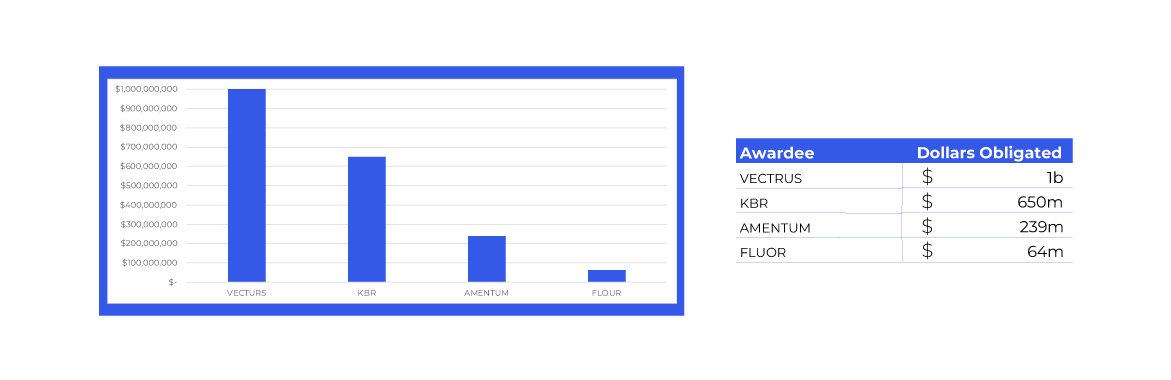

AFCAP - Spending to Date (Q1 2025)

AFCAP - Spending to Date (Q1 2025)

With growing demand for contingency support under AFCAP V, PTS is well-positioned to deliver cleared, deployable talent across engineering, logistics, and airfield operations.

Other Air Force programs:

- HII was awarded a 5-year, $296M task order to support USAFE-AFAFRICA air and space operations, providing technical and analytical services for C2, air defense, and ISR missions.

- Andruil received a $99M IDIQ under Phase IIII of the Thunderdome SBIR initiative to prototype decentralized data-sharing networks using its Lattice software platform.

- KBR secured a $176M contract under the ASTRO program to provide equipment maintenance and modernization for space domain awareness at the AF Maui Optical and Supercomputing Site in Hawaii. LinQuest a KBR company, won a $970M contract to support USAF with digital engineering services.

- EWAAC expanded with 122 additional vendors under its $46B ceiling to accelerate the development of agile, next-gen weapons systems.

- V2X won a $21M contract to sustain critical avionics and EW systems, supporting B-52, B-1B, and C-130 fleets.

- Boeing was selected over Lockheed Martin to produce the F-47, the next-generation fighter to replace the F-22 and operate alongside semiautonomous platforms.

Defense Logistics Agency (DLA)

As we enter 2025, DLA’s program outlook remains uncertain with many large programs in prolonged acquisition processes. Industry partners continue to voice concerns about prolonged procurement timelines, particularly under DOGE efficiency reforms. These extended cycles strain proposal validity and increase risk for bidders.

Subsistence Prime Vendor (SPV) Programs

- The SPV contract award for Iraq, Jordan, Kuwait, and Syria is anticipated in Q2.

- An RFP for Northern Europe’s full line food distribution program is open, with proposals due April 15. Unlike previous multi-zone strategies, this solicitation stands alone to enhance competition.

- SPV Southern Europe’s RFI was released last April; RFP expected in Q3.

- Awards for Japan, Singapore, Philippines, Diego Garcia, and Australia are expected in Q2.

- DLA is reviewing a revised acquisition strategy SWAEA to integrate existing SPV Programs in SAPNEA, Bahrain, Qatar, and KSA.

- An RFI for Norfolk land customers, including Guantanamo Bay, Cuba, and Honduras, closed Jan 10; RFP expected in Q3.

Maintenance, Repair & Operations (MRO) Programs

- DLA collected RFIs on April 1 for the Pacific Region MRO contract (Zone 1 &2); RFP expected in Q3.

- Noble, TWI, and SupplyCore continue supporting $916M MRO Europe & Africa contracts through May 2026; recompete begins Q3.

- The CONUS-Alaska-Hawaii RFP was (issued in 2021) remains under evaluation. Bridge contracts continue across 12 Zones pending final award.

- PTS supports DLA primes through all phases - bid, proposal, and contract mobilization – with a large talent pool of logistics and MRO specialists.

In January, DLA awarded $4.9B in MRO contracts to ASRC Federal ($3B for Northeast Zone 1) and Noble Supply ($1.9B for Northeast Zone 2). ASRC’s win builds on its 2023 acquisition of SAIC’s logistics and supply chain business. Both firms previously held $60M bridge contracts issued in June 2024. The new awards run through January 14, 2027, with a two-year base and four two-year option periods.

Department of Homeland Security (DHS)

Significant policy changes are shaping DHS strategy, with enhanced focus on border security, immigration, and enforcement. ICE and CBP funding increases have accelerated operations and infrastructure expansion across the southern U.S. border. Many companies that previously provided immigration support under Health and Human Services (HHS) Office of Refugee Resettlement (ORR) are now shifting focus to DHS where the funding seems to be moving for border support.

ICE Detention IDIQ— In response to the Presidential Proclamation Declaring a National Emergency at the Southern Border, ICE issued a solicitation on April 1 for emergency detention and related services. The requirement will be fulfilled through multiple IDIQ awards covering facility operations, security, medical care, transportation, legal resources, and detainee management nationwide. Offerors may propose support for one or more service objectives. Proposals are due by April 7, with a 2-year performance period beginning April 14.

- Leidos received a $2.63B, 7-year contract from TSA for checkpoint maintenance services, integral to airport security.

- Granite Construction won a $168M TO from CBP under the Border Infrastructure IDIQ for a task involving barrier gap design and construction work along the southern U.S. border.

- Dev Technology Group received a $43.8M GSA MAS delivery order to support CBP’s ACE and ATAP platforms and received a $15.5M contract to provide soft-sided facilities and support services in Yuma, AZ which falls under the existing $1.75B CBP BPA for Southwest border infrastructure.

- CSI Aviation secured a $151M contract to provide air charter services for ICE’s enforcement operations.

STATE DEPARTMENT

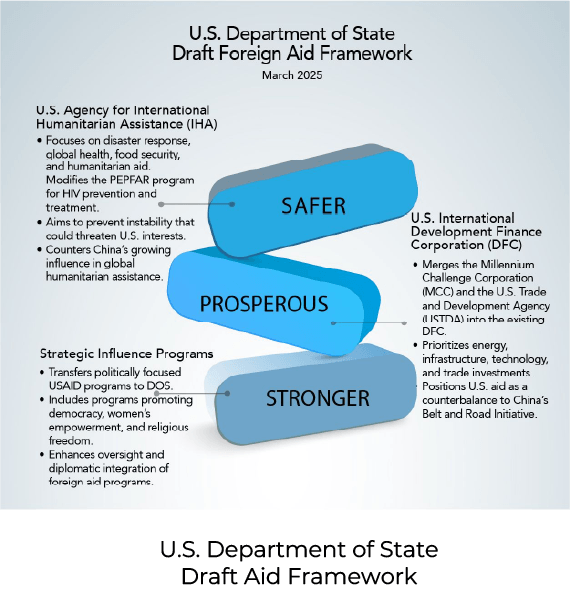

Foreign Assistance Restructuring in Progress – The State Department (DOS) is undergoing a sweeping restructuring to absorb USAID, following the termination of 5,200 out of 6,200 programs, approximately $60B. The realignment introduced a new foreign aid structure centered on economic prosperity, security alignment, and global influence, with emphasis shifting from governance and stabilization to commerce, trade, energy, and urgent health.

DiPSS — KBR secured a $187M MedSSI TO to operate a diplomatic hospital and clinics supporting 4,000+ personnel across Iraq. Ac4S received a $178.6M modification, raising the CARE TO to $365M.

Global Advisory – RFP was released in January for this $250M, 5-year, multiple-award IDIQ contract which replaces GASS and AF Advisory IDIQs. Proposals are due May 6 across full/open and SDVOSB/WOSB pools. Scope includes advisory, OCONUS logistics, evacuation support, and sustainment.

GLOBALCAP – This long-anticipated $5B IDIQ award – consolidating AFRICAP and GPOI – is expected Q2. Services include training, logistics, O&M, specialized procurement, and construction.

GATA III—Awarded to Amentum, IDS, Linxx, and Sincerus, the $765M, 5-year IDIQ saw early TOs for Iraq and Kenya halted by protest. As of Q1 2025, the contract remains under protest.

OBO — State’s Bureau of Overseas Building Operations (OBO) awarded American International Contractors (Special Projects) a $68.9M design-build contract for the new U.S. Consulate in Durban, South Africa. Futron was awarded a $36.9M design-build renovation contract for the U.S. Embassy in Bern, Switzerland; completion expected July 2027. Cadell won a $171M secure facilities contract at the U.S. Embassy in Buenos Aires, Argentina, and a $262Mconstruction contract for the new consulate in Adana, Turkey.

PTS provides support to prime contractors in foreign assistance, global health, capacity building, and diplomatic mission support.

EUROPE’s DEFENSE SECTOR

As the U.S. shifts focus to domestic priorities, Europe is stepping up its security responsibilities – spurring a redefinition of the post-WWII defense framework and fueling defense sector growth across the continent.

- Flagship Security Initiatives – In March, the European Commission launched Readiness 2030, a sweeping plan to “ReArm Europe” with up to $840B in defense investment. The initiative addresses gaps in logistics, C2, ammunition stockpiles, and mobility.

- Spending Priorities * * – Europe’s defense accelerations include plans to increase military readiness, the European Sky Shield Initiative ** ** (ESSI) ** ** for joint procurement, the NSPA’s procurement of 1 million artillery shells, Latvia’s coalition for 30,000 drones for Ukraine, increased funding for cyber / electronic warfare, and investments in air-to-air refueling, land border installations, and military mobility. The UK, U.S. and Turkey are excluded from €150B EU defense fund earmarked for weapons procurements from EU-based defense companies. Germany passed a constitutional amendment permitting an additional $500B in defense spending.

- Ukraine Support — The EU and its member states have allocated a total of €267B in aid to Ukraine. The EU Ukraine Facility launched a €50B fund to support Ukraine’s defense and reconstruction. France will deliver $211M in military aid to Ukraine using the interest from frozen Russian assets. Italy ** ** has ** ** authorized its 9th military aid decree, totaling €1B for 2025.

- Defending Europe – Initial estimates suggest 300,000 troops and defense spending of at least €250B in the short term to deter Russian aggression.

- European Defense Modernization & Contract Awards — Airbus secured €16.7B in new orders, including upgrades to the Eurofighter Typhoon and military satellite systems. BAE Systems reported a £9B Royal Navy submarine contract, a £77.8B order backlog, and a contract to expand 155mm artillery production. Leonardo was awarded a €300M contract for an additional 7 AW249 combat helicopters, bringing the total order to 47. Rheinmetall secured a $1.96B mobile communications contract, a $3.3B for platoon systems, and approved a JV with Leonardo (LRMV) to develop a new Italian Main Battle Tank (MBT) and Lynx platform for the Armored Infantry Combat System (AICS) program. Rolls-Royce secured a £9B contract to maintain and support the UK submarine fleet. MBDA, a pan-European JV between Airbus, the UK’s BAE Systems, and Italy’s Leonardo, won the Italian Navy missile supply contract, supporting the ESSI air defense system. Indra has secured a contract to equip the German Air Force with a space surveillance radar. Romania plans to acquire 150 Piranha 5 armored vehicles in 2025 to be delivered by GDELS as part of an €8B military upgrade. Kongsberg landed a $306M NSM missile deal with Denmark to modernize its Navy frigates. Nammo Group obtained new contracts to supply advanced artillery ammunition to the Norwegian Armed Forces. Hensoldt received a 350M contract extension for Eurofighter Mk1 radar.

- Mergers & Acquisitions—BAE signed an MoU with Repkon USA for advanced munitions. Leonardo has partnered with Turkey’s Baykar Technologies for UAV development. Finnish defense and technology company Patria has acquired a Belgium-based digital defense platform provider, Ilias Solutions, to expand its range of digital services. Saab and Ukrainian defense company Radionix have signed an MOU to establish a strategic collaboration on sensors and defense electronics.

As transatlantic demand surges, PTS stands at the forefront—uniquely positioned with European networks and global insight to deliver top-tier talent where it matters most. In a time of strategic shifts, we don’t just follow the trend—we lead it!

NATO/NSPA

Sweden officially joined NATO on March 11th! A revised defense spending target – likely above 2% - is expected at the June NATO Summit in The Hague, with several members moving toward 3%. NATO continues to advance capability initiatives across key domains to meet evolving strategic needs:

- Joint Procurement: The NATO Support and Procurement Agency (NSPA) is managing multinational joint procurement efforts, including NextGen Rotorcraft, Patriot SP, and Modular Air Defense Program (MADP). These initiatives aim to reduce costs through economies of scale while increasing interoperability across equipment, doctrine, and training.

- Innovation: NATO’s innovation ecosystem includes DIANA (Defense Innovation Accelerator for the North Atlantic), Tide Sprints and the €1B NATO InnovationFund, all aimed at supporting dual-use disruptive technologies such as AI, autonomous systems, and quantum systems.

- Force Readiness: The NATO Force Model (launched in 2024) aims for 500,000 troops at tiered levels.

- Strategic Planning & Policy: NATO has updated its Strategic Direction Plan to focus on the Black Sea, Arctic, and multi-domain operations. The Defense Planning Process (NDPP) continues to guide national contributions to collective defense.

- NSPA Spending: NSPA remains pivotal in NATO’s modernization efforts, spearheading significant projects such as the acquisition of Multirole Tanker Transport (MTT) aircraft and increasing contract utilization across key domains. Following the introduction of the 2023 NATO Defence Production Action Plan, NSPA has agreed to contracts totaling €10B, underscoring the Alliance’s increasing investments in collective capabilities.

NSATU Coordination –As of March 2025, NSATU (NATO Security Assistance and Training for Ukraine) is partnering with NSPA to streamline delivery of equipment, training, and logistics to Ukraine.

Procurement Pipeline—NATO currently has 29 high-visibility procurement projects underway, targeting areas such as air-to-air refueling, uncrewed maritime systems, C2 infrastructure, and advanced training platforms.

Military Exercises - Steadfast Dart 2025 began in February with 10,000 troops and marked the debut deployment of the Allied Reaction Force (ARF), NATO’s multi-domain rapid reaction unit. NATO also launched Flotex 25, a major multinational maritime exercise designed to enhance Allied naval cooperation.

Industry & Innovation Events

- TIDE Sprint 2025 took place in Helsinki, Finland (Feb 17-21), focusing on NATO’s digital transformation, AI integration, and cybersecurity preparedness.

- NSPA 2025 Industry Days include new focus areas such as Ammunition Supply Chain, NextGen RotoCraft (NGRC), and Clean Energy. The 2nd NGRC Industry Day will be held on May 27; registration is open through April 15th. A full list of the 2025 events is here.

- Reach out to Jim Shields, PTS’s in-house NATO expert, to discuss upcoming procurement opportunities and NSPA projects that match your firm’s strengths and growth objectives. You can also meet Jim face-to-face at the ISOA European Industry Event in Wiesbaden!

FMS

In FY24, the total value of defense articles, services, and security cooperation facilitated through the FMS system surged to $117.9B, a record-breaking 45.7% from $80.9B in FY23. This sharp reflects growing global instability, particularly in Ukraine and Israel, as nations rush to replenish stockpiles and enhance their military capabilities. High-demand items include jets, drones, helicopters, tanks, and air defense systems, reflecting shifting military priorities worldwide. The State Department managed 16,227 FMS cases in 2024, with a combined value exceeding $845B. The FY24 total includes $96.9B in arms sales funded by allied nations, $11.8B from the Title 22 Foreign Military Financing program, and $9.2B from DOD programs and select DOS initiatives.

As FY25 continues, major deals also continue to flow in Q1. Israel leads with approved purchases of missiles and other defense systems exceeding $10B, followed by Japan at $4.78B. Kuwait has secured a $1B contract for the design and construction of maritime and land facilities, including the Mohammed Al Ahmed Naval Base, the Ras Al Ard Naval Base, and additional logistics hubs. These deals highlight the ongoing reliance on U.S. defense technology and infrastructure development in allied nations.

Amid this unprecedented demand, the U.S. government has acknowledged inefficiencies in the FMS system and is signaling an overhaul to streamline the process by cutting red tape, accelerating deliveries, and reducing approval timelines from years to a more responsive timeframe.

The U.S. General Services Administration (GSA)

GSA is undergoing a significant transformation to become the central agency for all domestic federal procurement, with a portfolio expanding to $400B. A key component of this shift is the GSA’s “rightsizing initiative” within the Multiple Award Schedule (MAS), aimed at streamlining contracts to improve efficiency and lower costs. Additionally, GSA is revamping FedRAMP to accelerate cloud security approvals while reducing its Technology Transformation Services (TTS) by 50% to focus on essential, policy-driven work.

-

GSA Takeover of IT GWACs — GSA is assuming management of IT Government-Wide Agency Contracts (GWACs), centralizing procurement across multiple categories, including IT, professional services, and medical sectors.

-

NITAAC and NASA GWACS — The NIH Information Technology Acquisition and Assessment Center (NITAAC) currently administers several IT GWACs, including CIO-CS, which expires in 2025. CIO-SP3 and CIO-SP3 SB have been extended through April 2026 and were expected to be replaced in 2025 by CIO-SP4, which has faced significant delays. The fate of these and other existing GSA GWACs like Alliant 3, the ASCEND BPA, Polaris SB, and upcoming iterations of NASA SEWP VI remains uncertain as consolidation is expected to eliminate duplicate GWACs and multiple award contracts (MACs).

MERGERS & ACQUISITIONS

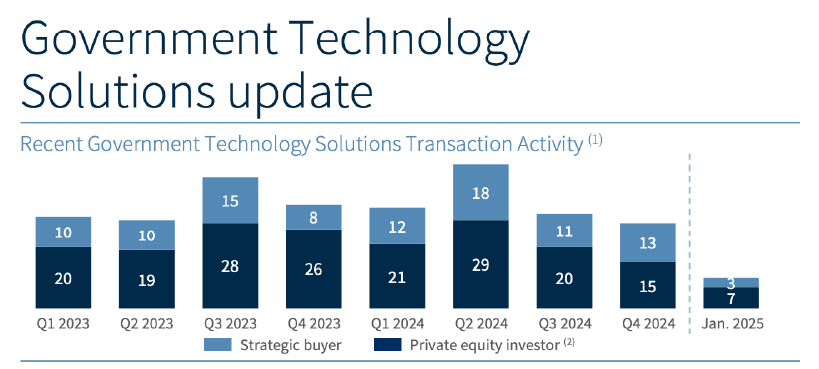

Post-election policy shifts and the Trump administration’s efficiency mandates have created uncertainty and impacted funding stability in the GovCon and GovTech M&A environment. According to Raymond James’ February update, the government tech sector posted 2.9% growth YoY – a sharp decline from its 5-year average.

While the pace of M&A has cooled in recent months, there were several notable deals:

- Gallant Capital acquired Navient’s Government Services (NGS), expanding its footprint in tech-enabled outsourcing.

- BWXT completed its $100M acquisition of L3Harris’ AOT subsidiary, and entered into an agreement to acquire Kinectrics, a major player in nuclear services.

- Agile Defense (Enlightenment Capital) acquired IntelliBridge, strengthening its advanced analytics and mission IT portfolio.

- Andruil acquired Numerica’s Radar and C2 businesses to expand its air and missile defense capabilities.

- Crimson Phoenix (Godspeed Capital) acquired Blackspoke, enhancing AI and GEOINT capabilities.

- Serco agreed to acquire Northrop Grumman’s MT&S business for $327M, expanding in mission training and ground network software.

- Parsons acquired TRS for $35M, deepening its environmental remediation expertise.

- SMX acquired cBEYONDData, enhancing its cloud and data support to DOD and federal civil clients.

- Boeing placed Insitu, its drone subsidiary valued at $500M, up for sale, part of a broader effort to divest non-core assets.

- Arlington Capital Partners (ACP) launched GRVTY, a new national security tech platform, and supported SPA’s acquisition of Intrepid, expanding capabilities in battle management and defense analytics.

- Ridgeline International (Enlightenment Capital) is set to acquire System High, expanding its capabilities in cybersecurity, intelligence, and mission protection.

- VT Group has acquired LOKI Solutions, strengthening its capabilities in electronic warfare, cyber operations, and electromagnetic spectrum dominance.

Small Business M&A Outlook Shifts Under New SBA Rules — New SBA regulations have reshaped the small business M&A environment, with three core areas impacting investment decisions: stricter recertification requirements, revised negative control definitions, and changes to 8(a) ownership thresholds. These rules have accelerated short-term deal activity but introduced greater scrutiny and valuation pressure on small business targets.

PTS UPDATES

Senior Executive Career Seminar – Amid a growing wave of federal workforce talent migration, more senior executives are beginning to explore new opportunities in the private sector. To support this transition, PTS is hosting a Senior Executive Career Seminar on April 23 in the Tysons Virginia area – an exclusive, high-value event designed for public sector leaders considering their next career move. Attendees will gain practical tools and strategies to navigate this pivotal career moment, including resume refinement, digital branding, and interview preparation – drawing on the personalized approach of the PTS Career Concierge, which has helped many executives secure their next leadership role. The seminar will feature keynote remarks from LTG (Ret.) Scott Spellmon, former Commanding General of USACE and 55th Chief of Engineers, who successfully transitioned to the private sector via PTS Career Concierge and now serves as a Senior Account Executive at SOSi. Guests will enjoy complimentary drinks, food and the opportunity to network. Click here to register.

European Defense Talent — As defense investment accelerates across Europe, PTS is ready to meet the growing demand for specialized talent in the defense sector. We are expanding our consulting and search capabilities in the region under the leadership of PTS European Defense Senior Advisor Jim Bowden. With a proven track record and trusted European network, PTS is actively placing cleared professionals, program leaders, and mission-aligned specialists into key MOD and NATO-aligned programs. We are committed to helping companies scale their presence in Europe—offering executive search, key talent, and market-entry guidance to deliver results where they matter most.

GovTech Expansion — As the administration focuses on modernizing federal technology infrastructure, PTS has expanded its presence in the GovTech sector. We are placing talent in high-demand areas like Cloud, AI, Cybersecurity, Intelligence, C5ISR, Software Engineering, and Network Architecture, supporting both leadership and specialized roles across CONUS and OCONUS markets. This growth is powered by our internal experts, including Candice Smith, a former Scrum Master, and Isaac Khaneles, a systems engineer-turned-recruiter, who help strengthen our client relationships in fast-evolving domains.

BD Expert Search has rapidly become PTS’s premier, purpose-driven service, accounting for over 50% of all placements. We specialize in identifying and placing top BD talent across GovCon, including CGOs, Capture Professionals, P2W Experts, Proposal Specialists, Solutions Architects, Pricing Analysts, and Account Executives. PTS continues to expand this capability to meet the evolving demands of the GovCon sector and drive continued growth for our clients.

Outplacement & Career Concierge — Through our Career Concierge service led by Robyn Cronin, PTS remains committed to supporting professionals navigating transitions within GovCon and out of public service. Our tailored services include resume enhancement, social media optimization, personal branding, targeted networking, and interview coaching. We have successfully assisted numerous individuals through complex transitions, particularly in a climate of restructuring and shifting priorities.

For companies facing downsizing, we also offer dedicated Outplacement services that mitigate risk, uphold brand reputation, and support impacted employees through career pivots. Positioned at the intersection of talent strategy and GovCon expertise, PTS provides a personalized, strategic approach to career development and workforce transition.

Welcoming New Talent: Isaac and Biz Join the PTS Team!

In January, PTS welcomed Isaac Khaneles to the team as an Account Executive. With over three years in technical recruiting and four years as a systems engineer, Isaac brings deep expertise across GovCon, GovTech, defense, space, and geospatial industries. His technical background and recruiting experience make him a great asset in connecting clients with hard-to-find technical talent across both cleared and commercial roles.

Bisrat (Biz) Zelalem joined PTS in February as Business Development Manager to focus on driving client engagement, optimizing sales process & CRM, and expanding our presence in key GovTech and defense markets. With over eight years of experience in business development and talent management, Biz brings a wealth of expertise in consultative sales, workforce solutions, and contract negotiation, making him a key force in driving PTS’s continued growth.

Events

PTS continues to create high-impact networking opportunities across the GovCon sector. This quarter, we engaged with government, military, and industry leaders both in the U.S. and Europe, further strengthening our relationships and expanding reach in the industry.

PTS Executive Networking Happy Hour – January 16 | Washington, D.C.

PTS kicked off the year with a high-impact Executive Networking Happy Hour, welcoming 50+ senior leaders from across GovCon and GovTech sectors. The event offered a great platform for executive-level networking, strategic dialogue, and relationship building. LTG(r) David J. Julazadeh former NATO Deputy Chief of Staff for Capability Development, delivered a powerful keynote focused on NATO’s transformation. LTG Julazadeh drew on his experience leading the development of NATO’s Multi-Domain Operations Concept, Digital Transformation Roadmap, and inaugural Space Symposium, and he emphasized the importance of:

- Political cohesion among NATO’s 32 member states

- The need for bold, empowered leadership in response to global instability

- Accelerating integration of emerging technologies, particularly AI, cyber, and space-based tools

- LTG Julazadeh currently supports small and mid-sized defense, aerospace, and tech firms entering the NATO market through stakeholder mapping, capability framing, and strategic advising. “Dave offers a rare combination of operational insights that don’t have a seat at the table yet,” says Jake Frazer, PTS President. “He understands how to turn vision into opportunity.” For organizations looking to engage with NATO or align capabilities with its evolving priorities, reach out to PTS to explore how Dave’s perspective may support your efforts.

AFCEA Army IT Days – January 17 | Washington, D.C.

PTS sponsored AFCEA NOVA’s annual ARMY IT Day, which brought together military and industry stakeholders to discuss modernization efforts across cyber, AI, and robotics.

Intel Public Sector Summit & POC 2025 AI Summit – March 2025

Bisrat Zelalem and Candice Smith represented PTS at these two flagship GovTech events. Both summits highlighted the federal government’s rapid movement toward AI enablement, data-centricity, and mission-oriented digital infrastructure. PTS continues to partner with agencies and integrators to align talent strategies with emerging innovation needs.

Combat Engineering & Logistics (CEL) Conference – March 24-26 | Warsaw, Poland

CEL 2025 served as a pivotal forum for military engineering and logistics professionals across NATO and Allied Forces, spotlighting capability gaps, operational insights, and emerging technologies. PTS was represented by Jake Frazer, Martyn Brooks, and Jim Bowden who actively contributed to discussions on forward posture, logistics optimization, and allied capacity building. During the conference, PTS hosted an exclusive Executive Leadership Dinner at Warsaw’s iconic Red Hog restaurant, bringing together over 20senior leaders to exchange perspectives on the evolving defense landscape. PTS is proud to be at the forefront of these conversations, delivering talent solutions that align with the strategic priorities of NATO and its partners.

Beyond 2025 Conference – March 25 | Arlington, VA

Andy McWilliams attended Red Team Consulting’s “Beyond 2025” conference, where discussions focused on what’s ahead in the government contracting landscape. The conference underscored the importance of pivoting strategically as the current administration’s objectives become clearer. Read Andrew’s post for more details.

Upcoming Events

- ISOA Europe Industry Days | April 7 – 10 | Wiesbaden, Germany

- Senior Executive Career Seminar | April 23 | Tysons Corner, VA

- POC Digital Transformation | April 24 | Washington D.C.

- PSC Annual Conference | April 27 – 29 | Greenbrier, WV

- ISOA Indo-Pacific Conference | May 15 – 16 | Honolulu, Hawaii