Q2 2024 Industry Update

by Bibiana Rais | 09 Jul 2024

INDUSTRY TRENDS

Precision Talent Solutions (PTS) has established itself as a valued partner for public sector contractors, not just through our successes in executive placement but also with our unique insight. Our team consists of industry veterans with extensive knowledge of the government contracting (GovCon) landscape. This allows us to provide customers and candidates with market intelligence and exclusive perspectives. As we reach the midpoint of 2024, PTS is excited to share our Q2 Industry Update, summarizing activity within major programs and areas of operation, contract awards, M&A, and larger trends that impact your business and ours.

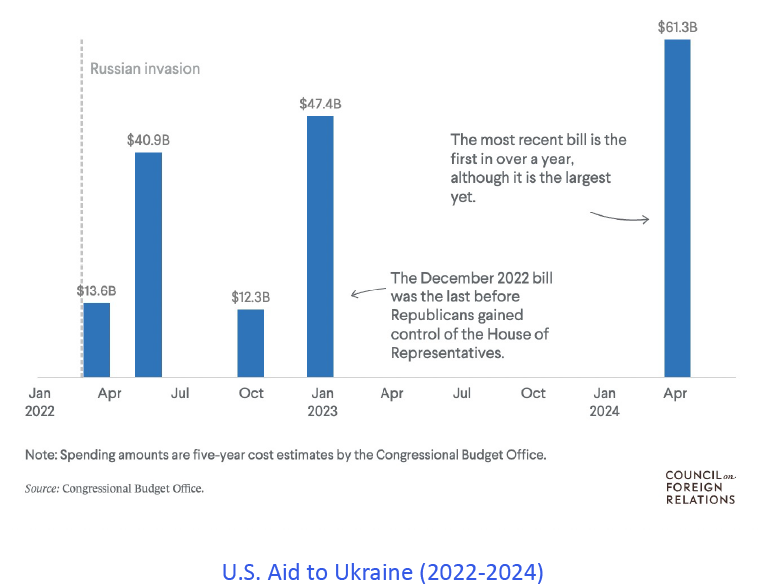

UKRAINE – As of June 30th, the Russia-Ukraine conflict has been ongoing for 857 days. PTS continues to monitor Ukraine funding for US and European Government Agencies and provides periodic updates to our customers and partners delivering support in Ukraine. According to the Council on Foreign Relations’ report from May 2024, the U.S. Congress has passed five bills allocating $175 billion in response to Russia’s invasion of Ukraine in February 2022.

Discussions are underway to allow the deployment of American defense contractors to support fleet maintenance, training, and other technical and advisory services on sites in Ukraine. In June, Ukraine’s state-owned defense conglomerate Ukroboronprom and Amentum signed a Memorandum of Intent (MOI) to establish a joint venture. Rheinmetall is investing heavily in Ukraine, setting up joint production facilities for armored vehicles, ammunition, and air defense systems.

Specific Ukraine-related contracts awarded in Q2 include TetraTech receiving the $438 million Securing Power, Advancing Resilience & Connectivity (SPARC) contract. USAID seeks proposals for the Revenue and Expenditure Governance Reforms Operationalized (RevGRO) contract. The roughly $48 million contract proposals are due August 2nd, 2024. USAID also seeks a security partner to implement the Ukraine Partner Liaison Security Operation (PLSO) contract, with proposals due July 22nd, 2024. The winner will have to be recused from all other security work in Ukraine. USAID announced that it is allocating $500 million in new funding for energy assistance and redirecting $324 million in previously announced funds toward emergency energy needs in Ukraine. This funding will be used to repair energy infrastructure damaged in the war, expand power generation, and protect energy infrastructure. The State Department plans to provide an additional $300 million in Ukrainian civilian security assistance to support life-saving equipment for Ukrainian border guards and law enforcement. While the future of Ukraine remains uncertain, it is clear there will be a need for increased support. PTS is supporting customers in Ukraine with management and technical talent, specifically around USAID and Maintenance, Repair, & Overhaul (MRO) programs. We are also building pipelines for both local and expat engineers, project managers, construction, health & safety, and other high-demand categories to support expected demand.

THE MIDDLE EAST–Since the eruption of conflict between Israel and Hamas on October 7, 2023, tensions in the Middle East have intensified, affecting several countries in a region striving for stability. The United States responded by enacting legislative measures to provide significant military aid to Israel, totaling over $12.5 billion. This aid package includes $3.8 billion from a bill passed in March 2024 and an additional $8.7 billion from a supplemental appropriations act approved in April 2024. For context, this amount surpasses any annual military aid provided in any year since the Camp David Accords of 1978 generated the Egypt-Israel peace treaty in 1979. Approximately 25% of this aid comes in the form of Foreign Military Financing (FMF) grants to acquire U.S. military equipment and services. PTS is closely monitoring FMS acquisitions and substantial sustainment requirements in the Middle East to best support our clients operating in the region.

MAJOR PROGRAMS

Below is a synopsis of the major programs by agency and contracts that drive our industry.

ARMY

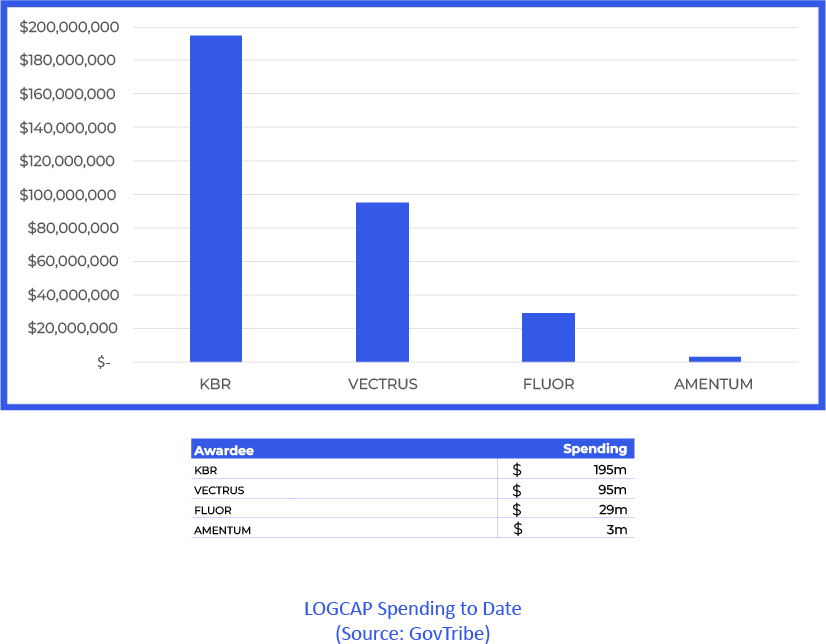

LOGCAP V— We are currently midway through a 10-year LOGCAP V contract that was originally awarded in April 2019. The Army Support Command (ASC) is facing a critical decision on whether to recompete all of the performance task orders, referred to as LOGCAP 5.5, or to proceed with the procurement process of LOGCAP VI. If the USG chooses 5.5, it will lead to a significant amount of bid & proposal activity and could potentially change the current COCOM distribution (with KBR handling EUCOM/NORTHCOM, Fluor working with AFRICOM, Amentum handling SOUTHCOM, and V2X managing CENTCOM/INDOPACOM).

Last year, ASC solicited Task Orders to the LOGCAP V primes to integrate the Army Prepositioned Stocks (APS) into LOGCAP instead of the EAGLE contracting vehicle. This represented a significant shift in the Army Logistics contracting landscape, and awards were announced, with KBR winning APS-2 (EUCOM - $306m) and Amentum winning the remaining task orders (Kuwait - $128m, Korea/Japan - $63m, and South Carolina + afloat - $72m). In June, several bid protests were filed regarding the APS task orders. The protests raise concerns about how technical and management proposals were evaluated, the weighing of past performance records, and the Army’s best value tradeoff decisions. The resolution of this protest will determine the shape of this large Army program.

So far, KBR and V2X have been the largest recipients of LOGCAP V obligations since the award in 2019. According to GovTribe data, KBR has received $4.6 billion, while V2X has received $3.2 billion. LOGCAP V will continue through 2030 and has an $82 billion ceiling. PTS has extensive knowledge of the LOGCAP talent needs and broad reach across the industry for PMOs, PMs, Shared Services, and technical talent.

USACE awarded Conti Federal Services a $65.8 million contract for the construction of Secure Annexes in Baumholder. These annexes will provide operational facilities for the relocation of US Special Operations Forces (SOF) Command units to Smith Barracks at US Army Garrison Baumholder, Germany. The new facilities will assist in the planning and execution of SOF operations in EUCOM and AFRICOM.

The U.S. Army Regional Cyber Center in Europe (RCC-E) awarded SOSi and Peraton a contract to support RCC-E with monitoring, operating, maintaining, and defending the vital components of the Department of Defense Information Network (DoDIN) within the United States Army Europe-Africa (USAREUR-AF) AOR.

Army Contracting Command awarded Amentum a $44 million contract to establish and start two new regional logistics hubs in Iraq. Additionally, Amentum received a $58.6 million modification for maintenance, supply, and transportation logistics support services in Kuwait. The same command also awarded AM General an $11 million modification to its Joint Light Tactical Vehicle (JLTV), initially awarded in 2023 as a $221 million 5-year (plus 5-year option) contract to manufacture an estimated 20,000 vehicles and approximately 10,000 trailers, integrating technology enhancements for delivery to the US Army. PTS continues to provide its clients with talent for Army programs, offering cleared IT networking support, senior logistics roles, and tactical vehicle technicians.

DTRA

On May 29th, 9 companies secured spots on a $4 billion DTRA 10yr IDIQ Contract for Countering Weapons of Mass Destruction (C-WMD) R&D, with work to be divided into three mission pools, including (Pool 1) artificial intelligence, machine learning, data science and software development; (Pool 2) operations and countermeasures in a chemical, biological, radiological and nuclear environment; and (Pool 3) targeting, information operations and irregular warfare. Congrats to ARA, Booz Allen Hamilton, Leidos, Peraton, SRC, Two Six Technologies, Noblis, Parsons, and Signalscape. PTS offers a strong talent pool to continue supporting DTRA’s mission.

NAVY

NAVFAC Pacific awarded in April a combined $2B Global Contingency Services (GCS) IDIQ contract (the Navy’s version of LOGCAP) to V2X, KBR, IAP-ECC, Fluor, Amentum, and AECOM-ASO JV. These six contractors will compete for task orders to provide short-term facility support services in response to natural disasters, humanitarian efforts, military actions, or potential service interruptions at various locations, including remote areas around the world. The term of the contract is not to exceed 102 months, with an expected completion date of September 2032.

On April 18th, the Navy’s Naval Facilities Engineering Command released the RFP for the provision of Base Operations Support (BOS) Services at the Diego Garcia, British Indian Ocean Territory (BIOT). Proposals are due by July 31, 2024. The procurement is underway for the Navy Djibouti Base Operations Support (BOS) Services Contract at Camp Lemonnier in Djibouti, Africa, to support 4,000 military personnel with a full range of base support services. Responses are due by July 24, 2024. On April 8th, NAVFAC collected capabilities statements from companies interested in providing BOS services at U.S. Naval Air Station Sigonella and its outlying activities in Sicily, Italy. It intends to award a single-award IDIQ contract for general management, facility support, custodial services, integrated solid waste management, grounds maintenance, utilities management, transportation services, and environmental services. The contract is expected to have one base year and up to eight one-year option periods for a total potential term of 102 months. The RFP is expected to be released in Q3 2024. PTS consistently delivers key personnel and subject matter experts (SMEs) to prime contractors, bolstering their bid and proposal teams and optimizing operations.

V2X landed a $88 million contract expanding Navy IT and communications support in the Pacific region to support the operation and maintenance of Navy communication, electronic, and computer systems at the Naval Computer and Telecommunications Area Master Station Pacific (NCTAMS PAC). NCTAMS serves as the principal Navy hub for communications in the Pacific and provides crucial command, control, communications, computers, and intelligence support the U.S. and allied forces across the Pacific and Indian Oceans.

The Navy extended the $1.9 billion Naval Information Warfare Center Pacific (NIWC PAC) cyberspace science, research, engineering, and technology integration IDIQ to original awardees, including BAE Systems, BAH, ICF, Leidos, Peraton, Parsons, SAIC, and SRC. PAE/Amentum was awarded a $33 million modification to a previously awarded contract for base operation support services at Marine Corps Air Station Iwakuni, Japan. This award brings the total cumulative value of the contract to $123 million. In Q2, a notable award was granted by the Naval Sea Systems Command – a multiple-award contract worth up to $982 million - to 49 industry partners. This contract is aimed at supporting current and future unmanned surface vehicles, marking a significant development in the sector. AECOM has been awarded a $98 million IDIQ contract modification for environmental services in INDOPACOM. On June 26th, NAVFAC released an RFP for a Pacific Deterrence Initiative Multiple Award Construction Contract (PDI MACC) to support various design-build and design-bid-build construction projects across INDOPACOM. This substantial procurement is expected to result in 3 awards with a ceiling of $15 billion over 8 years.

Six 8(a) companies - Chugach, Copper River Infrastructure Services, Decisivelnstincts, DES, Nakupuna, and Spectrum Solutions - secured a $404 million IDIQ contract on May 7th to modernize telecommunication and network infrastructure across Marine Corps bases worldwide. It includes options that could increase its total value to $809 million over 10 years. The award underscores the importance of leveraging small business capabilities in critical defense projects. PTS recognizes the significance of acquiring the right talent for IDIQs, whether for large or small contractors and implements unique processes to help the primes to optimize the IDIQ PMO structure.

AIR FORCE

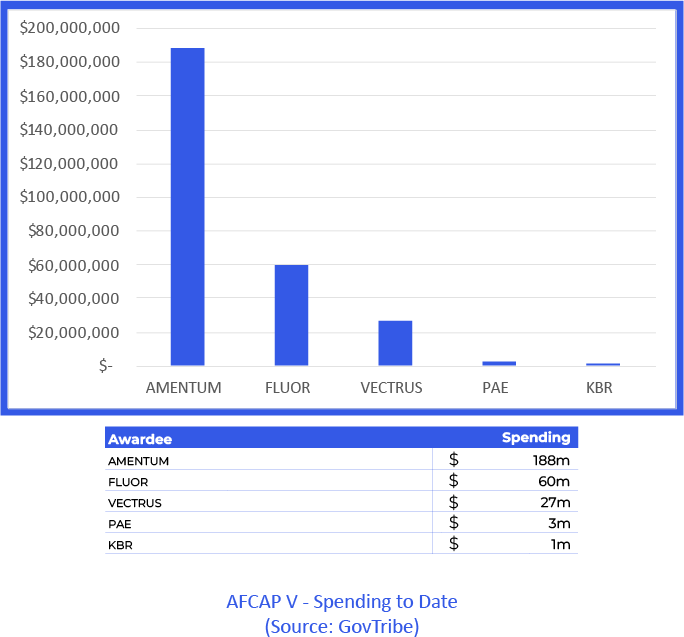

AFCAP V-The U.S. Air Force announced the AFCAP’s ceiling increase from $6.4B to $15B on April 29th to support expanding contingency planning, deployment, training, and equipping of forces; emergency and contingency construction; and other services. The original contract was awarded in April 2020 to 8 companies, including URS, DynCorp, PAE-Perini (now all Amentum), ECC, Fluor, KBR, RMS, and V2X.

In April, Fluor was awarded a $40M AFCAP V task order for pavement and transportation support at Tinian. In addition to Guam and Saipan, Tinian is one of the three principal islands of the Commonwealth of the Northern Mariana Islands, a territory of the United States in the western Pacific Ocean 3,700 miles west of Hawaii. Flour continues to deliver support at Ali Al Salem AB in Kuwait and completed WMR fuel support equipment, and ADR supplies tasks at Tyndall AFB in FL and operation and support services tasks at Holloman AFB in New Mexico.

Amentum has been the largest recipient of AFCAP V obligations since the award in 2020 with 11 task order awards, including delivering transient aircraft services in multiple locations across Southwest Asia, providing design, engineering support services, and mission support services at Al Dhafra AB in UAE, engineering support services at Ali Al Salem AB in Kuwait, materials to augment Tyndall AFB’s training and education missions, design and engineering services at Muwaffaq-Salti AB in Jordan, base operations support at Thumrait AB and Al Mussanah AB in Oman, supporting Typhoon Mawar recovery efforts and Operation Allies Welcome to assist refugee resettlement efforts at Joint Base McGuire-Dix-Lakehurst, and delivering installation support and sustainment services to the 724th expeditionary AIB Squadron in Agadez, Niger.

To date, V2X has been awarded 15 task orders, which account for 10.4% of all obligated AFCAP V contract dollars.

The 700th Contracting and 86th Civil Engineer squadrons held an industry week in May to outline future requirements and further understand industry capabilities. This comes in advance of the Kaiserslautern Installation Support Services (KISS) Multiple Award Contract (MAC) designed to address the need for a full range of service requirements, including facility, property, equipment, housing, and ground maintenance. An award is expected this quarter. PTS has supported many EUCOM-focused firms in the K-Town area with PMO, IT, and technical talent.

DLA

DLA remains actively engaged in its extensive acquisition processes, particularly focusing on its OCONUS supply programs. On April 4th, DLA issued an RFI for full-service food support to military and authorized land customers in Southern Europe, along with Navy ship customers in Northern/Southern Europe and Northern/Western Africa. Responses were due on April 16th. The RFP for DLA SPV operations in Iraq, Jordan, Kuwait, and Syria closed on June 16, 2024. The DLA SPV West Africa RFP faces a delay due to ongoing market research and validation of customer requirements, specifically in Niger. Looking ahead, attention is turning towards future opportunities with DLA SPV Europe and DLA Maintenance, Repair, and Operations (MRO) Europe & Africa. PTS brings extensive experience with various DLA programs and a robust talent network.

DLA awarded $180 million in facility MRO contracts to ASRC Federal and SupplyCore. These contracts are aimed at providing support to the Army, Navy, Air Force, Marine Corps, and Coast Guard. ASRC Federal will be responsible for performing work in Hawaii, Guam, and the Kwajalein Atoll, while SupplyCore will be supporting customer sites in Texas and Louisiana. Noble has been awarded a 458-day bridge sole-source $90 million IDIQ contract for facilities maintenance, repair, and operations supplies to be delivered in Florida, Alabama, and Mississippi to support the Army, Navy, Air Force, Marine Corps, and Coast Guard.

STATE DEPARTMENT

The Department of State (DOS) has selected 5 8(a) small firms for a $700 million International Law Enforcement Vehicle Support IDIQ, including Articom, Avidity Logistics Concepts, MIG-GOV, Olgoonik-Relyant JV, and Seneca Strategic Partners. The main performance areas covered under this IDIQ include law enforcement vehicles and accessories, aircraft ground support vehicles and equipment, fuel and petroleum tank trucks, maintenance and repair services, vehicle and equipment rental and leasing support, and training and knowledge transfer.

DiPSS –Diplomatic Platform Support Services (DiPSS) has been an active contracting vehicle, especially in the Middle East. In Iraq, multiple task orders are in progress, including air operation support services (AOSS), vehicle maintenance support services (VMSS), mission support services (MiSS), medical support services (MedSSI), and information resource management-IT (IRM-IT). In June, DIPSS released new task orders for life support, operations and maintenance, and medical support in Qatar. DIPSS Large Award has been extended by 6 months through December 2024, with a recompete scheduled to begin in early 2025. DIPSS Small is expected to expire in 2028. We are continuously monitoring the DIPSS program and task order requirements to ensure we are prepared to support the prime contractors with essential personnel, subject matter experts, project, and management personnel.

The latest update on the GLOBALCAP IDIQ, as of June 25th, indicates that its award, originally projected for Q2, is now expected to slip into Q3 and possibly even Q4. Currently in its evaluation phase following submissions in December 2023, GLOBALCAP marks the recompete of AFRICAP and GPOI contracts. This highly anticipated $5 billion flagship DoS contingency contract covers a range of services, including training, equipment, logistics, and architectural and engineering design and construction to be delivered in locations supporting peace, security, and regional stability initiatives. The contract features a 10-year ordering period. GLOBALCAP, along with GATA, represents two highly anticipated global contingency contracts scheduled for award by the end of FY2024. PTS stands ready with the requisite expertise, solutions, and rapid deployment capabilities to effectively support GLOBALCAP critical personnel requirements to ensure optimal staffing levels, mitigating potential execution risks associated with future tasks.

EUROPE’s DEFENSE SECTOR

UK MOD

Under the Hypersonic Technologies & Capability Development Framework (HTCDF), Amentum is eligible to bid for contracts to deliver a comprehensive suite of services to the UK Ministry of Defence (UK MOD) encompassing advanced research, state-of-art simulation, edge technology development, seamless solutions integration, and rigorous testing. The HTCDF framework, valued up to $1.25B over the next 7 years, has been established to accelerate the development of a sovereign UK Hypersonic Strike Capability whilst bolstering AUKUS collaboration with Australia and the United States.

KBR UK was awarded a $100M contract from the UK MOD to supply the British Army with a fleet of heavy equipment transporters (HET) under the Interim Capability Solution (ICS) contract. ICS builds on KBR’s successful 20-year history of HET support, which includes provision, operation, and maintenance of the vehicles, training, and use of Sponsored Army Reservists to support delivery. KBR continues to play a critical role in delivering and supporting UK military capability. PTS has built robust pipelines to support prime contractors delivering critical support to UK MOD programs.

BAE Systems has signed a contract with the Swedish Defense Materiel Administration, FMV, for new CV9035 MkIIIC vehicles and associated integrated logistic support. These vehicles will help replenish the Swedish Army’s fleet. The new CV9035 MkIIICs will replace CV9040 vehicles that were donated to Ukraine by the Swedish government and will also expand Ukraine’s capabilities. The CV90 has been selected by 10 European nations, eight of which are NATO members, and has been deployed in Afghanistan, Ukraine, and Liberia.

NATO/NSPA

At June’s Eurosatory 2024 in Paris, Stacy Cummings, the General Manager of NATO NSPA, highlighted the organization’s increasing role within NATO. In 2023, NSPA executed contracts worth EUR 10.6 billion, compared to its 2022 figure of EUR 4.8 billion. NSPA has provided extensive logistical support to Ukraine and, earlier in 2024, hosted the NATO-Ukraine Strategic Defense Procurement Review to modernize Ukraine’s defense procurement processes. NATO/NSPA celebrated the 15th anniversary of the Strategic Airlift Capability (SAC) Program’s flight operations at HDF 47th AB in Pápa, Hungary, which culminated in the inauguration of the new combined aerial port facility (CAPF) at the base. SAC comprises 3 Boeing Globemaster III C-17 transport aircraft managed by NATO on behalf of 12 partnering nations.

During Q2, NSPA has been busy releasing new FBOs and RFPs! In addition to the continuous flow of ammunition contracts and traditional weapons systems support requirements, NSPA has been tasked with sourcing at least two STRATEVAC Capability Packages - Aeromedical Portable Systems (APS). The RFP is out for the construction of a permanent hangar facility for the Spanish Navy at Rota Spain and the construction of a passenger and cargo terminal at Zaragoza AB, and NSPA has been awarded a first-of-its-kind contract for a taxi/shuttle service between Eindhoven Airbase, Netherlands, and/or Cologne-Wahn Airbase, Germany. A new RFP with a closing date of 22 July solicits more deployable containerized capabilities, including sanitary, laundry, food preparation and preservation, potable water and wastewater storage, power generation and distribution, and deployable fuel storage. There is also a new RFP closing on 29 August for 2 additional lots of deployable” Role 2” Medical Treatment Facilities.

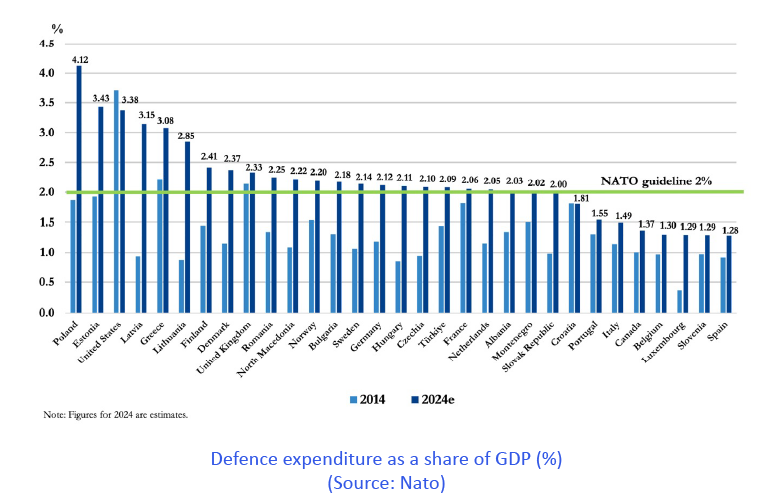

According to NATO’s latest defense spending data released in May, spending by European Allies and Canada has increased by 18%, with a record 23 Allies meeting the target of spending 2% of GDP on defense.

After the summer break, the next big event is the Fuel Industry Day, which NSPA will host on October 9 in Capellen, Luxembourg. The event will bring together NATO stakeholders and key industry players from NATO Nations that have the capability of acquiring, storing, transporting, and delivering bulk ground and aviation fuel. Companies do not have to be registered with NSPA to attend the Fuel Industry Day. Reach out to Jim Shields, PTS’s in-house NATO expert, to learn more about these and many other NSPA projects that align with your firm’s capabilities and strategic growth priorities.

FMS ACTIVITY

Under the FMS System, the U.S. has $595.9 million active government-to-government (G2G) sales cases with Ukraine.

In April, the DoS approved a $101 million FMS for Saudi Arabia’s communication and navigation systems (MIDS) and related equipment. The goal is to improve Saudi Arabia’s surveillance capabilities, strengthen homeland defense, and promote regional stability and progress in the Gulf Region. Iraq will receive C-172 and AC/RC-208 Aircraft Contractor Logistics and Training Support and related equipment for an estimated cost of $140 million. Major deals announced include the NATO NSPA Alliance Ground Surveillance Program Equipment and Support (GSPES) and related equipment for an estimated $250 million, UH-60M Black Hawk Helicopters and related equipment for an estimated $900 million to Sweden, and $1.05 billion in UH-60M Blackhawk Helicopters and related elements of logistics and support to Austria.

GWAC SPOTLIGHT

The ASTRO Master GWAC—Managed by the General Services Administration (GSA), ASTRO consists of 10 separate, individual, multiple-award, IDIQ pools. Services include engineering, software development, cybersecurity, systems integration, research and development, acquisition support, intelligence, and specialized technical support. Task orders under ASTRO are focused on meeting national security, defense, and intelligence community requirements.

Key task orders include $1.3 billion for Engineering and Emerging Operations support to the Air Force awarded to HII Mission Technologies, $862 million for cybersecurity, IT modernization, and intelligence support services for the DOD and intelligence community awarded to ManTech, $1.2 billion for Bold Venture services to Space and Missile Systems awarded to Parsons, and $918 million for Engineering Development and Technology solutions to the Army’s PEO Soldier awarded to BAH. Leading prime contractors receiving these awards include CACI, BAH, ManTech, SAIC, Parsons, HII, and Sierra Nevada Corporation.

Bidders of the U.S. Army’s Warfighter Training and Readiness Solutions (W-TRS) contract are breathing a sigh of relief now that RFP responses have been submitted. The program, formerly known as both Warfighter Focus (WFF) and ATMP, seeks to consolidate services for training networks, combat training centers, and live ranges across multiple DOD locations worldwide. An award is expected this summer.

MERGERS & ACQUISITIONS

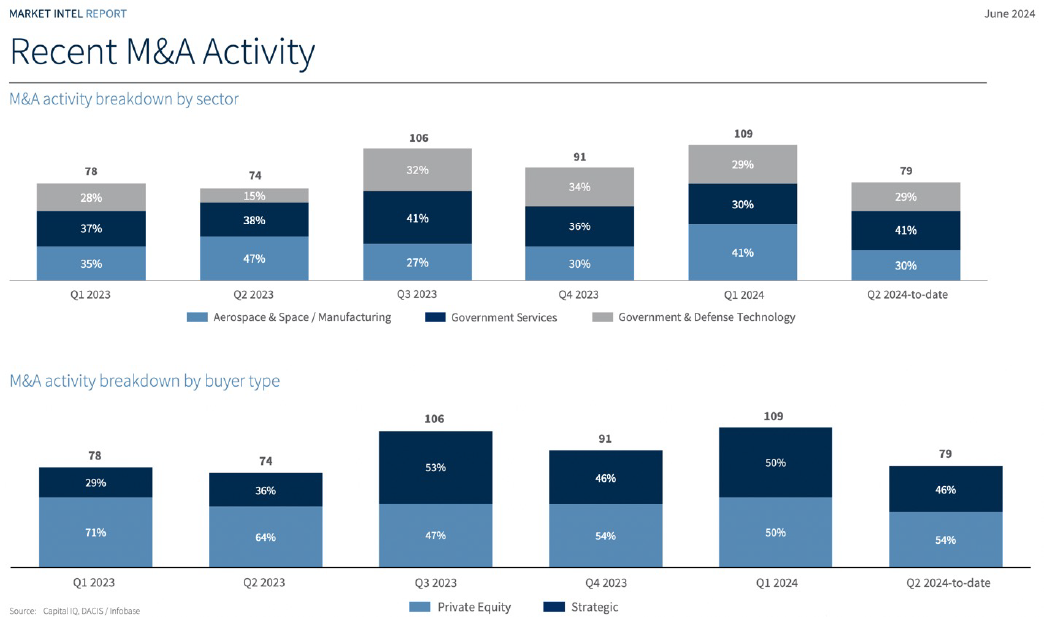

A report by financial services company Raymond James indicates that 79 mergers and acquisitions took place in the defense and government market during Q2, marking a 6.7% increase from the previous year.

Tyto Athene, LLC, a portfolio company of Arlington Capital Partners (ACP), is set to acquire MindPoint Group, a premier provider of end-to-end managed cybersecurity services. Tyto delivers enterprise-level solutions that enable modern networking, enterprise IT, and cybersecurity services in US defense, national security, intelligence, space, and public safety agencies globally. MindPoint will bolster Tyto’s cyber capabilities and expand its current footprint in the federal civilian market.

In May, Culmen announced the expansion of its research and global health capabilities through the acquisition of Vysnova Partners. Amentum and Jacobs continued the merger of Jacobs’ Critical Mission Systems (CMS) and the cyber and intelligence (C&I) portions of the Divergent Solutions with Amentum. Jacobs CMS and C&I add expertise in energy, space exploration, intelligence and analytics, and digital modernization, heavily centered around NASA, with longstanding support for large programs, including COMET, JETS II, ESSCA. Outside NASA, Jacobs CMS has provided significant support for defense customers, including the Missile Defense Agency (MDA), the US Army, and the Defense Cyber Crime Center (DC3), with strategic programs to include IRES, DC3 Training, and USAICoE Training Development and Support.

PTS UPDATES

CXO Search: PTS continues to expand its capabilities and industry reach. In 2023, we saw a 35% growth in the number of C-suite hires we assisted our clients with. The year 2024 is off to a strong start, especially regarding CXO positions, and it’s understandable: executive hires are incredibly important; they can be a matter of organizational life and death. Our intense focus on screening and vetting, combined with our placement within the market, allows our team to find the very best candidates for the boardroom.

Career Concierge: In May, PTS successfully launched Career Concierge, a new service offering focused on providing career consulting and support to professionals navigating careers in the GovCon industry. From refining marketing materials to defining their brand to personalized career coaching, our team of experts is dedicated to guiding individuals toward their career goals with precision and care. The PTS Career Concierge service also extends to providing outplacement solutions for companies, offering support during organizational changes. With a focus on delivering exceptional service and tangible results, we remain committed to empowering both individuals and organizations within the GovCon sector to thrive in today’s dynamic talent landscape.

BD Expert Search: Recognizing the pivotal role top BD talent plays, we’ve intensified our efforts to offer proactive and expert services tailored specifically to this critical field. While BD roles comprise half of our portfolio, our ambition is to elevate it to a flagship service, acknowledging its unique demands and unparalleled importance. At PTS, we’re dedicated to providing our clients with bespoke solutions, ensuring they access a meticulously vetted pool of candidates renowned for their expertise, strategic insight, and alignment with organizational objectives. Our process transcends traditional recruiting methods, incorporating in-depth assessments of candidates’ nuanced expertise, track records, industry certifications, and more. Through our tech-driven methodologies and distinctive philosophy, we deliver unparalleled support that not only meets but exceeds expectations, fostering success for both candidates and clients alike.

Throughout Q2, PTS participated in a series of events, which helped solidify our presence and network within GovCon.

In April, PTS leadership gathered for an offsite retreat in Switzerland, fostering team building and developing plans for future initiatives. We also participated in the ISOA Industry Days Event in Kaiserslautern, Germany, engaging with numerous candidates and clients and further expanding our reach. During the conference, PTS held a Stammtisch Executive Leaders Networking Dinner, providing a valuable platform for corporate leaders and senior executives to network within the industry. Additionally, in April, we attended the PSC Annual Conference at the Greenbrier, strengthening our relationships with senior leaders across the industry.

In May, PTS actively participated in the Bullhorn Engage conference in Boston, where we demoed several products with the goal of improving our tech stack. Our executives also visited the PTS team in Kosovo to conduct a workshop on PTS’s Proven Process (LEAD—Learn, Engage, Assess, Decide). We also participated in the SOF Conference in Tampa, meeting with our Special Operations customers and candidates.

June was marked by noteworthy events, including the AFCEA International conference in Brussels and the AFCEA NOVA Networking event. These events provided valuable opportunities for engagement with key stakeholders and exploration of emerging trends in the industry. Following this, PTS sponsored an Executive Leaders Networking Event in Arlington, VA, which saw participation from over 50 CXO and industry leaders. The event featured a keynote address by LTG (Ret) Lance Landrum, who provided a detailed account of his experience at NATO, where he arrived just before the Russian invasion of Ukraine. His perspective on NATO’s political, financial, and operational transformations offered valuable context for understanding the alliance’s current and future challenges. On June 20th, PTS attended the prestigious 2024 ISOA Global Impact Awards Gala to celebrate excellence in GovCon with our partners, candidates, and guests.

Wrapping up the quarter, PTS attended the AWS Summit in Washington, DC, where our Account Executives had valuable face time with key customers, connected with potential candidates, and learned from industry experts about the latest applications of AI impacting the public sector.

Industry Related Events:

- Intelligence and National Security Summit – 8/27-28 - MD, USA

- ISOA Ukraine Conference- 9/10-12 - Warsaw, Poland

- AUSA Annual Meeting – 10/8-11 - DC, USA

- ISOA Annual Summit – 11/12 - VA, USA

- AFCEA TechNet Transatlantic – 12/4-5 – Frankfurt, Germany