Q3 2024 Industry Update

by Bibiana Rais | 06 Oct 2024

INDUSTRY TRENDS

LOGCAP 5.5, DiPSS, NAVFAC, GLOBALCAP, GATA, DLA, NATO!

As we approach the final quarter of 2024, Precision Talent Solutions (PTS) is pleased to present our Q3 Industry Update, reflecting the exciting developments in the defense and government sectors. Over the past nine years, PTS has refined its expertise and has become a trusted industry partner to our customers by delivering customized executive search and talent management services, along with strategic GovCon market intelligence. In this update, we highlight key trends, major contract awards, M&A activity, and upcoming initiatives that define this dynamic industry.

UKRAINE – As of August 2024, Congress appropriated more than $174B to support Ukraine since the start of the war. Procurement efforts have been progressing despite geopolitical pressures from the upcoming U.S. election and the impending winter. While using Western equipment in its counteroffensive, Ukraine has not yet received approval to strike Russian territory with long-range missiles. There is a critical need for spare parts, tourniquets, vehicles, and ammunition. The U.S. remains a key supplier, with the Biden administration’s latest infusion of more than $2.7B in military aid for Ukraine providing a significant boost. This aid includes long-range contracts for advanced systems like the Patriot missile battery, though much of it will take time to materialize on the battlefield. Immediate aid valued at $375M was also approved, focusing on short-term needs such as glide bombs, cluster munitions, and artillery drawn through presidential drawdown authority.

The Security Assistance Group – Ukraine (SAG-U) has been rolled under NATSU, a new NATO command responsible for coordinating arms deliveries, training, and O&M support for Ukraine. Northrop Grumman and Ukroboronprom announced plans for a NATO-compliant ammunition plant in Ukraine following discussions with President Zelensky in Washington, D.C. in July. Other key defense players, including BAE Systems, Day & Zimmermann, Boeing, Sierra Nevada Corporation, RTX, Lockheed Martin, General Dynamics, D&M Holding, AeroVironment, took part in these talks. Amentum signed an MOI for a joint venture with Ukroboronprom who is opening a new office in Washington, D.C.

USAID has been actively funding contractors like DAI, Chemonics, Abt Global, and Tetra Tech to manage projects in energy, health care, demining, and governance. Fresh from winning the Worldwide Conventional Weapons Destruction recompete, Tetra Tech is awaiting the Ukraine task order. USAID requested information on tuberculosis efforts, due October 14th, and will release a $100M mental health initiative this fall. Meanwhile, USAID’s Ukraine Rail Construction Project has been deferred in favor of the $600M Energy Security Project designed to address urgent energy infrastructure needs before the winter season. Bering Global Solutions continues to deliver vehicles for the Government of Ukraine under Western Hemisphere Programs IDIQ. Beyond U.S. assistance, eight coalitions funded by European countries continue to provide financial support for security areas like demining, drones, and integrated air and missile defense.

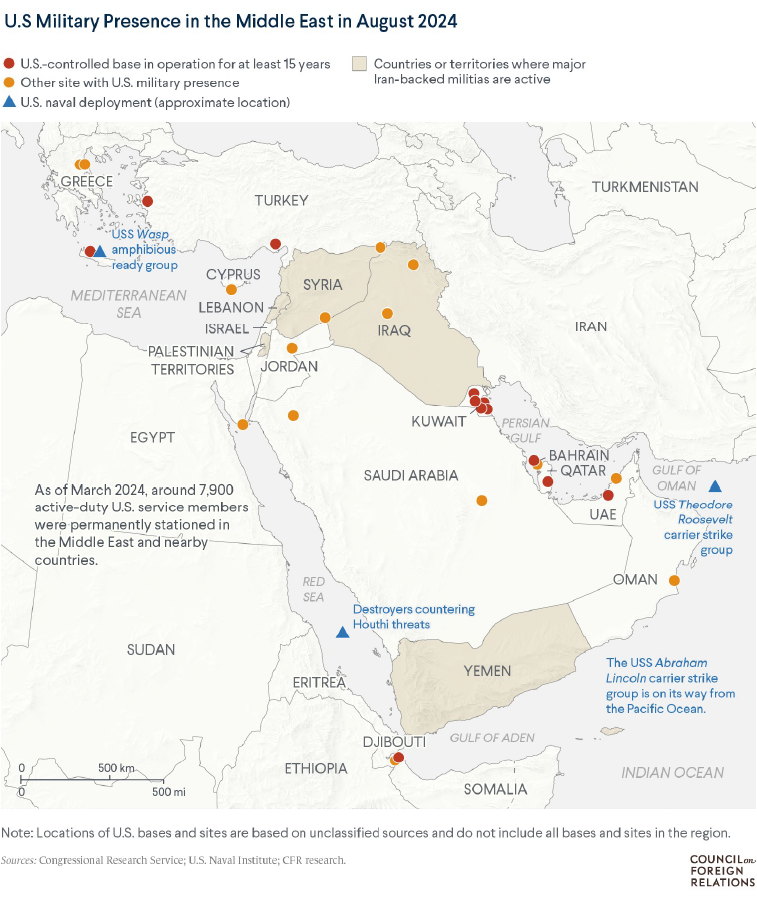

THE MIDDLE EAST– Recent Israeli airstrikes targeting Hezbollah leaders in Lebanon, ongoing violence in Gaza, and the escalating Yemeni civil war have fueled regional instability, prompting the U.S. to reassess its military and diplomatic strategy, despite its gradual withdrawal from the region in recent years. In September, Secretary of Defense Austin ordered U.S. forces to increase their readiness by deploying additional troops to the region and placing others on standby, which is expected to lead to increased contractor support, particularly through contingency contracting vehicles, to provide logistical, operational, and infrastructure support. Support for Israel remains a central pillar of U.S. policy, especially considering security threats from neighboring regions.

The United States has announced an additional $336M in humanitarian aid for the people of Gaza and the West Bank affected by the ongoing conflict, raising the total U.S. assistance for Palestinians to over $1B since October 2023. The funding will support life-saving aid such as food, emergency healthcare, clean water, sanitation, and emergency shelter for displaced Gazans ahead of winter.

The U.S. military continues to have an extensive footprint in the Middle East, which is expected to surge in the coming weeks.

The U.S. is also working diplomatically with Arab nations, such as though the Abraham Accords to promote greater regional cooperation. Ongoing discussion about the U.S. military presence in Iraq reflect the delicate balance between maintaining a presence to counter security threats, such as ISIS, and addressing local political concerns. There has been a notable increase in defense and reconstruction contracts aimed at bolstering security and enhancing infrastructure in conflict-affected areas. Jordan has seen significant contracting activity as the U.S. enhances posture to support Israel while maintaining stability in a volatile region.

MAJOR PROGRAMS

Below is a synopsis of the major programs by agency and contracts that drive our industry.

ARMY

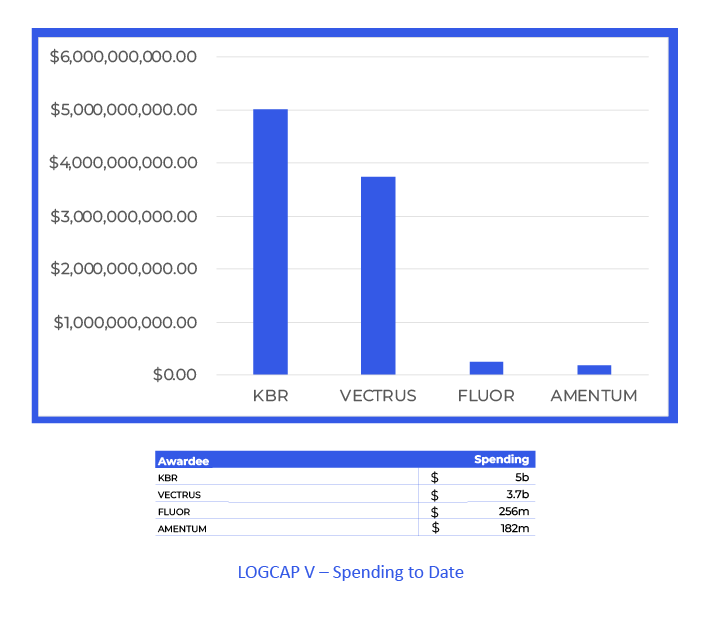

LOGCAP V — Now that we are halfway through the 10-year, $82B LOGCAP V award, the government has signaled that it intends to recompete the performance task orders on this global contact in what is being called “LOGCAP 5.5”. Army Sustainment Command (ASC) has indicated that it will issue the draft RFP in mid-October, hold and industry in mid-November, and then release the full RFP in early 2025 in a move that could reshuffle the entire LOGCAP landscape. This will certainly generate a tremendous amount of bid & proposal activity over the next year.

ASC also anticipates resolving multiple protests from contractors over the APS task order integration, representing a significant shift in the Army Logistics contracting landscape. Awards were announced with KBR winning APS-2 (EUCOM) and Amentum winning the remaining TOs (Kuwait, Korea/Japan, South Carolina + afloat). It will be interesting to see how ASC can manage the APS award resolution on top of the LOGCAP 5.5 acquisition activity. Key members of the PTS team have been around LOGCAP since the Balkans and have a deep understanding of the talent and program management requirements for this pace setting contract.

USACE awarded Parsons a $68.5M million design-bid-build contract to deliver new US Army housing units at Kwajalein Atoll, Marshall Islands while MVL received a $91M contract to construct a new aircraft control tower and passenger terminal building. USACE awarded a $2.35B Operation, Maintenance, and Engineering Enhancement (OMEE VII) MATOC contract supporting the Defense Health Agency at worldwide locations to 12 companies. CACI received a five-year $414M TO contract to provide global operational support for unmanned systems to the Army’s C5ISR Center, enabling warfighters to respond rapidly to current and emerging threats. Serco was awarded a $323M contract for facility repairs and upgrades at Pituffik Space Base (formerly Thule AB) in Greenland, which supports missile warning, missile defense, and space surveillance missions.

INSCOM released a pre-solicitation for the Global Intelligence, Logistics, and Engineering (GILE) Services, with the RFP expected on October 4th. This contract will be competed among large businesses only and provide multi-disciplined engineering, facilities maintenance, logistics, and sustainment support services to INSCOM, Army Cyber Command, Army Intelligence, Joint Forces, Combatant Commands, and the IC. PTS has a long history of supporting the US Army programs across all theaters and understands the critical aspects of matching program requirements with the right talent.

Defense Threat Reduction Agency (DTRA)

DTRA published a Special Notice on August 30th for a Cost-Plus Fixed Fee (CPFF) IDIQ contract to provide fully integrated SME support with Advisory and Assistance Services (A&AS) to the Strategic Integration Directorate. The prequals were collected on September 11th; the future contract is anticipated to have a 1-year base period and four 1-year option periods, with an approximate contract ceiling of $92.4M.

DTRA awarded Culmen a $16M bridge contract for threat reduction logistics services to support the Cooperative Threat Reduction Directorate. The work provides logistics services across the cooperative threat reduction portfolio, including the Biological Threat Reduction Program, chemical security and elimination, global nuclear security, strategic offensive arms elimination, the Proliferation Prevention Program, and other assessments and administrative costs. PTS has built a reputation for placing exceptional operational and technical talent to support DTRA contracts. Our deep understanding of the mission-critical requirements enables us to identify and deliver highly skilled professionals who drive success in areas like threat reduction, WMD countermeasures, and emerging technologies.

NAVY

NAVFAC continues to be a very active contracting shop with most of the OCONUS BOS programs going through acquisition. The Navy Djibouti BOS Services Contract procurement at Camp Lemonnier is currently underway. The RFI responses were collected on August 13th. KBR filed a protest expected to be resolved in November 2024. NAVAC released new solicitations for the BOS Contract at New Sanno, Tokyo, Japan, due October 17th; BOS Services at Sauda Bay, Crete, Greece, due October 4th, and BOS San Diego contract, due October 17th, to provide services at the main NBSD facility as well as surrounding outlying areas in San Diego, California. This solicitation is a total small business set-aside. Here is a published list for ongoing and upcoming NAVFAC projects.

KBR has received a bridge contract to continue providing BOS services at NSF Redzikowo in Poland, following the expiration of the current task order on August 31st. The original task order was awarded under NAVFAC Pacific’s GCSMAC contract, with KBR being awarded the follow-on Global Contingency Services MAC III on April 4th. Due to the geopolitical tensions caused by Russia’s invasion of Ukraine, a no-risk option was prioritized to ensure uninterrupted BOS services until a new contract was awarded to V2X on September 26th valued at $98M. BOS Sigonella’s RFP, expected to be released in Q3, is now anticipated to be published in Q4. Valiant continues to provide BOS services at NAS Sigonella under the final modification, extending the performance period to December 2024. V2X received a contract modification valued at $10M for BOS support at Naval Support Facility Deveselu, Romania, bringing the total cumulative contract value to $50M.

DZSP 21 received a $106M contract modification to continue providing BOS services in Joint Region Marianas. The work will continue in Guam and is expected to be completed by July 2025. After dismissing the protest filed by the incumbent KBR, the proposals for BOS Diego Garcia have been extended through October 2nd. The RFI responses were collected for Facility Services, Housing Equipment Cleaning at the Naval Air Facility Atsugi and Combined Arms Training Center at Camp Fuji on September 25th. RFI has been issued for an IDIQ Design-Build/Design-Bid-Build multiple-award construction contract for U.S. Government installations in the Okinawa Region, Japan. Responses were due by October 3rd. The contract is anticipated to have an aggregate value up to $1 billion awarded across multiple contracts over 8 years.

The Military Sealift Command awarded CACI a $69M contract to provide worldwide logistics services commencing October 18th. Siemens, which built a liquefied natural gas energy-efficient power plant at Naval Station Guantanamo Bay (NSGB), was awarded a $107M price modification to increase the energy service performance contract at NSGB, bringing the total contract value to $936M. The facility uses LNG to operate a new dual-fuel combined cycle power plant serving the installation, reducing annual fuel consumption by approximately 27.4%.

KBR has been awarded a $153M contract to support Naval Test Wings Atlantic and Pacific over 5 years. The work includes aircrew services, engineering support, and independent air vehicle and ground operations analysis. The contract also supports 7 developmental test squadrons and the U.S. Naval Test Pilot School. Culmen has been awarded a $39M IDIQ contract to provide biosurveillance and epidemiology research services to support the ongoing development, performance, and management of research across INDOPACOM. V2X secured a $141M award to continue providing comprehensive engineering support for C4I systems to the Navy Fleet and a $747M seven-year IDIQ contract to maintain the Navy’s F-5 aircraft.

AIR FORCE

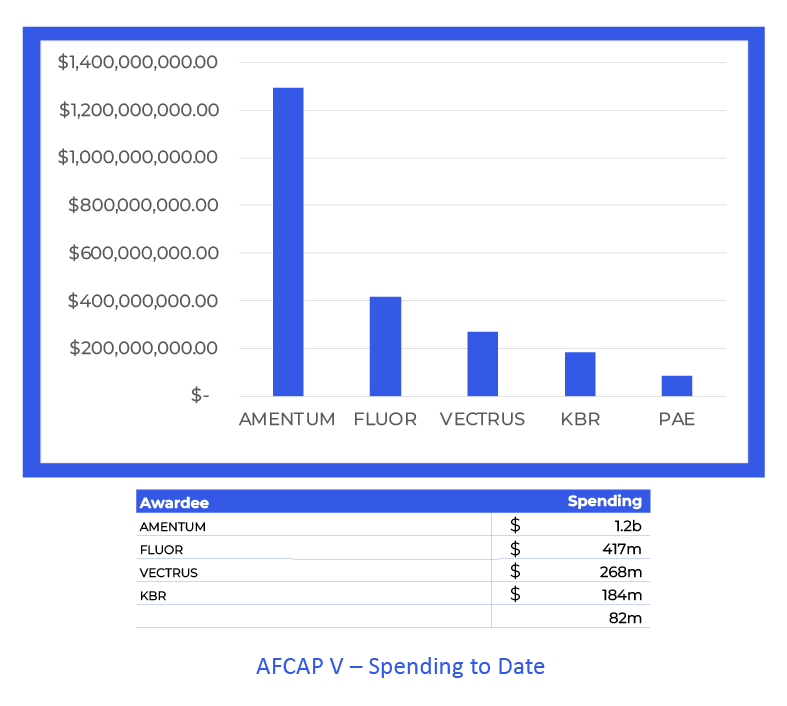

AFCAP V-–Earlier this year, USAF increased the maximum ceiling value of AFCAP V IDIQ from $6.4B to $15B. Six companies, including Amentum, ECC, Fluor, KBR, RMS, and V2X, hold positions on the contract. Several task orders were awarded under “urgent and compelling” circumstances, which occurs when there isn’t enough time for a full competition, and direct awards are made on a rotational basis among the primes. As we approach the end of the year and look ahead to 2025, it is anticipated that some of these urgent and compelling task orders will be reopened for competitive bidding.

The U.S. Air Forces in Europe—Air Forces Africa published a Special Notice related to the Kaiserslautern Installation Support Services (KISS) contract opportunity in July, seeking feedback from the industry on the acquisition strategy and draft qualification matrices for various service areas under the KISS contract, including housing maintenance, custodial services, grounds maintenance, and total facility maintenance. A draft RFP is expected in Q4. Turkey/Spain BOS, now called the USAFE Base Operations Support (BOS)’s RFI, dropped in June, RFP expected in Q4.

ASRC Federal has secured a $146M contract to provide comprehensive BOS services for Sheppard Air Force Base (SAFB) and Lake Texoma Recreational Annex at Fredrick Airfield in Wichita Falls, Texas. SAFB is a key installation for the USAF’s training operations and annually trains over 60,000 airmen and other military personnel. Cherokee Federal has received a $49M TO under the USAF’s Training Intelligence Plans and Exercise Support Cyber Readiness Operations Weapons and Tactics Network Defensive Operations II (TRIPLECROWN) contract. The USAF has awarded positions to 23 companies on a 10-year, $12.5B contract to provide a pool of qualified sources to modernize, operate, and maintain the network infrastructure on all USAF locations globally, including Guard and Reserve bases.

Defense Logistics Agency (DLA)

DLA remains actively engaged in its extensive acquisition processes, particularly focusing on its OCONUS supply programs. DLA SPV Southern Europe collected RFIs in April 2024 for full-service food support to military and authorized land customers in Southern Europe and Navy ship customers in Northern/Southern Europe and Northern/Western Africa. The RFP is expected in Q12025.

Noble, TWI, and Supplycore continue to provide support under the DLA TS MRO Europe and Africa PV contracts. They supply various types of maintenance, repair, and operations items to DLA customers located in EUCOM and AFRICOM. The current contracts are valued at up to $916 million combined and have a performance period through May 2026. PTS anticipates the RFP for recompete to be released in Q22025. It will be interesting to see what DLA’s per-zone acquisition strategy will look like across EUCOM and AFRICOM AOR.

DLA SPV Iraq, Jordan, Kuwait, and Syria closed on June 16th, with awards due in 1Q2025. DLA Troop Support is considering proposing a modified acquisition strategy for the SPV Southern West Asia and Eastern Africa (SWAEA) to provide support for both land-based and afloat customers in the SWAEA AOR. This new program aims to combine two existing DLA SPV Programs – DLA SPV SAPNEA and DLA SPV Bahrain, Qatar, and KSA. Currently, Valiant manages SAPNEA (UAE, Oman, Djibouti, and Eastern Africa) and OFI handles Bahrain, Qatar, and KSA.

DLA TS MRO programs that support DOD troops with class IV and IX in Japan, Okinawa, and South Korea and additional locations like the Philippines within INDOPACOM are expected to be recompeted in Q22025. The DLA TS SVP for Japan, Singapore, Philippines, Diego Garcia, and Australia is expected to get awarded in 1Q2025.

DLA awarded 85 companies positions on the potential 10-year, $11.9B J6 Enterprise Technology Services 2.0 (JETS 2.0) contract to provide information technology support services for DLA and other DOD customers. AM General has been awarded a $41.5M contract to supply diesel engines and containers for the U.S. Army.

GSA

GSA announced the first OASIS+ Small Business contract awardees in July, with 1,383 small businesses expected to be awarded contracts across 7 domains. OASIS+ Small Business is one of six contracts in the OASIS+, a suite of multiple-award IDIQ contracts with a 5-year base period and a 5-year option term and no contract ceiling or cap on awards, designed to provide federal agencies with professional (non-IT) services in CONUS and OCONUS locations. A complete listing of all companies selected for the award is here. These awards were prioritized before the legacy OASIS SB contract’s December 2024 expiration. GSA plans to reopen solicitations for on-ramping in FY 2025.

A significant award activity totaling $8B was recorded in Q3 under the GSA ASTRO Master GWAC:

- V2X secured a mission-critical contract to enhance readiness capabilities for the U.S. Army globally with the Warfighter-Training Readiness Solutions (W-TRS) task order valued at $3.7B over 5 years. Awarded by the Program Executive Office for Simulation, Training and Instrumentation (PEO STRI), V2X is set to offer mission enablement services across the Army’s extensive network of Training Aids Devices Simulations and Simulators (TADSS), supporting hundreds of thousands of these critical devices worldwide.

- Booz Allen Hamilton booked two task order contracts, including a $1.7B TOfrom the US Army focused on egress security cooperation and FMS support services and a $2.5B TO from the Office of the Chief of Staff for service solutions for modernization analysis readiness capability threat and training (SSMARTT).

DOD is set to issue a multiple-award IDIQ contract for the Long-Range Enterprise Intelligence, Surveillance, and Reconnaissance Activity (LEIA) valued at an estimated $3B over multiple years to bolster intelligence, surveillance, and reconnaissance (ISR) capabilities to monitor potential threats in the INDOPACOM. GSA awarded a single-award Indefinite Delivery Contract (IDC) valued at $73.4M to Supplycore. The contract provides forward supply logistics solutions for the CENTCOM region, including Kuwait, Jordan, Bahrain, and the UAE. GSA has established similar 4PL-type programs with distribution platforms in CENTCOM, EUCOM, INDOPACOM, AFRICOM, and other AORs to pre-position class II commodities in support of DOD and other federal customers. The GSA EUCOM and GSA Japan operations are carried out by Noble, while LCI manages operations in Korea.

PTS recognizes the importance of acquiring the right talent for GWAC programs and implements customized processes to assist large and small primes in optimizing the task order team structure and key personnel to maximize the TO operational success.

TRANSCOM

TRANSCOM awarded 30 offerors an IDIQ contract for Port Operations and related Transportation Services (PORTS) worth a total program value of $710M to provide support across 6 global regions for a base period of 5 years, with up to 4 option periods extending the contract for a total of up to 11 years. Crowley was awarded a 10-year, $613M IDIQ contract for transportation services within the US, Puerto Rico, and Canada, and received a $480M economic adjustment under an existing contract to continue coordinating surface freight shipping operations.

In September, DOD Chief Digital and Artificial Intelligence Office (CDAO) hosted its highly anticipated Industry Day for Advana, a major upcoming recompete of a $15B contract for the DOD’s flagship big-data platform that centralizes government-owned data for advanced analytics and decision-support services. In recent months, AI has rapidly advanced in defense applications, transforming operations within the DOD. From autonomous systems to sophisticated data analytics, AI technologies are revolutionizing how the DOD functions. As these capabilities grow, DOD agencies are actively exploring innovative methods to leverage AI’s potential and are making substantial investments in its adoption, which presents a significant opportunity for AI and technology defense contractors to offer cutting-edge capabilities and solutions to meet the growing demands of the defense sector. PTS actively monitors emerging trends and provides innovative talent management solutions to help FedTech contractors secure new business.

DEPARTMENT OF STATE

GLOBALCAP and GATA are two highly anticipated global contingency contracts, both scheduled for award by the end of Q4.

GLOBALCAP--Proposals are still under review for this new $5B IDIQ, consolidating two legacy DOS IDIQs—AFRICAP and GPOI—focused on peacekeeping and stability initiatives in sub-Saharan Africa. The contract is expected to have up to seven awards in the full & open pool and seven in the socio-economic pool, reserved for WOSBs and SDVOSBs. While awards were initially expected in Q4, delays in the evaluation process suggest awards may be pushed to Q125. Due to changes in the incumbent landscape, including only one qualified SDVOSB left on AFRICAP, it is anticipated that there will be at least two new awardees in the F&O pool and nearly all new entrants in the set-aside pool.

AFRICAP/GPOI—AFRICAP remained busy with task orders, including awarding a significant APC requirement contract for Zambia to Amentum a large construction project in Kenya at Manda Bay to Relyant and two “train & equip” contracts for Cote D’Ivoire and Mozambique, which are still under evaluation. The GPOI IDIQ concluded earlier this year, with the program office recompeting legacy IDIQ Task Orders as SB set-aside RFPs over the summer. Contracts for Togo, Tanzania, Uganda, and Chad have already been submitted, with Zambia, Malawi, and Senegal due soon. These contracts, which have a Base + 3 Option Years period of performance, will be recompeted under GLOBALCAP.

GATA--The DOS is still reviewing proposals for the GATA IDIQ, managed by the Anti-Terrorism Assistance Program Office within the Bureau of Diplomatic Security. In the past, GATA included seven regional awards, but this time it has been reduced to four regions, with each offeror limited to one regional award. There is potential for new awardees due to M&A activity and changes in the incumbent landscape. The contract was initially expected to be awarded by June 30th, but a pre-award protest filed by Relyant in the spring delayed the process. However, the protest was dismissed by the GAO in July. AQM has requested that the remaining offerors extend their proposal validity through September, which suggests that awards are imminent in Q4.

GLOBAL ADVISORY—The Global Advisory (GA) is another significant DOS IDIQ contract expected to be released early in FY2025. This contract will combine two existing IDIQs that focus on providing advisory assistance to partner nations. The DOS GA IDIQ will be the main way for AF/RPS and PM/GPI to obtain international advisory services. It will bring together the Global Advisory Support Services (GASS) IDIQ, managed by PM/GPI, and the now-completed Africa Advisory Services (AAS) IDIQ, previously managed by AF/RPS. GASS was the result of a full and open competition with three incumbents, while AAS was an SDVOSB set-aside with four prior awardees. There have been acquisition delays, and small businesses have actively lobbied the DOS ODSBU to influence the final solicitation. The contract is anticipated to be limited to small businesses, with a socio-economic set-aside pool for WOSBs and SDVOSBs.

DiPSS– KBR secured two major task orders in Iraq, including a $187M TO contract for medical support services (MEDSSI) and a TO contract to provide life support, operations and maintenance, and fuel services for the U.S. Embassy in Baghdad. Meanwhile, V2X landed a $130.5M contract for medical support services (MSS-D) in Doha, Qatar, and SOSi took home a $100M operations and maintenance services TO for Doha. Looking ahead, two additional task orders for Iraq—covering vehicle maintenance and airfield operations support—are set for award in Q4. The DIPSS Large contract has been extended through December 2024, with a recompete expected in early 2025, while the DIPSS Small remains active until 2028.

The State Department eliminated Amentum from a $840M TO competition to provide support services at the US Embassy in Baghdad and other locations in Iraq, offering significant opportunities to other Iraq-licensed contractors to support the OBO. PTS has been providing top cleared talent for US Embassy support programs for the past 7 years and continues to offer a strategic advantage for prime or task order bids with compelling and compliant talent.

USAID

USAID has awarded Chemonics, Creative Associates, Democracy International, DAI, DT Global, MSI, and Palladium positions on a $5B SWIFT 6 IDIQ contract. The SWIFT 6 IDIQ is structured around two service areas: Implementation of Transition Programs (SWIFT-Programs) and Program Operations Technical Assistance Support (SWIFT-Support). These components enable USAID to take advantage of emerging opportunities in the political landscape, providing adaptive and agile programming in countries or regions experiencing complex political crises. The SWIFT 6 IDIQ has a 10-year ordering period with an additional 2-year performance period for ongoing task orders.

In the upcoming months, USAID is expected to award several contracts as part of the $17B NextGen Global Health Supply Chain initiative (NextGen GHS). The NextGen In-country Logistics (ICL) contract, valued at up to $1.49B , will focus on providing warehousing and transportation for health commodities and is expected to be awarded in Q4. Additionally, the NextGen Procurement Service Agent (PSA) - HIV contract, with an estimated ceiling of over $3B, will support the procurement and delivery of quality-assured HIV/AIDS and other health commodities for the USAID’s Office of Global Health and is anticipated to be awarded by Q12025. Proposals were collected in June 2024. Another anticipated contract is the NextGen Procurement Service Agent - Diagnostics contract, valued up to $2.79B, which will manage procurement for lab, diagnostic, and molecular commodities. These awards, along with the NextGen Qualifying Testing Issuing (QuTI) contract, expected by September 30th and valued at up to $299M, will play crucial roles in managing various health supply chains globally. USAID has already achieved significant milestones with contracts awarded under the NextGen GHS initiative, including the Control Tower contract valued at $105.9M , awarded to Deloitte in May 2023, and the NextGen Comprehensive Technical Assistance for Health Supply Chain and Pharmaceutical Management (NextGen Compete) IDIQ, worth $2.2B, awarded in Q1 to a consortium including Guidehouse, Chemonics, and other industry leaders.

We are actively tracking the NextGen GHS initiative and its key elements to ensure we provide top-tier personnel to support prime contractors throughout the bidding and proposal process.

DEPARTMENT OF INTERIOR (DOI) & DEPARTMENT OF JUSTICE (DOJ)

The DOI has awarded positions to 7 companies on its Foundation Cloud Hosting Services 2 (FCHS2) contract, a 10-year, $2B contract vehicle to enhance the department’s IT infrastructure and cloud capabilities. Accenture Federal and Cognosante are new to this round, while incumbents SMX, CGI Federal, SAIC, Zivaro, and IBA continue their roles from the expiring contract, set to end on October 30th. To date, DOI has allocated $601M, about 69% of the contract’s ceiling, with CGI Federal and SMX receiving over $190M each in TO spending. The FCHS2 contract is strategically aligned with the $1B Cloud Hosting Solutions III (CHS III) contract awarded to Peraton, naming it the lead enterprise cloud broker for DOI over the next 11 years.

DOJ is seeking information from vendors capable of providing global administrative, logistical, professional, and technical support services for its Investigative Criminal Investigative Training Assistance Program (ICITAP) and Office of Overseas Prosecutorial Development, Assistance and Training (OPDAT) programs. This recompete for a contract currently held by Amentum since 2020 is valued at 400M. An industry day is scheduled for November 6th.

EUROPE’S DEFENSE SECTOR

Over the past 6 years, venture capital investment in Europe’s defense tech has grown fivefold, with 2024 on track to hit $1B. Germany, the UK, and France dominate, capturing 87% of the total funding. Within NATO, defense tech investment is growing 25% faster than the broader alliance, with NATO countries set to reach $5.9B by the end of Q4. Currently, 78% of Europe’s defense spending goes outside the continent, with a significant portion benefiting U.S. manufacturers. A report by Mario Draghi, former Italian Prime Minister, stresses the urgency for Europe to become more self-reliant in its defense capabilities, especially as tensions with Russia escalate.

UK MOD –UK MOD has initiated a new Strategic Defense Review (SDR) to be delivered in the first half of 2025. The review is being conducted in response to the evolving global security landscape, focusing on strengthening the UK’s homeland security, supporting Ukraine against Russia, and modernizing the UK’s nuclear deterrent. The UK MOD has awarded NP Aerospace a $94.6 million CVSSP contract to provide spares and post-design services for conventional vehicles in the British Army, making NP Aerospace the single point of supply for wheeled vehicle support, consolidating the provision of these services for the British Army.

Two leading European suppliers of defense technology, Rheinmetall and Leonardo signed a strategic partnership for the development of the next land defense systems. In July, Rheinmetall celebrated the official takeover of its new state-of-the-art 30mm ammunition factory in Várpalota, Hungary, designed to produce ammunition and other products for the KF41 Lynx infantry fighting vehicle (IFV), which will be built in Zalaegerszeg and delivered to the Hungarian armed forces.

NATO/NSPA

During the 33rd NATO Summit in July in Washington, D.C., NATO announced the creation of a new command, the NATO Security Assistance and Training for Ukraine (NSATU), dedicated to coordinating and streamlining the alliance’s support for Ukraine. Headquartered in Wiesbaden, Germany, with key logistical outposts on NATO’s eastern flanks and approximately 700 personnel, NSATU will serve as the central hub for organizing military aid, training programs, and logistical support for Ukraine. NSATU is expected to collaborate closely with NSPA’s Operations Support Program for contracted services. Drawing on its experience in supporting NATO operations in Afghanistan and Kosovo, NSPA is well-positioned to assist NSATU in key areas such as procurement and supply chain management, maintenance and repair services, infrastructure development, transportation logistics, and medical support. These capabilities will be vital in ensuring the success of NSATU’s mission in Ukraine and addressing the country’s defense and training needs.

NSPA has been actively engaging with NATO stakeholders and industry in Q3. In August, the agency hosted the NSPA/DCMA Host Nation Conference in Luxembourg, focused on AI in Government Quality Assurance, contract audit procedures, and the impact of Sweden’s accession on procurement. Additionally, NSPA organized virtual and in-person Industry Days for the UK and France, respectively, with a major Fuel Industry Day scheduled for October 9th. This event will target companies capable of operating in NATO’s eastern flank and beyond. NSPA also completed several major procurement projects, including the purchase of 220,000 155mm artillery shells valued at $1.2B and up to 1,000 Patriot interceptor missiles, along with continued progress on high-visibility initiatives like the Alliance Future Surveillance and Control (AFSC) and the Multinational Multi-Role Tanker Transport project. Reach out to Jim Shields, PTS’s in-house NATO expert, to learn more about upcoming procurements and other NSPA projects that align with your firm’s capabilities and strategic growth priorities.

FOREIGN MILITARY SALES (FMS) HIGHLIGHTS

DOS has approved a $7.2B FMS for Romania, including 32 F-35A Lightning II Joint Strike Fighter aircraft and related equipment delivered by Lockheed Martin, who will also deliver support under a recently approved $390M FMS contract for Croatia for M142 high-mobility artillery rocket systems and related equipment and services. DOS has also approved a $65M for Iraq for vessel maintenance, repair, and related equipment, which follows an earlier $39M FMS package for ship repair and sustainment under the Vessel Maintenance and Repair (VMR) program. Amentum will serve as the primary contractor, with around 65 multinational contractor representatives deployed to Iraq. Egypt will benefit from the recently approved FMS to provide Stinger missiles and related elements of logistics and program support for an estimated cost of $740M, with RTX as the principal contractor.

IDS International has been awarded 7 TOs in 2024, amounting to over $54M, to support FMS training through the US Army Security Assistance Training Management Organization (USASATMO). IDS provides agile Technical Assistance Field Teams (TAFTs) and Mobile Training Teams (MTTs) to partner nations in key geopolitical regions, including Poland, Kosovo, Romania, and Bahrain and delivers specialized training in Iraq to elite forces and medical personnel. PTS continues to support FMS contractors with the best program talent in critical overseas locations.

MERGERS & ACQUISITIONS

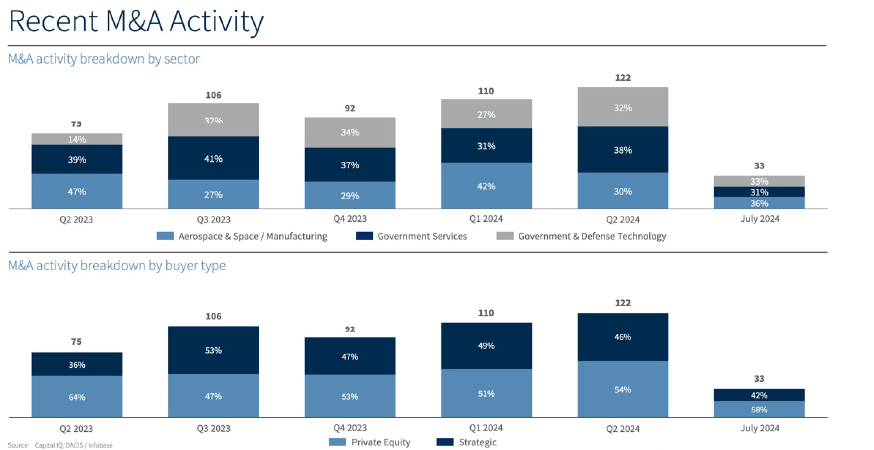

The strong M&A activity in the government contracting sector continued into Q3, following a busy Q2 with 122 M&A transactions reported—an increase of 63% over the same period last year and an 11% rise from the previous quarter. According to Raymond James’ report in August, the government services sector was the most active, accounting for 38% of Q2’s M&A deals, followed by the government and defense technology portfolio at 32% and the aerospace and space/manufacturing sector at 30%. Private equity was heavily involved, making up 58% of the acquisitions. July alone witnessed 33 M&A transactions and continued throughout Q3, demonstrating strategic realignments and expansions within the GovCon.

KBR has completed its acquisition of LinQuest for approximately $737M, expanding its engineering, digital integration, data analytics, and related technical capabilities in support of DoD and IC agencies. CGI merged with Aeyon, a leader in digital transformation and AI technologies, including data management, analytics, and intelligent automation, to expand support to the USG’s national security agencies and customers. Amentum has announced its new board of directors, which took effect after the completion of its merger with Jacobs’ Critical Mission Solutions and Cyber and Intelligence divisions, on September 27th. GDIT expanded AI and cyber capabilities by acquiring IEX, an expert in AI/machine learning, cyber, software development, and cloud services for the SOF and the IC.

Behrman Capital has agreed to sell its portfolio company kSARIA, a manufacturer and supplier of connectivity offerings for the aerospace and defense end markets, to ITT for approximately $475M. Parsons has agreed to buy BlackSignal Technologies for approximately $200 million to broaden its cybersecurity, AI, and electronic warfare capabilities and its client base across the DOD and IC. Exigeracquired data science company XSB to expand its proprietary data and AI tools portfolio. ITC Federal has taken a major step forward with an investment from Blue Delta Capital Partners to accelerate growth and ability to deliver innovative solutions in GovCon. Chenega has acquired SecuriGence to integrate this VOSB into its military intelligence and operations strategic business units. Tyto Athene, an Arlington Capital Partners portfolio company, completed the previously announced acquisition of MindPoint Group on June 30th.

Rheinmetall expanded its North American presence by completing a strategic acquisition of Loc Performance, a leading vehicle specialist, positioning the company for major defense contracts, and expanding its manufacturing footprint in North America. Boeing and Lockheed Martin continued negotiating with Sierra Space over the possible sale of their JV, ULA, in a deal worth up to $3B. Cherokee Federal has purchased a major stake in Advance Technology Applications (ATA) through the newly established growth capital firm Sovereign Capital to expand its presence in federal contracting. CACI has agreed to buy Azure Summit Technology for approximately $1.2B to expand its technology offerings for the DOD and other national security agency customers.

PTS UPDATES

CXO Search - PTS continues its robust performance in executive search, with a 25% increase in placing CXO roles in Q3 over the same period in the last year.

GovTech - Our entry into the GovTech market has accelerated our growth, with Account Executive Candice Smith leading this expansion. Her deep understanding of the sector has allowed us to build strategic partnerships and solidify our presence. Our focus on screening, vetting, and placing the best candidates ensures our clients secure top-tier executive talent capable of leading their organizations toward success in an increasingly complex business environment.

Outplacement & Career Concierge – PTS Career Concierge services saw significant success in Q3, helping numerous professionals in the GovCon industry refine their personal brands, navigate career transitions, and achieve their professional goals. Looking ahead, we are excited to be preparing for the launch of our Outplacement offering – an important service for companies undergoing organizational changes and reorgs. Outplacement is designed to assist organizations in supporting employees through challenging transitions, providing career coaching and resume refresh as they move forward. We pride ourselves on our expertise in this area and are committed to making these transitions as smooth as possible for both individuals and companies.

BD Expert Search - Over 50% of all PTS placements are in BD, cementing our reputation as true experts in business development talent. Our deep industry connections in the BD space give us unparalleled access to the industry’s top players, enabling us to provide clients with the best candidates. With our bespoke recruitment process and tech-driven methodologies, we match our clients with candidates who are strategically aligned and have a proven track record of success. As we elevate BD recruitment to a flagship service, we remain committed to delivering customized solutions and building long-term relationships with both candidates and clients.

This quarter brought numerous opportunities for growth and collaboration, setting the stage for PTS’s continued success in the months ahead.

In early July, PTS attended the South East Europe ISOA Reception and Dinner in Skopje, North Macedonia, hosted by the South Eastern Chapter. The event highlighted cooperation opportunities and addressed critical regional infrastructure challenges. PTS was proud to sponsor and participate in this important industry gathering.

During August, our Account Executive, Candice Smith represented PTS at the 2024 Intel Summit in Washington, D.C., where she engaged with senior government officials and technical experts to discuss national security challenges and innovative solutions, with a strong emphasis on AI and emerging technologies that support the Intelligence Community.

In September, the team kicked off the month with a company-wide retreat in Albania, focusing on collaboration, professional development, and refining PTS’s strategic goals for the year ahead. We officially launched our “LEAD” framework for internal operations and for customers: Learn, Engage, Assess, Decide.

Later in the month, PTS participated in the ISOA Ukraine Conference in Warsaw, Poland. Jake Frazer led a panel on NATO and the NSPA, with valuable contributions from PTS’s in-house NSPA expert, Jim Shields. During the event, PTS hosted an exclusive Executive Leadership Dinner at the Red Hog restaurant, where more than 60 executives gathered to exchange insights on the latest trends shaping our industry.

Following the conference, Candice Smith took part in a presentation on “Navigating Federal IT Contracting,” which explored the impact of election cycles on legislative changes, appropriations, and IT services spending. The discussion highlighted key trends and investments in AI/ML and RPA technologies, offering a glimpse into the industry’s future evolution.

During Q3, we also reached a significant milestone, growing our LinkedIn community to 26,000 followers!

UPCOMING INDUSTRY EVENTS

- AUSA Annual Meeting – 10/8-11 - DC, USA

- ISOA Annual Summit – 11/12 - VA, USA

- AFCEA TechNet Transatlantic – 12/4-5 – Frankfurt, Germany