2024 Year in Review

by Bibiana Rais | 05 Jan 2025

Precision Talent Solutions presents the annual 2024 Year in Review edition, which covers NATO, LOGCAP, DLA, DiPSS, DTRA, and CHIPS, as well as notable M&A activity. 2024 was marked by a series of pivotal events that reshaped the global security and defense landscape. From the ongoing conflict in Ukraine and turmoil in the Middle East to the transformative impact of the U.S. presidential elections, these and other developments throughout the year collectively influenced foreign policy priorities and strategies worldwide. At PTS, we keep our finger on the pulse of major programs, contract awards, and M&A activities, ensuring we provide our customers and candidates with market insights beyond talent.

In this Year-in-Review edition, we spotlight the key opportunities, trends, and developments that have defined the government contracting (GovCon) landscape in 2024. We distill critical industry intelligence into an engaging and accessible read, offering insights into what lies ahead for 2025. This summary is based on published market research, human intelligence, earnings reports, content from multitudes of conferences, and the great contribution of guest writers who have specific expertise in niche segments of GovCon. We invite you to stay in the know by following the PTS LinkedIn page and exploring our blog for the latest industry updates and expert commentary.

Major Events Shaping the Defense and Government Industry in 2024

Geopolitical Turmoil and Regional Conflicts - From the war in Ukraine and escalating Middle East tensions to Azerbaijan’s takeover of Nagorno-Karabakh, Sahel coups, and China’s assertive moves near Taiwan, 2024 exposed critical vulnerabilities to global stability and security. With 56 active conflicts worldwide and 92 nations involved in cross-border engagements, the internationalization of conflict has intensified, reshaping defense priorities and diplomatic efforts and increasing the need for robust stability operations. For deeper insights into these challenges and strategies for addressing them, explore PTS’s blog post, Charting a Path Forward, examining global insecurity in 2024 and beyond.

Ukraine - In 2024, global attention on Ukraine competed with crises in the Middle East, but Ukraine remained a top U.S. priority, receiving approximately $61.3B in security assistance since Russia’s invasion. Key milestones included the Biden Administration’s 71st aid tranche in September, which focused on air defense, artillery, and anti-tank weapons. USAID spearheaded reconstruction efforts, awarding significant contracts such as TetraTech’s $428M SPARC award, the $48M RevGRO program, and the $600M Energy Security project to stabilize energy infrastructure before winter. DAI recently received a $51M contract to implement revenue and expenditure governance reforms, and Deloitte received $90M to improve Ukraine’s health system’s accountability, efficiency, and transparency over five years. USAID Support for Trade, Recovery Opportunities, and National Growth in Ukraine (STRONG-UA) proposals are due January 6, 2025, with an undisclosed award date. The State Department provided $300M in civilian security aid, while international coalitions emphasized demining, drones, and integrated air defense systems. In Q424, a critical policy shift lifted restrictions on U.S. military contractors in Ukraine, enabling on-site maintenance and repairs for U.S.-supplied weapons. Private sector engagement expanded, highlighted by Ukroboronprom-Amentum’s JV and Rheinmetall’s investments in armored vehicle and ammunition productions. C5 Capital, a Washington, D.C. and London-based VC firm, has partnered with Brave1, a Ukrainian defense technology accelerator, to support local defense tech startups in Ukraine. The results of the 2024 U.S. presidential elections are set to bring interesting changes in defense and foreign policy under President-elect Trump’s administration. In Ukraine, diplomatic efforts regarding a ceasefire are expected to be a focus, with General Kellogg being nominated as Special Envoy for Ukraine. U.S. assistance might transition from direct aid to a more loan-based support model, reflecting fiscal and strategic considerations.

Middle East - The cycle of violence in the Middle East is likely to continue despite ongoing government efforts to negotiate cease-fires. Military attacks between Iran and Israel in 2024 risk escalating into 2025 as Israel reshapes the region through military operations. The collapse of the Assad regime in Syria has disrupted the old geopolitical order, with far-reaching international implications. The U.S. maintains about 40,000 military personnel in the Middle East, including 900 in Syria supporting Kurdish militias and counter-ISIS efforts. Increased U.S. troop readiness in 2024, directed by Secretary of Defense Austin, included deployments and standby forces. Discussions on U.S. presence in Iraq reflect balancing counter-ISIS operations and political sensitivities, with a potential troop withdrawal in 2025, but a residual force likely in Kurdistan through 2026 to support regional stability.

NATO’s Strategic Adjustments and European Defense Spending - Russia’s actions spurred European nations to increase defense spending, and NATO’s combined budget now accounts for about 50% of global military expenditures. Finland and Sweden’s integration into NATO added critical combat capabilities on the “High North”, while inflation and historical underinvestment have tempered the full impact of budget increases. The evolving U.S. approach to NATO commitments and global military strategy will play a pivotal role in shaping the defense outlook for 2025.

INDOPACOM & China’s Advancing Strategic Posture - China made significant strides in its strategic capabilities, further solidifying its presence and influence in the Indo-Pacific region. Notable advancements include progress on the DF-27 missile, a platform with potential reach, and the development of its Type-003 aircraft carrier, the Fujian. The PLA has increasingly focused on power projection, evidenced by military exercises near Guam and Alaska, signaling its intent to challenge the status quo in the region. In response, the FY25 Pacific Deterrence Initiative (PDI) allocates $9.9B across diverse programs and contracts, aiming to bolster the U.S. strategy posture and operational readiness. This funding emphasizes MILCON and enhanced logistical operations, alongside investments in cutting-edge technologies and cyber capabilities. About $465M is allocated for MILCON initiatives in Guam, a critical node for regional operations. Supporting infrastructure and logistics enhancements, $1.3B is planned for improved logistics, maintenance, and prepositioning of equipment, munitions, and fuel, including Army’s APS-4 and Early Entry Fluid Distribution System (E2FDS) and $1.4B to cover INDOPACOM-wide infrastructure enhancements.

These key developments illustrate how 2024 has been a transformative year for the defense and government industry. In 2025, the industry must adapt to several upcoming trends, regulations, and changes in contracting, including:

- Cybersecurity Regulations – The Cybersecurity Maturity Model Certification (CMMC 2.0) has arrived, and government contractors must adhere to its standards. The Deltek guide offers updates regarding CMMC 2.0, detailing the necessary information for maintaining compliance.

- America First Policies – The “America First” policy prioritizes domestic interests over international commitments, as reflected in the aftermath of President-elect Trump’s victory in November. Holland & Knight outlines various changes the incoming administration could implement, drawing on Trump’s previous term and proposed plans.

- Small Business Contracting. Small businesses (SBs) in federal contracting, particularly in defense, face growing challenges as the vendor base shrinks. The 2024 Vital Signs report highlights key barriers, including complex acquisition processes, rising bidding and compliance costs, and limited subcontracting opportunities for overseas contracts. Contract consolidation under large IDIQs, inconsistent sole-source contracting rules across set-asides, and financial pressures compound these difficulties, which are expected to persist into 2025.

MAJOR PROGRAMS

The summary below highlights the significant developments in 2024 within key programs that PTS tracks across various agencies influencing our industry, as well as the contracting trends we expect to observe in 2025.

ARMY

In 2024, the U.S. Army focused heavily on modernization, investing in long-range precision fires, next generation combat vehicles, and network enhancement. Army’s budget request for FY25 is $185.9B, reflecting a modest increase of $400M over FY24. This near-flat budget presents challenges as the Army seeks to balance rising personnel costs, modernization efforts, and operational readiness. During 2024, the U.S. Army continued to significantly impact global security by building and maintaining strong alliances and partnerships. From deploying High Mobility Artillery Rocket Systems (HIMARS) in Tunisia to assisting the Philippines with integrating C-17 aircraft, the Army introduced several groundbreaking initiatives during numerous strategic multinational exercises.

LOGCAP V — In 2024, LOGCAP V reached the midpoint of its 10-year, $82B contract, with only 12% ($9.3B) of the total obligated funds utilized across 35 awarded tasks.

- Key developments included significant activity around Army Prepositioned Stock (APS) support. After ASC solicited TOs to the LOGCAP V primes to integrate APS into LOGCAP instead of the EAGLE contracting vehicle, awards were announced with KBR winning APS-2 (EUCOM - $307M) and Amentum winning APS-5 (Kuwait/Qatar - $128M), APS-4 (Korea/Japan - $63M), and APS-1 and APS-3 (South Caroline plus afloat - $72M). In June, several bid protests were filed regarding the APS TOs.

- Looking ahead to 2025, the Army logistics landscape is poised for a significant reshuffle. The anticipated release of the “LOGCAP 5.5” RFP in Q1 is likely to drive robust acquisition activity and could realign contractor roles and responsibilities. There is speculation about whether the USG will proceed with recompeting the performance task orders on LOGCAP 5 or shift its focus toward LOGCAP 6 acquisition planning. It will also be interesting to see how the new Trump administration might utilize this very versatile contract for domestic requirements around immigration.

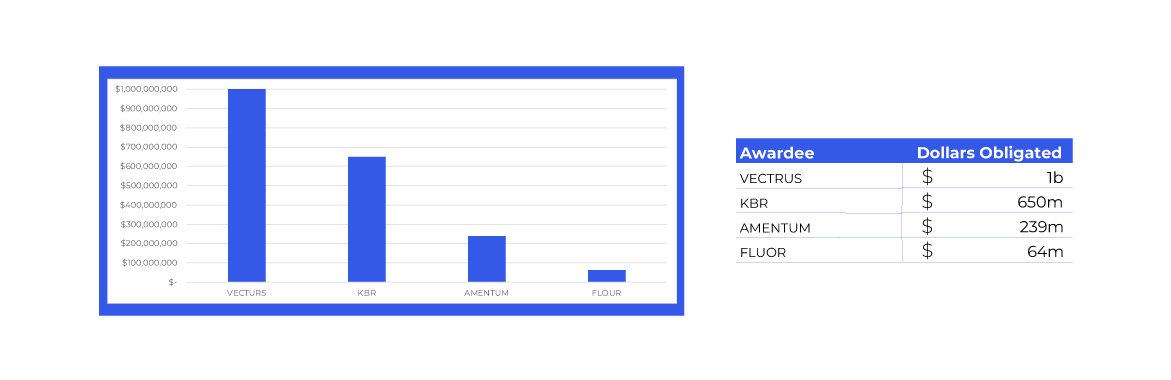

Logcap V - Spending to Date (2024)

PTS has a long history of excellence in supporting prime contractors involved in the LOGCAP program, consistently delivering unparalleled talent, including PMO leaders, senior shared service executives, site managers, and technical staff.

USACE — The USACE is managing an unprecedented $92B in active projects – a historic high that highlights its expanding role in supporting the Army, DOD, and various interagency efforts. The USACE’s workforce exceeds 40,000, its largest in three decades, reflecting its commitment to a growing project portfolio. Priorities focus on infrastructure and quality of life needs, while supporting combatant commanders worldwide. The latest USACE acquisition forecast released on December 19 details hundreds of potential contract opportunities spanning FY25.

PTS has supported architecture, construction, environmental, and engineering talent for USACE, NAVFAC, and OBO programs globally. We have compiled a comprehensive list of licensed Professional Engineers categorized by state and type (ME, EE, CE, etc.), offering our clients a diverse selection of talent.

President Jake Frazer and LTG Scott Spellmon, 55th Chief of Engineers and Commanding General, US Army Corps of Engineers - PTS Happy Hour, October 2024

Other significant Army contracts to watch for in 2025 include:

- MAPS — All eyes are on the Army’s massive $50B MAPS IDIQ contract, designed to provide the Program Executive Office (PEO) and Department of Defense (DOD) with knowledge-based support services and to support the Army’s enterprise infrastructure and infostructure goals with IT services. The Industry Day took place on 8 November 2024, and the RFP is expected in Q1.

- ACCESS — The Army Contracting Command gathered feedback from the industry regarding the Enterprise for Sourcing Services (ACCESS) acquisition, which will replace the Responsive Strategic Sourcing for Services (RS3) and Information Technology Enterprise Solutions - 3 Services (ITES-3S) IDIQ contracts. The proposed scope for ACCESS includes engineering, research, logistics, acquisition, training, IT, and medical services. The government is considering a 5-year base period with one 5-year option period.

- ModEL — The Industry Day was held in December for the $927M DISA J6 C4 Modernization, Engineering, Life Cycle Refresh (ModEL) initiative. This BPA will support DISA’s J6 Command, Control, Communications, and Computers strategic efforts by providing software, hardware, and technical labor services across 4 primary task areas.

- LEIA —SMX has been awarded a 7-year $3.2B LEIA TO to continue providing C6ISR across all areas, improving its ISR capabilities to monitor and address potential threats in INDOPACOM.

Notable tasks were awarded under the GSA ASTRO Master GWAC, providing direct support to the U.S. Army:

- W-TRS — V2X was awarded the Warfighter-Training Readiness Solutions (W-TRS) TO valued at $3.7B over 5 years by the Program Executive Office for Simulation, Training, and Instrumentation (PEO STRI) to enhance the U.S. Army’s global readiness capabilities by delivering mission enablement services.

- SSMARTT — BAH captured two major TOs: a $1.7B contract from the U.S. Army for egress security cooperation and FMS support services and a $2.5B contract from the Office of the Chief of Staff to provide Service Solutions for Modernization Analysis Readiness Capability Threat and Training (SSMARTT).

- LTRAC MAC 2 — Twelve companies secured positions on the Army’s $344M live training support contract (LTRAC MAC 2). The LTRAC MAC 2 program covers a broad range of activities, including Continuous Technology Refreshments (CTR), modifications, modernization, and the introduction of new capabilities for critical military training systems. Key programs supported under this contract include the Combat Training Center – Instrumentation System (CTC-IS), Digital Range Training System (DRTS) Tier 1, Future Army System of Integrated Targets (FASIT), Homestation Instrumentation Training System (HITS), Joint Pacific Multinational Readiness Center (JPMRC), and Synthetic Training Environment Live Training System (STE-LTS). Earlier in 2024, the DRFP for LTRAC MAC 3 (F&O), one of three MACs under the larger LTRAC umbrella, was released, followed by the DRFP for LTRAC MAC 1 in October. RFPs for both are expected in 2025.

NAVY

The U.S. Navy has proposed a $257B budget for FY25, reflecting a 6% increase from FY24. This marks a pivotal moment for the Navy, showcasing its strategic priorities and evolving defense approach with notable shifts in allocations, particularly within the Naval Air Systems Command (NAVAIR) and Naval Sea Systems Command (NAVSEA). In 2024, both organizations experienced a significant 30% decrease in spending compared to 2023, indicating potential changes in procurement strategies ahead. A key focus for the Navy remains its dedication to small business contracting, having allocated $20B to small business set-asides over the past 3 years. The Navy is also enhancing its contracting methods through preferred vehicles like SeaPort NxG, OASIS, and IAC MAC, which provide contractors with opportunities for growth through collaboration and competitive bidding.

2024 OCONUS Base Operating Support (BOS) Update

- Singapore BOS — Centerra was awarded the $54M contract in April. The work is expected to be completed by June 2032.

- Diego Garcia BOS — RFIs were collected in July, but procurement has been delayed. The RFP is now expected to be released in 2025.

- Sigonella BOS — In April, RFIs were collected from companies interested in providing BOS services at U.S. Naval Air Station Sigonella and its outlying activities in Sicily, Italy. RFP is anticipated in Q1.

- Djibouti BOS — KBR continued to provide BOS services in Djibouti throughout 2024, valued at $100M. The recompete began in Q224, with proposals collected in August. Awards are expected in Q1.

- Souda Bay BOS —The recompete for the contract currently held by IAP began in December. Proposals are due in January 2025.

- Poland BOS — The contract, valued at $98M, was awarded to V2X in September.

PTS has a strong legacy supporting NAVY BOS programs globally, backed by a diverse team of licensed professional engineers, former Navy CECs and Seabees, and experienced PMO and TO management personnel.

INDOPACOM — Between 2024 and 2028, the DOD plans to allocate approximately $9B to military projects in Guam, including $7.3B for military construction projects and $1.7B for an integrated missile defense system. Military construction spending is expected to peak in 2025, with a significant amount of that spending going toward the Navy’s construction of Marine Corps Base Camp Blaz. Top procurement initiatives in the region include:

- PDI MACC — Proposals were collected in September for this $15B Pacific Deterrence Initiative Multiple Award Construction Contract (PDI MACC) aimed at supporting the PDI program through task orders for various design-build and design-bid-build construction projects, including new facilities, repairs, renovations, and infrastructure upgrades across INDOPACOM. Three IDIQ awards are anticipated, with a base period of 60 months and three option periods of 12 months each. Awards are expected in 2025.

- MC BASE CAMP BLAZ — The release of the RFP for the $500M construction of a multi-story communications center, initially expected in Q424, has been postponed to Q1.

NAVSUP WEXMAC — The Naval Supply Systems Command (NAVSUP) awarded 87 companies a $2.85B, 10-year Worldwide Expeditionary Multiple Award Contract (WEXMAC 2.0) in December. This is a follow-on contract for a wide range of worldwide expeditionary support services and supplies to support humanitarian assistance, disaster relief, contingencies, exercises, lodging, logistics, and ashore operations globally across 26 geographic regions CONUS and OCONUS. Small businesses are set aside for awards in regions 23, 24, 25, and 26. Some of the awardees include Amentum, KBR, Crowley, Culmen, V2X, Plus Ops, Palladium, KVG, JJWWS, Inchcape, Gardaworld, Bodwe-KVG JV, and MS2.

SeaPort NxG — The successor to SeaPort-e, Seaport NxG is the Navy’s primary strategic contract vehicle for acquiring engineering and professional support services, covering 23 functional areas. Awarded in 2018 with a ceiling of $50B, this IDIQ is utilized by 10 Navy commands and 106 ordering offices, including the U.S. Marine Corps (USMC). In April, the RFP for SeaPort NxG MAC (Rolling Admission II) was issued, allowing prime MAC holders to compete for future TOs valued at $4.25B for a wide range of engineering and program management support services. Proposals were collected in July, and awards are expected in Q1.

Amentum began performance on a $490M TO to modernize the U.S. Navy’s multi-engine training aircraft fleet at Naval Air Station Corpus Christi, TX, and also won a $105M Research, Development, Test and Evaluation (RDT&E) contract under the DoDIAC MAC to support Naval Surface Warfare Center Crane (NSWC Crane) to develop next generation of Electronic Warfare (EW) and ISR mission and survivability systems. Additionally, through the DoDIAC MAC, CACI secured a five-year, $314M TO to provide engineering services and technology to the U.S. Navy’s Naval Undersea Warfare Center (NUWC). Leidos received a $248M contract from the Naval Information Warfare Center Pacific to provide support services for unmanned and automated systems for maritime ISR.

AIR FORCE

In a year defined by transformative priorities and unprecedented investments, the U.S. Air Force (USAF) pursued an ambitious modernization agenda backed by a historic $842B defense budget - the largest in U.S. history. Of this, $259.3B was allocated to the USAF, marking a 4% increase from the previous year. Key initiatives included acquiring 72 new fighters, retiring 310 aging aircraft, and advancing next-generation capabilities, the B-21 Raider stealth bomber, Next-Generation Air Dominance (NGAD) systems, and Collaborative Combat Aircraft (CCA). At the same time, the Space Force experienced a nearly 15% budget increase, underscoring its growing role in national security and technological dominance.

AFCAP — In 2024, the AFCAP V contract reached a pivotal midway point in its lifecycle, marking a year of significant developments. Originally launched in June 2020, AFCAP V remains a cornerstone of the U.S. Air Force’s ability to deliver critical contingency planning, deployment, logistics, emergency construction, and related services worldwide. This 8-year IDIQ contract, initially valued at $6.4B, continues to be executed by six prime contractors: Amentum, ECC, Fluor, KBR, RMS (IAP), and V2X. Notable AFCAP V highlights for 2024 include:

- The contract ceiling increased to $15B, reflecting the growing demand for support in contingency operations, emergency construction, and force deployment.

- Per GovTribe, 73 TOs have been awarded under AFCAP V to date, with 9 awarded in 2024 alone, valued at $7563M. Many of these were issued under “urgent and compelling” circumstances, underscoring the contract’s vital role in meeting mission-critical needs, however, some of these tasks may transition to competitive bidding in 2025.

- Only three prime contractors received tasks in 2024: V2X led with five awards, followed by Fluor and Amentum, each securing two. Fluor received the highest total award value at $449M, with a $409M award for pavement and transportation support services at North Field in Tinian. V2X demonstrated its competitive edge with a steady flow of TOs, highlighting its ability to respond swiftly to operational demands.

As the contract enters its second half, the expanded budget and strategic focus on contingency readiness signal continued opportunities. Anticipated competitive rebidding of urgent tasks awarded in 2024 will likely bring new energy among the six primes. PTS has been a key partner to AFCAP prime contractors, providing specialized cleared engineering, airfield, and logistics talent to support diverse TO requirements.

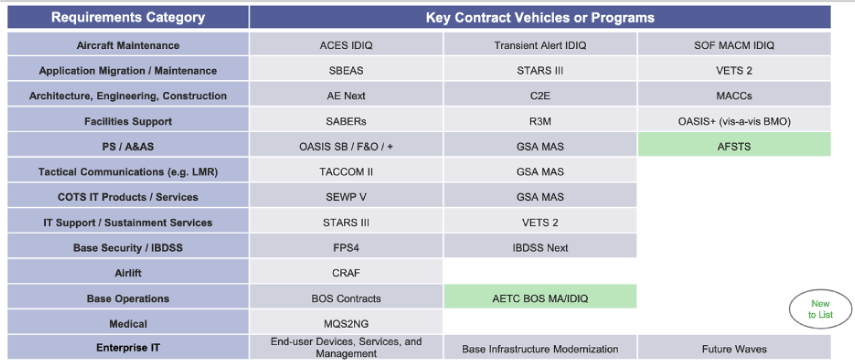

Deltek reports the following key contract vehicles currently supporting the USAF’s mission support requirements:

Source: GoWin by Deltek, 2024

AETC BOS IDIQ — The Department of the Air Force’s Air Education and Training Command (AETC) released the RFI in April for a potential $4B, 15-year BOS services IDIQ for 14 CONUS AETC bases. The services encompass civil engineering, logistics, communications/IT, community services, purchasing management, ground handling, financial management, visual information, publications, and human resources. The current AETC BOS services customers including Keesler Air Force Base (AFB), Laughlin AFB, Maxwell AFB, Sheppard AFB, and Vance AFB. The government is considering an enterprise-wide approach, with the TO anticipated for Vance AFB followed by TOs for other bases as required. The RFP is expected in Q2.

CHIPS — In December, the RFP for the CENTCOM HQ IDIQ for Professional Services (CHIPS) was released. This $750M contract is a 100% small business set-aside, specifically targeting SDVOSBs and SBA-certified 8(a) small businesses. The solicitation plans to award 10 contracts within each socioeconomic category. Proposals are due January 9.

GPMS — Other notable awards by USAF in Q4 included Amentum securing a $448M contract for Global Prepositioned Materiel Services (GPMS), which covers the storage, maintenance, outload, and reconstitution of GPMS assets at locations in South Carolina, Kuwait, Oman, Qatar, and the UAE. Northrop has been selected for an $801M IDIQ contract to deliver combat AF distributed mission operations services, including training for AF personnel worldwide, ranging from daily team training sessions to large-scale exercises. HII wins a $6.7B AF contract for Electronic Warfare Support.

Defense Logistics Agency (DLA)

In 2024, DLA remained actively involved in its extensive acquisition processes, with a particular focus on its OCONUS supply programs. DLA Troop Support (TS) experienced a relatively calm period regarding new awards. Nevertheless, behind the scenes, the agency’s acquisition teams spent the last 12 months aligning with the strategic initiatives established by the new DLA Director and preparing SOWs for significant and high-profile RFPs anticipated for release in 2025.

2024 Subsistence Prime Vendor Programs (SPV) Update

- DLA SPV Iraq, Jordan, Kuwait, and Syria bids were collected in June and are still under evaluation; awards are expected in late Q2. It will be interesting to see how DLA will handle this procurement in terms of requirements driven by the events in Iraq and Syria.

- The special notice for a $490M SPV Guam was issued in April. The AOR for Guam includes land customers, visiting ship customers, and the Marshall & Micronesian islands, which are supported via barge deliveries. The maximum contract dollar value is $980M inclusive of all base and option period, and surge requirements. The award is expected in Q1.

- Awards for DLA TS SPV Japan, Singapore, Philippines, Diego Garcia, and Australia are expected in Q1.

- In April, DLA released an RFI for SPV Southern Europe and Navy ship customers in Northern/Southern Europe and Northern/Western Africa. The RFP is expected in Q1.

- DLA is considering proposing a revised acquisition strategy for the SPV Southern West Asia and Eastern Africa (SWAEA) to support both land-based and afloat customers in the SWAEA AOR. This new initiative aims to integrate two existing DLA SPV Programs: DLA SPV SAPNEA and DLA SPV Bahrain, Qatar, and KSA.

- In December, DLA released a pre-solicitation notice for full-line food and beverage item distribution for DLA TS in Norfolk land customers and surrounding areas, including Guantanamo Bay, Cuba, and Honduras Region. RFIs are due January 10.

2024 MRO Programs Update

- The recompete for DLA MRO Japan and Korea is scheduled to start by Q3.

- Noble, TWI, and SupplyCore continue to support DLA TS MRO Europe and Africa PV contracts, supplying maintenance, repair, and operations items to EUCOM and AFRICOM customers. The contracts are valued at $916M and run through May 2026.

- In October, ADS, Noble and SupplyCore were awarded a $100M, 5-year IDIQ contract to deliver commercial MRO in the Middle East and Southeast Asia, including in Bahrain, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia, Syria, the United Arab Emirates, Yemen, Afghanistan, Kazakhstan, Kyrgyzstan, Pakistan, Tajikistan, Turkmenistan, and Uzbekistan.

- DLA awarded $180M in facility MRO to ASRC and Supply Core. The $90M contract with ASRC has an ordering period end date of June 15, 2025, while the contract with SupplyCore runs until February 6, 2025. ASRC will perform work in Hawaii, Guam and the Kwajalein Atoll, while SupplyCore will support customer locations in Louisiana and Texas.

PTS offers extensive experience across various DLA programs and has a strong talent pool to support prime contractors during the bid and proposal season.

Other notable DLA contracts awarded in 2024 include a $11.9B, 10-year JETS 2.0 contract to provide IT support services for DLA and other DOD customers, awarded to 85 companies; Knexus booked a 5-year contract with DLA to implement GenAI services.

Defense Threat Reduction Agency (DTRA)

In 2024, DTRA continued its mission to counter WMDs and emerging threats. The agency’s WMD Combat Support and Operations program received a $44M increase to $672M, while $20M was allocated for research and technology development. DTRA’s Cooperative Threat Reduction (CTR) Program, collaborating with 35 nations, faced a $7M cut in its biological threat reduction program, now $228M. In 2025, DTRA plans to establish a Chief Digital and Artificial Intelligence Office to drive innovation and data-centric operations, promote AI, and facilitate collaborative, data-driven decision-making across all directorates. Key awards and procurement activities in 2024 include:

- CTRIC IDIQ Recompete — In May, DTRA initiated the procurement for the $970M CTRIC IV IDIQ contract, with awards anticipated in Q1.

- C-WMD R&D IDIQ — ARA, Booz Allen Hamilton, Leidos, Peraton, SRC, Parsons, Signalscape, Two Six Technologies, and Noblis secured positions on a $4B, 10-yr C-WMD R&D IDIQ Contract.

-

In December, TTI won a $325M contract to support DTRA’s Cooperative Threat Reduction (CTR) program which mitigates global threats from WMD.

Key opportunities to track for 2025 with DTRA include:

- CSCEP — DTRA is preparing to release the RFP for the Countering Weapons of Mass Destruction (CWMD) Security Cooperation Engagement Program (CSCEP) IDIQ contract in Q2. The CSCEP mission focuses on training, equipping, and assessing partners in regions including Eastern Europe, the Middle East, South Asia, Southeast Asia, and Africa to prepare for, protect from, and respond to WMD/CBRN threats globally. This single-award IDIQ will support DTRA’s on-site inspection and Building Capacity Directorate (OB). Draft requirements documents, including Sections L and M, were posted on December 19.

-

AAS — DTRA has issued a pre-solicitation for the Advisory and Assistance Services (AAS) to support its Strategic Integration (SI) Directorate on December 9. The RFP is expected later in December. The contract will be a single award, 5-year IDIQ to provide non-commercial SME for fully integrated support of the SI Directorate’s Combat Weapons of Mass Destruction (CWMD) and Information Resilience Office (IRO) missions. The award is anticipated in May 2025.

PTS is known for sourcing exceptional operational and technical talent to support DTRA contracts. With a comprehensive understanding of mission-critical requirements, we excel at identifying and delivering top-tier professionals who drive success in areas such as threat reduction, WMD countermeasures, and emerging technologies.

STATE DEPARTMENT

GLOBALCAP — The anticipation surrounding the GLOBALCAP IDIQ award is exceptionally high among government contractors as we start 2025, and for good reason. Initially expected to be awarded in Q224, the timeline has now shifted, with projections indicating that the award will occur during Q1. With a funding ceiling of $5B allocated over a decade, GLOBALCAP will integrate the legacy AFRICAP and GPOI programs, establishing a flagship contingency contract for the State Department (DOS) to support U.S. foreign policy by providing diverse services, including training, logistics, operations and maintenance (O&M), specialized procurement, architecture and engineering (A&E) support, and construction activities. The DOS intends to grant up to 7 awards within both F&O and Small Business socio-economic categories, which will encompass designations for WOSBs and SDVOSBs. Considering the evolving incumbency landscape, new awardees are anticipated to emerge, particularly within the Small Business pool.

- AFRICAP/GPOI — In 2024, 7 TOs were awarded under the AFRICAP III IDIQ, amounting to a total of $173M. Relyant secured $71.2M for construction work at Manda Bay in Kenya, while Amentum received $28.3M for armored personnel carriers (APCs) for Zambia. Nelogis won three TOs, valued at $3.1M for the NCO development project in Tanzania, $1.4M for logistics, procurement, and training support in Senegal, and $2.5M for ISR support in Djibouti. Sincerus was awarded 2 TOs, totaling $58.1M for the train & equip mission in Côte d’Ivoire and $8.8M for curriculum development in Mozambique. As reported in GovTribe, 69 tasks have been awarded under the AFRICAP III IDIQ program to date with a combined value of $945M, representing 63% of total contract obligations. Small business primes account for 16.8% of the awards, while large businesses receive 83.2%.

- The GPOI IDIQ concluded in 2024, with the program office recompeting legacy IDIQ TOs as small business set-aside RFPs over the summer. Sincerus won 4 TOs, including in Togo, Tanzania, Zambia, and Chad. Apogee Systems won a $4.2M TO in Uganda. Malawi and Senegal are expected to compete under GLOBALCAP IDIQ upon award in 2025.

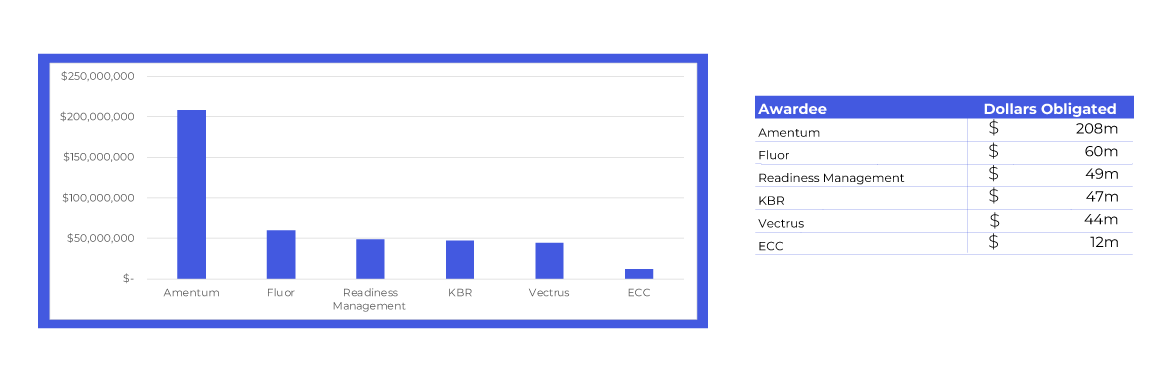

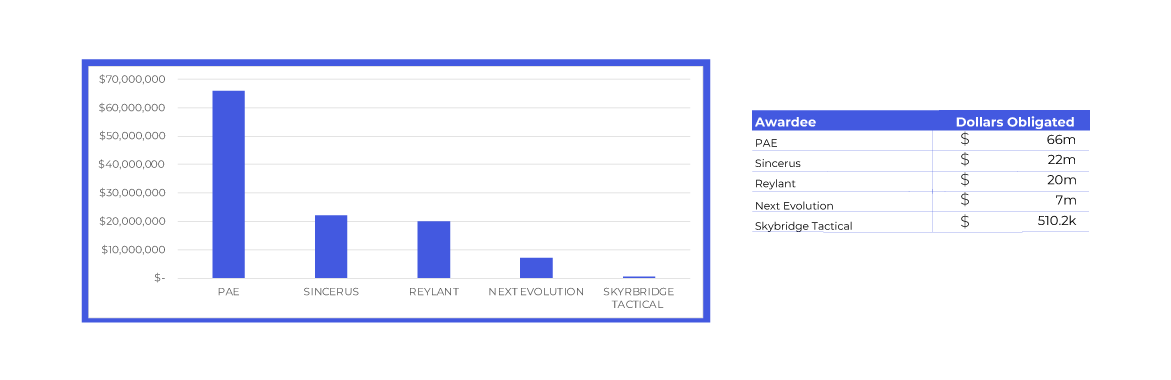

AFRICAP - Spending to Date (2024)

GATA — The State Department awarded the $765M, 5-year Global Antiterrorism Training Assistance (GATA III) IDIQ in September to Amentum, IDS International, Linxx, and Sincerus. Just weeks after the award, the program showcased its momentum with early training wins, including a $20.9M contract to Amentum, $17.5M to IDS in Kenya, and $10.1M to Linxx in Iraq. However, due to a protest filed by Culmen, all procurements are on hold during the stop-work order period. Expectations are high for new tasks in 2025 to support the State Department’s commitment to rapidly deploying capabilities that enhance global security

DiPSS — Activity on the DiPSS IDIQ finally picked up in 2024!

- Notable wins include KBR securing a $187M TO for medical support services task in Iraq. KBR also was awarded the Baghdad MISS, but it is currently under protest.

- In Qatar, SOSi made headlines with 2 significant awards: $221M for life support services and $99.5M in O&M support.

- V2X won a $130M TO for medical support services (MSS-D). It’s great to see these vital missions finally gaining traction.

- The DIPSS Large contract has been extended through December 2024, but a recompete strategy remains unclear. Meanwhile, the DIPSS Small contract remains active and is set to continue through 2028.

GLOBAL ADVISORY — Another contract in 2025 to keep an eye on! The State Department issued a pre-solicitation notice in November with a timeline for the RFP release in 60 days. Valued at $250M over 5-years, the Global Advisory (GA) IDIQ will support the Bureau of African Affairs (AF/RPS) and the Bureau of Political-Military Affairs (PM/GPI and PM/SA), combining 2 pre-existing contracts on delivering advisory assistance to partner nations including the GA Support Services (GASS) IDIQ, managed by PM/GPI, and the now-concluded Africa Advisory Services (AAS) IDIQ, formerly overseen by AF/RPS. A total of up to 8 awards will be granted, which will include 5 set-asides for SDVOSBs and WOSBs, in addition to 3 contracts awarded under F&O competition. The GA IDIQ will be focusing primarily on sub-Saharan Africa and regional organizations while also having the ability to expand worldwide.

PTS is well-known for providing outstanding talent and expert support to prime contractors engaged in various State Department programs, including Global Defense Report Program (GDRP) tasks. We drive mission success by offering compliant and effective PMO and IDIQ management teams, along with technical, cleared, or executive staff.

USAID

In FY 2024, USAID obligated $30.5B through 23,186 actions, with acquisition awards exceeding 24% of the total. Cooperative agreements and grants, especially PIO grants, accounted for over 43% of obligations. Funding reached $1B for U.S. small businesses, about 13.7% of acquisition awards. $301M was allocated via fixed-amount awards, a nearly 25% increase from FY23. The agency welcomed 240 new partners in FY24, a 20% increase from last year. The Office of Small Disadvantaged Business Utilization (OSDBU) has made significant progress in engaging SDVOSB, including a twofold increase in funding allocated for SDVOSBs.

NextGen Global Health Supply Chain — USAID’s long-awaited awards under the $17B NextGen Global Health Supply Chain initiative (NextGen GHS) have experienced significant delays. In March, the President signed the second package of final fiscal year 2024 appropriations bills, which included funding for U.S. global health programs at DOS, USAID, CDC, and NIH. The total funding allocated to DOS and USAID through the Global Health Programs (GHP) account, constituting most of the global health assistance, was $10B, reflecting a decrease of $531M compared to fiscal year 2023. Here are the key updates on GHSC:

- NextGen In-Country Logistics (ICL) — Valued at $1.49B, this contract provides warehousing and transportation for health commodities. Awards expected in Q1

- NextGen Procurement Service Agent (Integrated PSA) — Includes Malaria, Family Planning, Reproductive Health, Maternal and Child Health, Nutrition, and Other Health Elements. This IDIQ, with an estimated ceiling of over $3B, was expected to be awarded by the end of 2024, but no awards have been announced yet. The scope of work includes procurement and supply chain services for a wide range of health commodities. A competitive range has been established, and several offerors have submitted their BAFOs. The award is expected in Q2.

- NextGen Procurement Service Agent - HIV (PSA HIV) — This IDIQ contract, with a ceiling of $3B, provides procurement and related supply chain services for HIV/AIDS health commodities. The award is expected in Q2.

- NextGen Procurement Service Agent - Lab, Diagnostics, and Molecular (PSA Diagnostics) — A single-award contract valued at up to $2.79B will support the procurement and associated supply chain services for HIV/AIDS lab, diagnostic, and molecular commodities. The award is expected in Q1.

-

NextGen Qualifying Testing Issuing (QuTI) — A single-award contract worth up to $299M provides quality support for health commodities procured for GHP under NextGen. The award is anticipated in Q3.

In January 2024, USAID awarded a 10-year, $2.2B contract for the NextGen Comprehensive Technical Assistance for Health Supply Chain and Pharmaceutical Management (NextGen Compete). Currently, there are 4 active TOs forecasted with anticipated award dates in Q125, ranging in value from $25M-$749M. Additionally, a Small Business Set-Aside TO RFP for Communication and Knowledge Management (CK) is expected in Q1, valued between $50M-$99M. This TO will focus on the systematic collection, analysis, synthesis, reporting, and dissemination of results across the suite of NextGen awards.

PTS has supported its clients across the USAID NextGen Global Health programs, with an emphasis on talent development and alignment with global health priorities. We facilitate access to premier talent for prime contractors throughout the bidding and proposal processes, thereby promoting success in this strategic program.

SWIFT 6 — In August, USAID awarded positions on the $5B SWIFT 6 IDIQ contract to Chemonics, Creative Associates, Democracy International, Dexis, DT Global, MSI, and Palladium. The ordering period is expected to extend through August 2034. The contract is structured into two core service areas: Implementation of Transition Programs (SWIFT-Programs) and Program Operations Technical Assistance Support (SWIFT-Support). These components allow USAID to address complex political crises with adaptive and agile programming, leveraging opportunities within evolving political landscapes in various countries and regions. The SWIFT 6 IDIQ features a 10-year ordering period, along with a 2-year performance period for ongoing task orders. In December, two companies – Valar and Proximity International – filed post–award protests concerning the contract. Decisions regarding these protests are anticipated in Q1.

DHS

The Department of Homeland Security (DHS) stands as a prominent entity in federal contracting, with substantial financial resources allocated to critical programs and services. By the end of FY24, DHS contract obligations are projected to reach $12B, constituting over 11% of its $103.2B budget for the year 2023. The top three DHS agencies—Customs and Border Protection (CBP), Immigration and Customs Enforcement (ICE), and the United States Coast Guard (USCG)—reported obligations exceeding $1B each in FY23, a trend expected to continue into 2024. Currently, ICE and CBP collectively employ nearly 88,000 personnel, with an additional 7,711 staff dedicated to ICE’s Enforcement and Removal Operations (ERO). Technology is integral to DHS operations across all mission areas, including border and transportation security, immigration, cybersecurity, and disaster relief and response, thereby creating a demand for innovative solutions.

Between 2023 and 2024, DHS increased its use of the consolidated General Services Administration (GSA) multiple award schedules, which include GSA MAS, Alliant 2, Alliant, OASIS Small Business (SB), and OASIS unrestricted contracts. However, several major IDIQ and GWAC contracts are either in the early stages of procurement or awaiting award/protest, leading to delays in numerous TO recompetes and forcing agencies to issue bridge contracts or seek alternative procurement options methods.

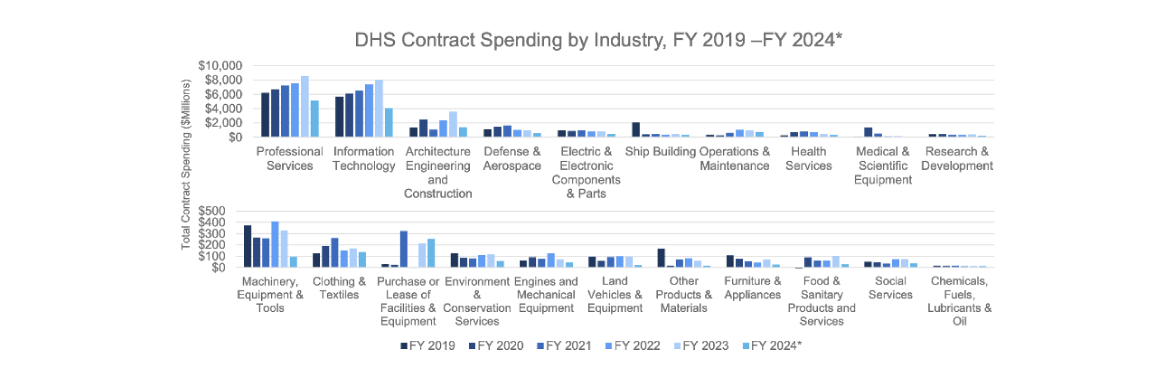

Source: GoWin by Deltek, 2024

Substantial expenditure with both ICE and CBP is anticipated in response to the influx of migrants and DHS’s responsibility for infrastructure support. The policies outlined by President-elect Trump’s forthcoming administration are likely to have a considerable impact on spending directions in 2025 and beyond, particularly in relation to the Southwest Border, detention facilities, the implementation of mass deportations, the recruitment of new border agents, and the allocation of military resources toward border security.

The following contracts are coming up for renewal in 2025:

- RMACC III — The U.S. Coast Guard (USCG) issued a notice in October for a $100M Design-Build/Design-Bid-Build (DB/DBB) IDIQ Regional Multiple Award Construction Contracts RMACC III to provide general construction services in any of the 50 United States, Puerto Rico, Guam, and the U.S. Virgin Islands. The estimated RFP release date is April 2025, with an estimated award date in June 2026. The contract will be set aside for small businesses.

- TacCom — In August, DHS issued an RFI for a Tactical Communications Equipment and Services (TacCom) and Technical Investigative Surveillance Operations (TechOps) III multiple-award IDIQ contract to identify qualified vendors capable of providing a wide range of tactical communications and technical investigative surveillance equipment and related services. RFP is expected in Q1.

- SPP — Responses were collected in December for the DHS TSA draft RFP for the airport security screening services (SSP) follow-on contract. About 15 awards are expected to be issued for this 10-year IDIQ, including 9 to qualified SBs. The final RFP is anticipated in Q1.

USCG awarded two pools for the 3rd iteration of the potential 10-year, $4B National Multiple Award Construction Contract (NMACC III) to 17 small businesses in November. In September, DHS awarded FirstSource III, a $10B, 10-year IDIQ contract vehicle designed to provide IT products and services focused on IT Value Added Reseller (ITVAR) services and software publishing. The contract vehicle is set aside for small businesses, with 5 separate tracks including 8(a), HUBZone, SDVOSB, WOSB, and a general small business track.

National Science Foundation — The National Science Foundation (NSF) is set to issue the final RFP in Q2 for its Antarctic Science and Engineering Support Contract (ASESC), a 20-year IDIQ contract valued at an estimated $8B. This contract will drive innovative science and technology in Antarctica, supporting NSF’s United States Antarctic Program (USAP) within a complex, interdisciplinary research landscape. NSF will partner with private industry and federal agencies, such as NASA, NOAA, and the Department of Energy, to facilitate high-caliber scientific research. The industry is already taking early action in response to this transformative opportunity. For instance, Parsons and V2X have established a JV called Polar Science Alliance to pursue this contract.

GSA

Polaris SB Pool — Polaris focuses on computer systems design services and IT support services for federal agencies. Awarded in October to 100+ small business awardees.

OASIS+ SB — OASIS+ Small Business (SB) is one of six contracts in the OASIS+, a suite of multiple-award IDIQ contracts with a 5-year base period and a 5-year option term and no contract ceiling or cap on awards, designed to provide federal agencies with professional (non-IT) services in CONUS and OCONUS locations. 1,383 SB awards were announced in July. These awards were prioritized before the legacy OASIS SB contract’s December 2024 expiration. GSA plans to reopen solicitations for on-ramping in FY 2025.

Alliant 2 & Alliant 3 — In December, the $75B ceiling on Alliant 2 was increased by an additional $7.5B to $82.B to ensure continuity of acquisition plans. GSA is actively working on establishing Alliant 3 GWAC, a new multiple-award IDIQ that will be used to procure customized IT services and IT services-based solutions. The contract is currently forecasted to be awarded in April 2025.

ASTRO — In Q3, the ASTRO Master GWAC recorded significant award activity amounting to $8B. PTS provided details in our quarterly report.

PTS understands the significance of securing the appropriate talent for GWAC programs. To enhance operational success, we customize processes that aid both large and small prime contractors in optimizing their task order team structures and key personnel.

GOVTECH

In 2024, the landscape of government technology (GovTech) underwent a significant transformation to adopt emerging technologies to improve the efficiency, security, and accessibility of public services. These advancements represent a broader trend toward digitalization, facilitating ongoing innovation into 2025. In February, the White House’s Office of Science and Technology Policy released an updated list of critical and emerging technologies (CETs) vital to U.S. national security and economic prosperity. This list includes areas such as advanced computing, artificial intelligence (AI), clean energy generation and storage, data privacy, cybersecurity, and space technologies. Here are PTS’s top picks for trends influencing GovTech in 2025:

Cybersecurity — By the end of 2024, cyberattacks cost the global economy over $10.5T. This highlights the growing threats in cyberspace and underscores the need for cybersecurity as a strategic priority for individuals, organizations, and governments.

- In 2023, the Securities and Exchange Commission (SEC) adopted long-awaited cybersecurity rules for public companies, requiring officers, directors, and chief information security officers (CISOs) to evaluate cybersecurity and disclosure controls and processes and to work with experts for reporting. That places a high demand on executive and management cybersecurity expertise! PTS has a dedicated team to help with cybersecurity talent required to oversee and execute reporting requirements and remain compliant.

- A CyberSeek report indicates 265,000 additional cybersecurity professionals are needed to meet staffing needs.

- In October, the GSA announced 182 Phase 1 awardees in the 8(a) small business set-aside track of the OASIS+ contract program, with formal awards expected by the end of 2024. These businesses cover 7 domains: 141 in management, 105 in technical, 20 in intelligence, 14 in R&D, 12 in logistics, 15 in facilities, and 12 in environmental services. OASIS+ includes 6 IDIQ contracts with a 5-year base and a 5-year option, providing service solutions for federal agencies. Earlier awards included 113 HUBZone, 345 SDVOSB, 309 WOSBs, and a total of 1,383 small businesses announced in July 2024. The program will have an open on-ramping process in FY25 to increase participation.

- ManTech has secured a potential five-year, $1.4B TO to provide advanced cyber solutions in support of mission-critical requirements for the Interagency Intelligence and Cyber Operations Network (ICON).

Artificial Intelligence (AI) — If cyberattacks and defense in 2024 were a game of chess, AI would be the queen, having the capacity to establish significant strategic advantages for the player who utilizes it most effectively. AI is transforming operations within state and local governments by automating complex governmental functions, including budgeting, grants management, and procurement.

- Following President Biden’s AI Executive Order, efforts have begun to integrate AI across governmental agencies. In September, DOD Chief Digital and AI Office (CDAO) unveiled a plan for Advana, a recompete of a $15B contract for the DOD’s flagship big-data platform centralizing government-owned data for advanced analytics and decision-support services.

- In November, the DOD released a draft RFP for a $15B DOD Advancing AI Multiple Award Contract (AAMAC) to support the Advana data, analytics, and AI platform. RFP expected by mid-2025.

- The DOD’s Chief Digital and Artificial Intelligence Office (CDAO) has launched a multivendor ecosystem designed to enable the integration of applications, data platforms, development tools, and services across government and industry. This initiative, known as the Open Data and Applications Government-owned Interoperable Repositories (Open DAGIR), aims to support the Combined Joint All-Domain Command and Control (CJADC2).

- Anduril has been awarded a $100M production agreement by the DOD’s CDAO to scale AI-driven tactical data solutions. Work on the contract will primarily occur in the National Capital Region through November 2028, with $33M in research and development funding allocated for FY24 and FY25. Palantir and Anduril are negotiating with around a dozen tech firms, including SpaceX, to form a consortium for defense contracts. This initiative aims to secure a larger share of the $850B U.S. defense budget from prime contractors like Lockheed Martin, Raytheon, and Boeing, bringing together top firms from Silicon Valley to provide innovative and efficient solutions to the U.S. government. Ongoing conflicts in Ukraine and the Middle East, along with rising geopolitical tensions between the U.S. and China, have increased the government’s dependence on tech companies that are developing advanced AI products for military applications.

The technological progress achieved in 2024 lays a solid foundation for further advancements in 2025. As governments continue to digitize operations, the focus will remain on addressing ethical considerations, safeguarding privacy, and minimizing risks. With billions of dollars in cloud computing, AI, cybersecurity, and edge computing driving transformation, strategic planning and timely action are more crucial than ever for assisting government contractors in capitalizing on emerging opportunities. Red Team Consulting has released a top 10 list of government opportunities shaping 2025 to get ahead with strategy, capture and bid activities, and help contractors navigate the high-stakes government contracting landscape.

If you need to enhance your business development team to effectively pursue the next generation of technology contracts, PTS offers a tailored process for aligning the right BD talent with these early actions to shape and implement your bid and win strategies.

President Jake Frazer and Account Exec. Nevenka Popovic - AFCEA TechNet Transatlantic Conference, December 2024

EUROPE’S DEFENSE SECTOR

The war in Ukraine, coupled with escalating global tensions, has significantly boosted Europe’s defense sector in 2024, resulting in worldwide defense expenditures hitting $2.2T in 2023, with Europe accounting for $388B — the highest since the Cold War. Europe’s top 7 defense contractors saw backlogs of over $300B, reflecting surging demand. Key highlights include:

- Ground Warfare’s Impact: Ammunition shortages have boosted European suppliers like Rheinmetall (Germany), Nammo (Scandinavia), and Chemring (UK). Rheinmetall’s market value quadrupled after Germany’s $100B defense investment, and it projects doubled sales by 2026. Other companies, such as Nexter, have ramped up production of battlefield-proven equipment like the Caesar howitzer.

- Air and Missile Defense Growth: Renewed interest in air-defense systems has benefited companies like Sweden’s Saab, MBDA (jointly owned by BAE Systems, Airbus, and Leonardo), and Hensoldt (Germany). Saab’s anti-tank missiles and radar systems, along with MBDA’s contracts worth €9B, underscore the demand.

- Technology Innovation in Conflict: Ukraine has become a testbed for emerging technologies. Start-ups like Helsing (AI for battlefield analysis), Tekever (drones), and Milrem Robotics (autonomous vehicles) showcase rapid innovation cycles of 3-6 months. This collaboration between tech firms and traditional defense giants highlights a shift in procurement strategies.

- The European Defense Fund (EDF) drew record interest in 2024, with 298 proposals submitted. This underscored a growing alignment among EU Member States and industry stakeholders. Twenty member states exceeded investment benchmarks, with several allocating more than 40% of their defense budgets to procurement and development.

UK MOD — In 2024, the UK MOD placed new contracts valued at £15.7B, an increase of £2.5B compared to 2023, despite a reduction of 50 contracts in number. The top ten suppliers received 39% of total MOD procurement expenditure in 2024, up from 37% in the previous year. These included BAE Systems, Babcock, Rolls-Royce, QinetiQ, Airbus, Leonardo, Leidos, Thales, Serco, and Boing. BAE Systems has been the MOD’s largest defense supplier for over a decade, and in 2024 alone received an additional £1.2B, totaling over £5.7B in MOD contracts. Payments made via FMS agreements with the USG totaled £0.6B in 2024, a nominal decrease of £119M from 2023.

- In July, the UK MOD initiated a new Strategic Defense Review (SDR) to be delivered in the first half of 2025. The review is being conducted in response to the evolving global security landscape, and will focus on strengthening the UK’s homeland security, supporting Ukraine against Russia, and modernizing the UK’s nuclear deterrent.

- In October, the UK announced its intention to increase its defense spending by £2.9B ($3.8B) in 2025, surpassing its commitments to NATO and providing military aid to Ukraine amounting to £3B annually.

President Jake Frazer and former Security Assistance Group - Ukraine (SAG-U) commander Tony Aguto - ISOA Annual Summit, November 2024

NATO/NSPA — NATO celebrated its 75th anniversary in 2024! NATO’s NSPA achieved significant milestones, such as securing major contracts and delivering critical support across the alliance. NSPA’s spending under management in 2022 was $4.7B and jumped to $10.3B in 2023. We can expect a similar trend in 2024 and going forward. Key accomplishments in 2024 include:

- A €1.1B framework contract for 155mm ammunition, a €5B deal for Patriot missiles, and a $250M procurement for Alliance Ground Surveillance (AGS).

- NSPA delivered 65 civilian ambulances to Ukraine in record time and marked 25 years of support for NATO’s Kosovo Force (KFOR) by renewing contracts and initiating new construction projects.

- Industry engagement was strong, with events like the Host Nation Conference and Fuel Supply Industry Day highlighting collaboration and operational efficiency.

- Leadership transitions set the stage for future success. In October, Mark Rutte assumed the role of NATO Secretary General.

- NATO established a new command for Ukraine (NSATU) dedicated to coordinating and streamlining the alliance’s support for Ukraine. This NATO command will coordinate with the US-led Security Assistance Group – Ukraine (SAG-U).

- Late 2024 saw the launch of projects such as the Modular Ground-Based Air Defence (GBAD) and new multinational cooperation on Remotely Piloted Aircraft Systems (RPAS), paving the way for advancements in interoperability and technological innovation.

- ISTEC received a contract for smore discharger systems (SDS) for the British Army’s new M270 multiple-launch rocket system (MLRS).

- Looking ahead, NSPA will focus on implementing 2025 initiatives, including over 600 military requirements under the Deterrence and Defense Agenda (DDA) and NATO Warfighting Capstone Concept (NWCC). With a €2.46B budget for these projects, the agency aims to strengthen multinational cooperation and address evolving security challenges.

Connect with Jim Shields, PTS’s in-house NATO expert, to explore upcoming procurements and NSPA projects that align with your firm’s capabilities and strategic growth objectives.

President Jake Frazer moderating panel with Emanuele Piffaretti,Kevin Baird and Jim Shields - ISOA Ukraine Conference, September 2024

MERGERS & ACQUISITIONS

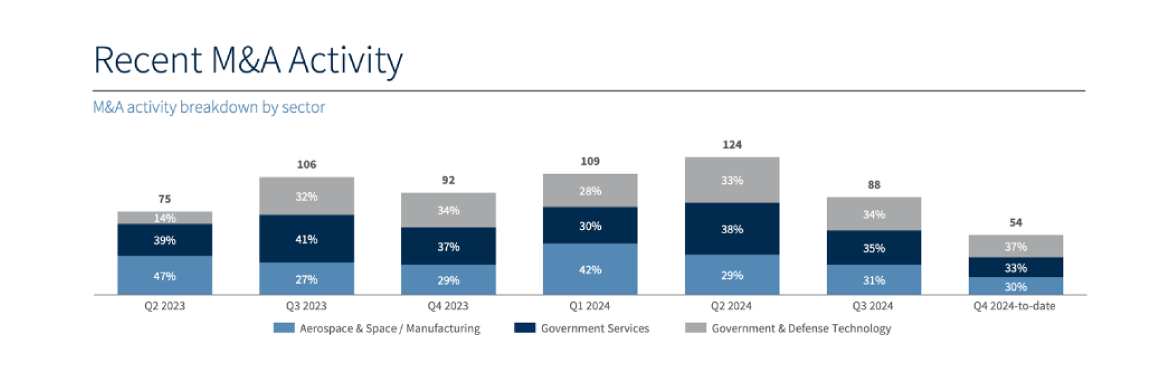

The government contracting sector experienced significant mergers and acquisitions (M&A) activity in 2024, with Raymond James reporting 375 M&A transactions by December. In the fourth quarter, government and defense services dominated, comprising 37% of deals, followed by government services at 33% and aerospace, space/manufacturing sectors at 30%. Private equity drove much of this activity, accounting for 52% of acquisitions.

-

In November, PTS participated in the 7th Annual Baird Defense & Government Conference, where industry leaders explored the post-election shifts shaping the defense and government sectors. Discussions highlighted a defense M&A landscape with steady national security-driven tuck-in acquisitions despite slower-than-expected overall activity.

Looking ahead to 2025, optimism is building for increased M&A activity, supported by expectations of an improved financial environment, private equity’s substantial dry powder, and strategic buyers leveraging robust balance sheets. As global conflicts persist and tensions with China and Iran rise, international defense spending among U.S. allies is poised to grow, creating opportunities for U.S. defense contractors.

PTS observed that efforts to rebuild the defense industrial base and expand FMS are positioning the industry for resilience and growth in the year ahead. PTS is uniquely positioned to support Private Equity firms focused on GovCon and high-growth PE-owned portfolio companies.

M&A Activity Reported by Raymond James December 2024

- AeroVironment acquired BlueHalo, strengthening its position in advanced defense technologies, including autonomous systems and counter-drone solutions.

- CACI has completed its acquisition of Azure Summit Technology, a leader in advanced radar and signal processing solutions.

- In a strategic move, Parsons Corporation acquired BCC Engineering, enhancing their position in the infrastructure market.

- Amentum completed its merger with Jacobs’ Critical Mission Solutions and Cyber and Intelligence Units, strengthening its position as a leader in government technology and defense solutions.

- Markon, a federal government consulting firm backed by Sterling Investment Partners, acquires JY Systems, a Maryland-based IT and cybersecurity services provider. This strategic acquisition expands Markon’s expertise in systems, software, and cyber engineering, particularly in support of Signals Intelligence (SIGINT) and cyber security missions.

- Velocity One, an aerospace manufacturing holding company, has signed a merger agreement to acquire EMCORE, a provider of inertial navigation solutions for the aerospace and defense sectors. Backed by Charlesbank Capital Partners, Velocity One will integrate Emcore alongside its existing subsidiaries, Cartridge ActuatedDevices and Aerosphere Power, strengthening its position as an industry leader.

-

BWXT is acquiring L3Harris’ Advanced Optical Technologies (AOT) business, a leading provider of advanced specialty materials and high-strength alloy manufacturing, for approximately $100M. The acquisition expands BWXT’s capabilities in advanced materials for commercial, military, and space applications.

2024 PTS UPDATE

CXO Search — PTS continued to build its capabilities in placing C-suite executives and Board positions. In 2024, PTS worked on over a dozen C-suite roles, including CEOs, CGOs, Chief Solutions Officers, CFOs, Chief Medical Officers, and CHROs. Our unique “contained” search model reduces risk for our clients by minimizing upfront fees while allowing PTS to invest in an iterative process to deliver success.

BD Expert Search — PTS launched our proprietary “BD Expert Search” product line, specifically designed to identify, screen, and select top BD talent across the industry, including CGO, Capture, P2W, Proposal, Solutions Architects, Pricing, and Account Executives. This process incorporates tailored video questions, bespoke personality assessments, win sheets, a referral network, and talent catalogues to provide our customers with the best BD talent

GovTech Expansion — Our expansion into the GovTech market gained significant momentum in 2024, positioning PTS for a targeted effort in this sector in 2025. We enhanced our capabilities and continued developing partnerships to serve clients in this vital and rapidly evolving area of Cloud, Artificial Intelligence, Cybersecurity, Intelligence, C5ISR, and Network Engineering. We have extended our reach for placing executives and specialized technical talent in both CONUS and OCONUS.

Outplacement & Career Concierge — PTS remains committed to assisting individuals navigating career transitions in the GovCon sector. Our services encompass resume enhancement, social media optimization, personal branding coaching, targeted networking, and interview preparation. Through our Career Concierge, we have supported numerous individuals seeking our specialized guidance. Positioned strategically within the GovCon industry, PTS enables individuals to leverage our expertise and connections for a successful career change. We also offer Placement services for companies facing downsizing.

Events & Industry Recognition — PTS continued to bring the industry together with top-notch Industry Networking Events both in the DC area and internationally. In April, we hosted our third “Stammtisch” in Kaiserslautern, Germany, on the sidelines of the ISOA K-town event. LTG (ret) Lance Landrum was our guest speaker for the Executive networking event at the Brass Rabbit in Arlington. In March and September, we had our third “Red Hog” event in Warsaw, Poland. On the sidelines of AUSA in October, LTG (Ret) Scott Spellmon shared perspectives from his command of USACE. These events are a great way to bring together industry leaders, get exposure for transitioning military who PTS mentors, and connect our diverse candidate/customer network. Our CEO, Jake Frazer, also represented PTS on notable stages, including a panel at the ISOA Annual Summit in November and as a speaker at the APMP Capture and BD Conference in Q424.

President Jake Frazer Leading CEO Panel Discussion - ISOA Annual Summit, November 2024

Last quarter was an active quarter filled with opportunities to connect, collaborate, and lead in the industry:

- AUSA Luncheon (October) — PTS hosted an AUSA luncheon, bringing together over 80 industry executives for an engaging networking event.

- ISOA Annual Summit (November) — Our CEO, Jake Frazer, led a panel discussion, contributing valuable insights on key industry challenges.

- AFCEA TechNet TransAtlantic (December) — PTS capped off the year by participating in this prominent event in Frankfurt, focusing on the intersection of technology and cybersecurity.

In addition to external events, PTS celebrated the following team milestones:

- Thanksgiving in Kosovo — Jake Frazer and Account Executive Martyn Brooks joined the PTS team in Kosovo for Thanksgiving dinner.

- Leadership Planning Session in DC — The leadership team convened in November to align strategic goals and prepare for an impactful 2025.

- Team Offsite in Albania — The entire PTS team gathered in September for interactive workshops, team-building sessions, and to foster a stronger bond across the organization.

Digital Growth —We reached a new milestone, growing our LinkedIn community to 27,000 followers, a testament to our increasing industry influence and engagement.