Q1 2024 Industry Update

by Jake Frazer | 08 Apr 2024

INDUSTRY TRENDS

2024 is set to be another year of extraordinary geopolitical volatility with the deteriorating security environment exemplified by a mounting number of conflicts, such as the Hamas-Israel war, Russia’s continued aggression against Ukraine, coups in Niger and Gabon, as well as China’s more assertive maneuvers around Taiwan, in the South China Sea and elsewhere. The combination of Russia’s war on Ukraine, numerous conflicts in the Middle East, and rising tensions between China and Western countries have been principal drivers of military spending and corresponding support. Global defense spending is up 9% from the previous year and is poised to rise further in 2024, based on already announced spending commitments. This era of insecurity is also resetting the GovCon industry. PTS is at the forefront of these developments and brings you this quarterly update highlighting major trends.

UKRAINE - Since October 7th, Ukraine has slipped from the spotlight of front-page news. Western assistance is now divided between Israel and Ukraine, presenting challenging decisions on aid allocation. The U.S. Government continues to discourage DoD contractors from entering Ukraine. DoS and USAID remain the primary providers of support for Ukraine. USAID has issued an RFI, due April 1 2th, seeking input on Ukraine Flagship Mental Health Activity, alongside a $90M proposal to enhance the country’s healthcare system, due May 15th. Additionally, DoS is in search of thirty-one modular mobile field camps by April 19th. The Bureau of Democracy, Human Rights, and Labor seeks applicants for a $1.6M digital security capacity and resilience grant, due April 10th. Chemonics recently secured a $250M, five-year contract with USAID for agricultural development. Vistant continues to supply talent to USAID in Kyiv, and Alutiiq recently won a $5.8M contract to provide medical kits. U.S. Congress was expected to address a $95b funding package for Israel and Ukraine the second week of April. President Zelensky has urged Speaker Johnson to prioritize securing munitions and air defense systems. While the U.S. deliberates on further aid, European nations are increasing support. Czech President Petr Pavel is spearheading a fundraising campaign for munitions, and President Macron of France has intensified his backing. The Fench, Estonian, German, British, and Japanese embassies are urging their businesses to enter Ukraine through government-led trade delegations. Some countries have pledged targeted support for specific regions. For instance, Estonia is leading reconstruction efforts in Zhytomyr oblast. Lykke Global Advisors, a U.S. commercial diplomacy firm, is identifying funding opportunities in Ukraine, including support commitments from various countries focusing on particular regions. Numerous funding opportunities of different magnitudes are available from international organizations. The United Nations Operations, Development, and World Food Programs regularly seek procurement support. UNOPs expects to release a long-anticipated demining contract in the coming months. PTS has been supporting talent needs for Ukraine since the onset of the war including linguists, the Chief of Party, supply chain, maintenance personnel, and business development talent. In anticipation of a major surge in requirements, PTS is building pipelines of pre-qualified Ukrainian talent to support reconstruction efforts to include engineer, project managers, PMO talent, construction, security, and government liaisons.

EUROPE’S DEFENSE SECTOR is experiencing a significant upsurge in activity, primarily fueled by Russia’s ongoing aggression against Ukraine and escalating tensions in other global hotspots like the Middle East. This surge has led to a remarkable increase in orders for major defense players and their associated suppliers. Defense spending in Europe alone reached $388b, a level reminiscent of the Cold War era, as reported by the International Institute for Strategic Studies. The influx of new orders has resulted in a substantial boost to the fortunes of Europe’s defense contractors. The combined backlog of the top seven companies in the region, such as BAE Systems, Leonardo, and Saab, has skyrocketed to over $300b, approaching record levels. Furthermore, the ground warfare in Ukraine has unexpectedly drained national stockpiles of ammunition and other military equipment, benefiting not only major players like Germany’s Rheinmetall and Scandinavia’s Nammo but also smaller suppliers. The increased military spending commitments by European governments have reignited investor interest in the sector, which was previously overlooked by many. Consequently, shares in Europe’s defense contractors have outperformed those of their American counterparts, signaling a resurgence of confidence in the European defense industry.

During 1Q2024, BAE Systems was awarded several large contracts, including a $754M contract award to continue producing the Armored Multi-Purpose Vehicle (AMPV) family of vehicles (FoV) for the U.S. Army, which starts the second phase of full-rate production of AMPVs between March 2026 and February 2027; a $318M contract from the US Army to provide technical and sustainment support services for the M109 Self-Propelled Howitzers and their companion vehicles; in March 2024, the Australian Government selected BAE Systems and ASC Pty Ltd to build Australia’s new fleet of nuclear-powered submarines in the latest significant development in the AUKUS trilateral security pact between the United States, the United Kingdom, and Australia; and U.S. Navy selected BAE Systems to continue supporting Mobile Deployable C5ISR programs. PTS remains steadfast in its commitment to provide technical talent ensuring that these missions are supported with the finest technical talent.

NATO/NSPA: PTS anticipates a continued increase in contracting activity by NATO’s Support & Procurement Agency (NSPA) as European requirements ramp up and the US shifts more contracting to NSPA to be more multi-lateral. NSPA is actively ramping up its industry engagement this year to enhance contracted logistics support for operations. In April, NSPA issued an EOI, due May 7th, to solicit industry support in the Arctic called Arctic-Compatible Deployable Camps and Auxiliary Services, outlining planning factors, equipment needs, and essential services for base camp support in extreme winter conditions. While this EOI is centered on Norway, the project is sponsored by the Operational Logistics Support Partnership so guidance received from industry will inform other “High North” requirements. In what is now becoming an annual event, NSPA will hold its 3rd Transportation Conference on June 4th, underscoring the Allies’ recognition of the collective need for commercial transportation capabilities that can move and sustain forces. This event aims to bring together movement experts from NATO and industry to address capability gaps and explore opportunities for adapting transportation systems to meet new challenges. The NSPA Fuel Industry Day, scheduled for October 9th, will convene NATO stakeholders and key industry players from NATO Nations to discuss sustainable alternatives and fuel handling equipment. NSPA has also announced dates for two traditional country-sponsored industry days, including for Italian companies in Luxembourg on April 22nd and Finland’s Industry Day is 30 May. PTS offers assistance to companies seeking to evaluate and access opportunities within NATO/NSPA. Our services encompass facilitating registration, analyzing capabilities vis-à-vis future NSPA contracts, aiding in bid endeavors and red team assessments, and facilitating mobilization efforts. These initiatives are overseen by former Navy CAPT Jim Shields, who possesses five years of experience in operational contracting at NSPA. For further details, please reach out to Jim Shields at Jim@pts.careers.

MERGERS & ACQUISITIONS in the first quarter of 2024 saw limited activity, especially between large firms, except for Airbus Defense and Space, which entered into an agreement to acquire Infodas, a German cybersecurity firm that was recently awarded a contract from the German military forces to secure their airspace surveillance systems. In February, CBRE and Arlington Capital Partners announced the successful acquisition of J&J Worldwide Services by CBRE. J&J is a prominent provider of engineering services, base support operations, and facilities maintenance for the U.S. federal government. With a focus on long-term, fixed-price contracts with the U.S. Department of Defense, J&J employs over 3,300 individuals globally and extends its services to more than 250 hospitals, clinics, and military installations, spanning regions including the United States, Europe, Asia, the Caribbean, and the Middle East. In March, SPA, an Arlington Capital Portfolio company acquired Technical Advisory Services programs from ManTech. V2X acquired Federal Defense Services, a division of VSE Corporation. Park Place Technologies acquired SDV Solutions, a VA-based SDVOSB, and a multi-original equipment manufacturer focused on providing client-centric data center infrastructure platforms for the federal government. HYPERLINK “https://aerostar.com/”Aerostar International has acquired Near Space Corporation of Tillamook, Oregon, a leader in high-altitude flight testing and aerospace soft goods design. Near Space’s notable projects include testing Boeing Starliner parachute systems and collaborating with NASA JPL on Venus exploration. They also manage the Tillamook Unmanned Aircraft Systems Test Range. acquired Near Space Corporation of Tillamook, Oregon, a leader in high-altitude flight testing and aerospace soft goods design. Near Space’s notable projects include testing Boeing Starliner parachute systems and collaborating with NASA JPL on Venus exploration. They also manage the Tillamook Unmanned Aircraft Systems Test Range. PTS works closely with Private Equity and PE-owned companies to fill key leadership roles that drive transformation and rapid growth.

MAJOR PROGRAMS

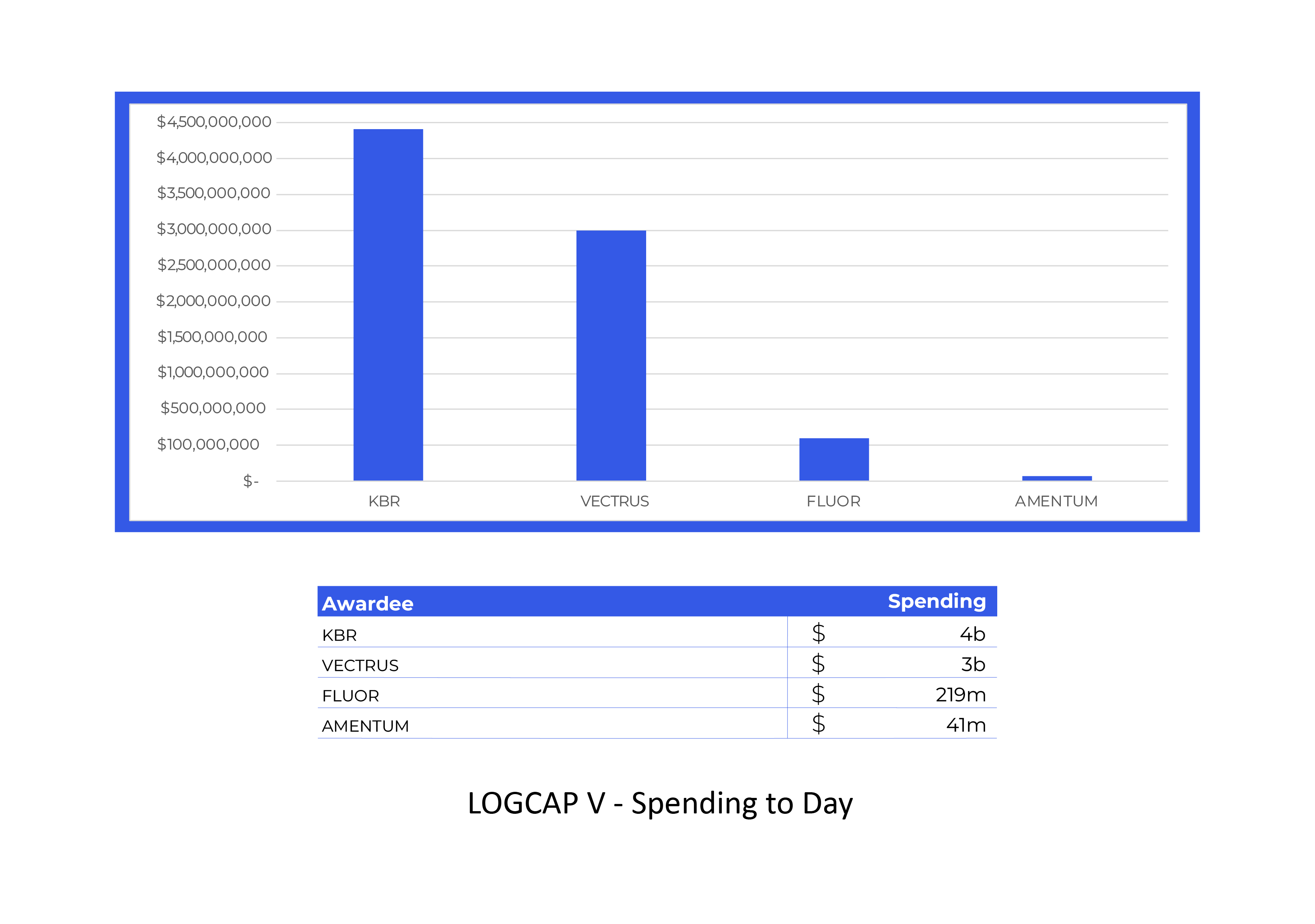

LOGCAP V – Happy birthday, LOGCAP V! Next week marks the 5th birthday of this massive Army program and the halfway mark in the $82B program’s 10-year life span. According to GovTribe, the current expenditure stands at just $7.8 billion, indicating a significant underutilization of this contingency contract. KBR and VX2 are notably leading with awarded dollars, surpassing 90% of the total awarded to date. As we hit this milestone and everything appears calm, things will begin to change. ASC has received proposals from all four primes to absorb the Army Prepositioned Stocks (APS), which will mark a major transformation and scope for the program. Awards are expected in the coming month with an almost certain protest period. Meanwhile, ASC appears prepared to recompete the performance Task Orders in the order in which they were started in what is being called “LOGCAP 5.5”. And now there is already talk about pre-solicitation planning and engagement for LOGCAP VI!

Fluor continues to deliver base life support and sustainment services to the US Force sites at Manda Bay, Kenya, and Camp Chabelley, Djibouti. KBR supports several LOGCAP tasks, including providing logistics, base operations, and contingency services at sites in Germany, Poland, and Kosovo. V2X supports logistics and sustainment tasks in Kuwait, Iraq, Kwajalein, and provides CAS DOS transition support in Qatar and Subic Bay, Philippines. Amentum is wrapping up support in Soto Cano. PTS has significant LOGCAP contract experience and a deep talent pool that we continue to leverage with multiple primes on the contract.

WPS III—To date, 9 tasks have been awarded under WPS III. GardaWorld continues to deliver security support and executive protection services at the US Embassy in Baghdad, Iraq, and Kyiv, Ukraine. In Q124, SOC received a $137M task order (TO) for Qatar, in addition to $200M for providing embassy/consulate security services in Jerusalem. Acuity/Janus provides protective, specialized security and logistical support services to the US Consulate General Erbil in Erbil, Iraq.

DiPSS – The Diplomatic Platform Support Services Program (DiPSS) is undergoing a flurry of activity, particularly in the Middle East. In Iraq, DIPSS is finalizing multiple task orders, including air operation support services (AOSS), vehicle maintenance support services (VMSS), mission support services (MiSS), medical support services (MedSSI), and information resource management-IT (IRM-IT). Meanwhile, in Qatar, the upcoming transition of the Career Assistance Research and Education (CARE) contract from the LOGCAP to DIPSS is anticipated for 3Q24, with new tasks released under DIPSS for life support, operations and maintenance, and medical support. The CARE program is going to expand its services to meet the additional needs of Afghan refugees who are waiting for processing for entry into the US. After 5 years of limited activity, the DIPSS Large Award is set to expire in May 2024, with a projected extension of merely 6 months, presenting a distinctive scenario. A recompete is expected to start in 1Q2025. DIPSS Small is set to expire in 2028, but small businesses are expected to participate in all task orders up to and above $120M. PTS has been supporting DIPSS tasks by providing primes with cleared and uncleared personnel. We are constantly monitoring the progress of DIPSS and are prepared to quickly mobilize the required subject matter experts, project, and management personnel to meet the upcoming task order personnel requirements.

GLOBALCAP – The GLOBALCAP IDIQ marks the recompete of Africa Peacekeeping Operations (AFRICAP) and Global Peace Operations Initiative (GPOI) contracts, with anticipated awards in 2Q2024. This $5b billion IDIQ will serve as a flagship DoS contingency contract aimed at advancing U.S. foreign policy objectives worldwide, particularly in enhancing peace, security, and regional stability. Following the submission of offers in December 2023, DoS is nearing the conclusion of AFRICAP and GPOI contracts. PTS, leveraging its extensive experience collaborating with multiple AFRICAP and GPOI primes, stands ready with the requisite expertise, solutions, and rapid deployment capabilities to effectively address critical personnel requirements and ensure optimal staffing levels, mitigating potential execution risks associated with future tasks.

DOS Overseas Building Operations (OBO)—OBO anticipates several set-aside design and construction projects for 2Q24, including new embassy compounds (NEC) in Bangui, CAR ($500M), Port of Spain, Trinidad and Tobago ($325M), and Praia, Cape Verde ($350M); Worldwide HVAC and BAS Support Services IDIQ ($100M) is under final review and anticipated to be released in April 2024. On February 20th, DOS OBO released market research for the design and construction for remediation of the central power plant at the U.S. Embassy in Baghdad.

Iraq DoD Support - In addition to the US diplomatic mission, approximately 2,400 U.S. military personnel continue to operate in Iraq, conducting military operations in Syria and the broader Middle East, which will require continuous logistics, base life support, and O&M support. In December 2023, Congress authorized a U.S. counter-IS partnership program in Iraq and Syria through December 2024.

BOS, Logistics, Base Life Support Programs - Several logistics, maintenance, and base life support opportunities were released and awarded in 1Q2024. In January, U.S. Air Force released an RFI for Kaiserslautern Installation Support Services (KISS) to support the 86th Civil Engineer Group with a full range of service requirements. Responses were due Feb 23rd. On March 5th, Navy BOS Djibouti RFP was released with proposals due on April 29th. On March 8th, Navy BOS Sigonella RFI was released with submissions of interests due April 8th. On April 4th, a pre-solicitation notice was released for Navy BOS Diego Garcia, with proposals due by July 4th. The Total Maintenance Contract for Kaiserslautern continues with VX2 until the decision on Amentum’s award is adjudicated, with a decision estimated in 2Q2024. KBR’s Diego Garcia contract worth $500M is expected to be recompeted later this year. The U.S. Army awarded V2X a $190M contract to support USARCENT’s mission in Kuwait and other broader USCENTCOM AOR and provide training support service; USACE awarded J&J Worldwide Services a 4-year contract to provide O&M at the Tri-Service Campus in San Antonio, TX; SAIC won a 5-year, $375M Navy contract for vehicle fielding integration in the US and overseas; ManTech won a 10-year BPA $500M DOJ contract for engineering IT services; Parsons won a spot on $200M GSA Construction Management contract and $115M DOL Facilities Management contract for the Job Corps Facilities Program. In February, General Dynamics Mission Systems was awarded a $335M contract as the prime integrator of the Trident II Fire Control System; Serco has been re-awarded a $525M for FEMA disaster recovery work; Amentum has won a $591M Navy contract for the international fleet to deliver lifecycle support and follow-on technical solutions to allied international naval forces; GDIT has won a $493M task order to provide technical and mission support services to USSOCOM. In March, Hanford Tank Waste Operations & Closure, a JV led by BWXT Technical Services Group, and includes Amentum and Fluor, was awarded the Hanford Integrated Tank Disposition contract to provide operation of tank farm facilities.

USAID – During Q1, USAID intensified its procurement activities in anticipation of the upcoming US elections. There’s a perception that the agency has been slow in implementing its agenda under the Biden-Harris administration, leading to a rush to expedite procurements for the remainder of FY24 despite a shortage of contracting personnel. This has resulted in increased task orders and compressed timelines for awards. Notable developments include USAID launching a $100M CARICOM fund to bolster climate resilience in the Caribbean. However, Congress’s FY24 budget deal reduced the International Affairs budget by 6%, with significant cuts in accounts like Global Health Security. Nevertheless, initiatives related to climate and trade received comparatively better funding. The Countering China Influence Fund saw a notable 23% increase. The agency is facing challenges in procurement planning due to budget cuts, including a likely reduction in hiring contracting staff. The FY25 Congressional Budget Justification seeks only a 1% increase to the International Affairs budget over FY23. Key awards in Q1 include contracts to Tetra Tech and Chemonics for various projects in Ukraine, NORC for a project in Uganda, and DAI for a project in Jordan. Deloitte and TetraTech expanded their capabilities through acquisitions, while DAI focused on strengthening its private capital teams. Abt Associates rebranded as Abt Global to strengthen connections across its entities. USAID is reconsidering the practice of naming key personnel for prospective awards well in advance, aligning with other parts of the U.S. Government. This shift places greater emphasis on bidders’ management approach and organizational structure, with a focus on post-award recruitment, including local hires. Additionally, USAID may have specific individuals in mind for certain programs, and the agency provides support for rapid talent searches and recruiting through the Project Team Support (PTS) mechanism. PTS has extensive experience supporting USAID and aid & development sector from C-Suite, Chiefs of Party, GHSC supply chain talent, and medical personnel. In February, USAID released the RFP for NextGen Global Health Supply Chain Procurement Service Agent (PSA), HIV/AIDS, with proposals due April 26th.

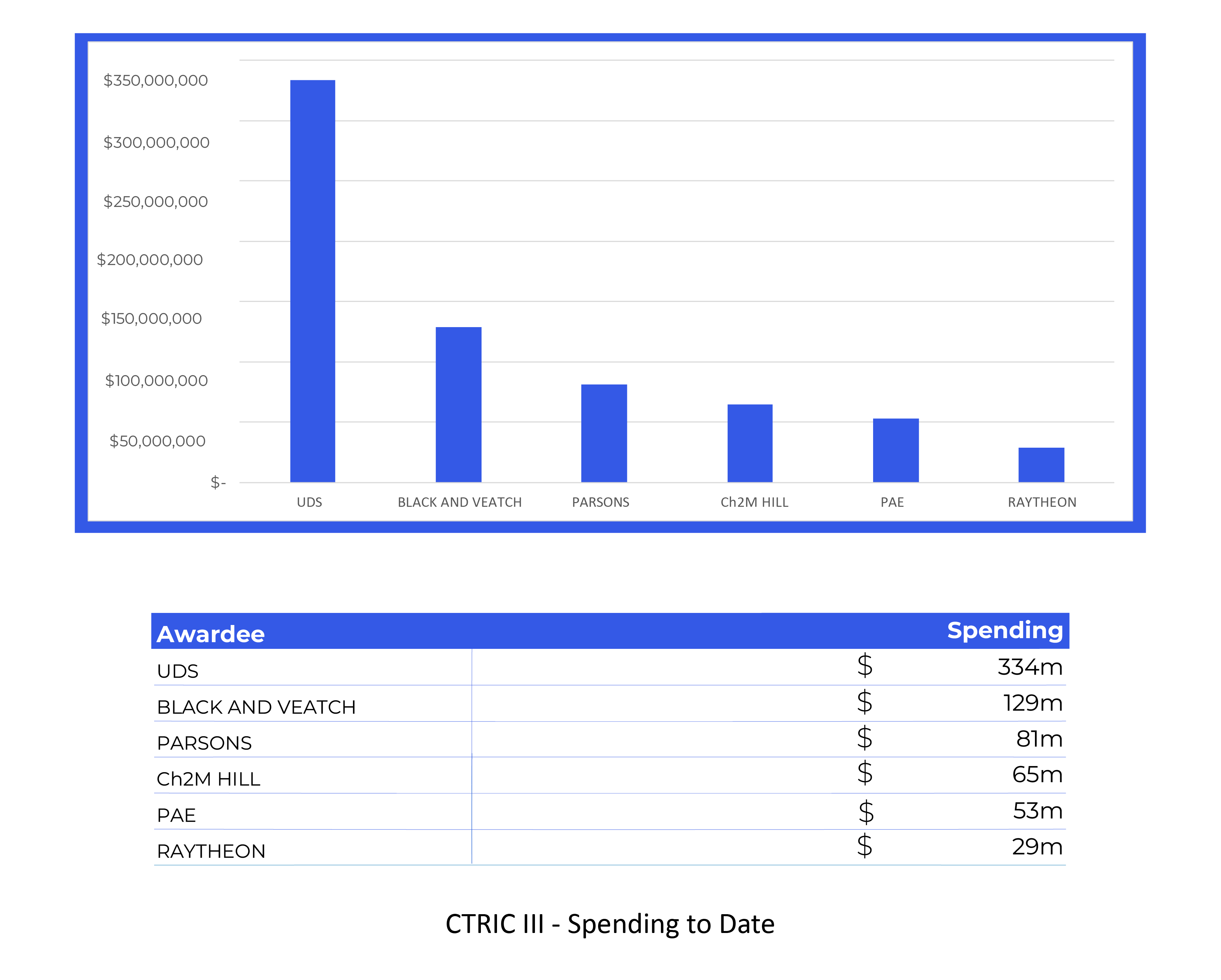

DTRA—The Defense Threat Reduction Agency (DTRA) recently unveiled plans for the CTRIC IV IDIQ contract, with the release of a pre-solicitation notice on March 12th. Multiple contract awards are expected for December 2024. This initiative aims to establish a contract vehicle that mirrors and extends the functions of the existing IDIQ CTRIC III contract. Currently, this contract is upheld by Amentum, Parsons, Jacobs, Black & Veatch, and Raytheon. On March 1st, DTRA declared its intention to grant a sole source bridge contract to Culmen International. This decision ensures the continuation of vital logistics support services across all facets of the Cooperative Threat Reduction Program. This six-month bridge contract is deemed indispensable for maintaining the uninterrupted operations of the CTR Program while long-term contract actions progress through open competition. PTS is proficient in navigating the intricate landscape of DTRA and offers extensive networks of former military and government personnel to support DTRA prime contractors with the best talent.

DLA – Defense Logistics Agency (DLA) continues to be busy with its typically prolonged acquisition process, especially as it pertains to its OCONUS supply programs. Guam Subsistence Prime Vendor (SPV) RFP is set to close its doors on April 21st. Following a steadfast acquisition strategy, DLA maintains its commitment to acquiring this program with the same dedication as the Small Business set aside. Meanwhile, the RFP for DLA SPV operations in Iraq, Jordan, Kuwait, and Syria is slated to conclude on May 19, 2024, with further amendments anticipated. As for the DLA SPV West Africa RFP, its timeline faces a delay pending additional market research and validation of customer requirements, with particular attention directed towards Niger. Looking ahead, eyes are on the horizon for forthcoming opportunities with DLA SPV Europe and DLA MRO E&A, which are expected to unfold later in the year. PTS has deep experience with a variety of DLA programs and extensive reach across the talent network.

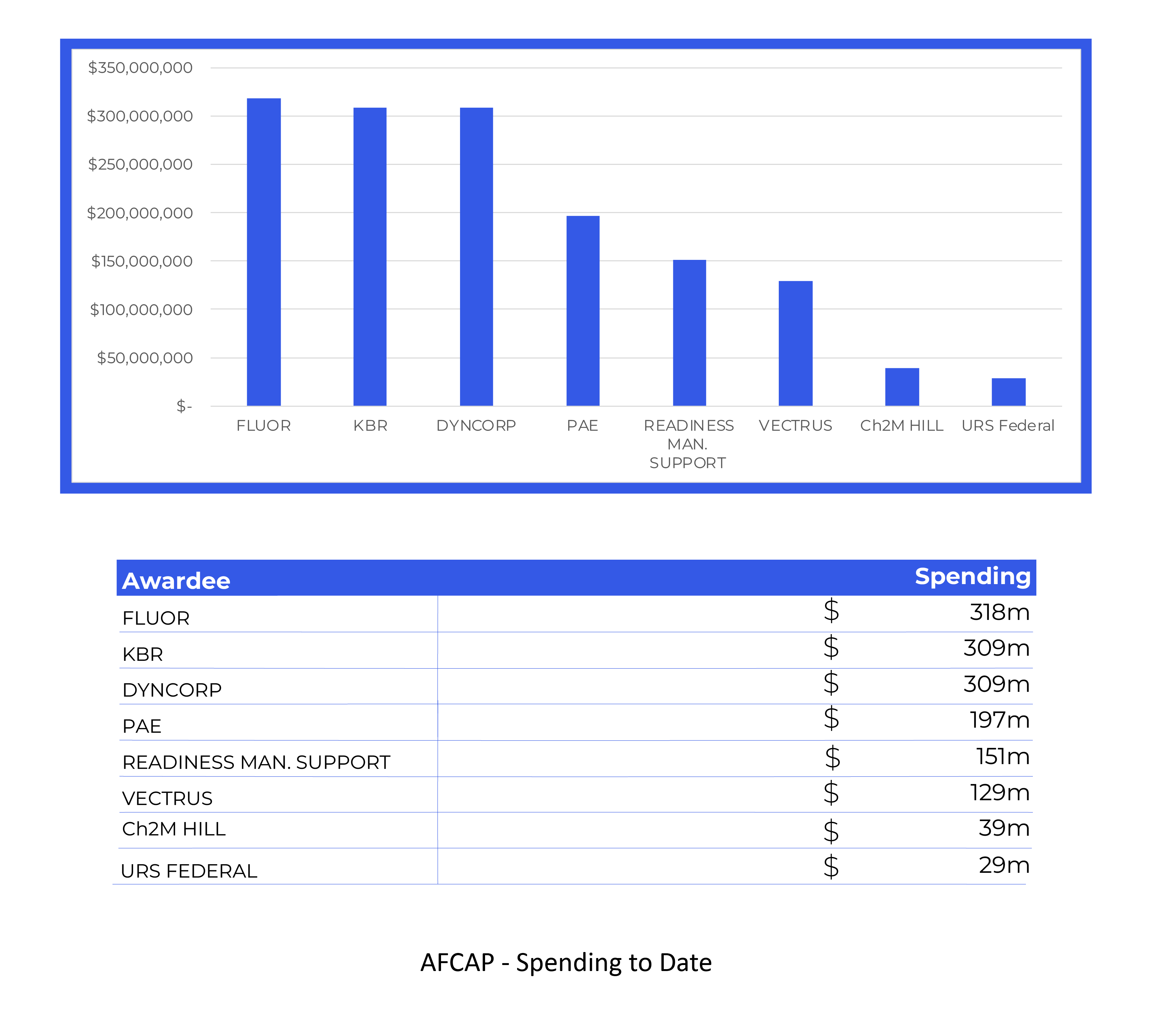

AFCAP V – The AFCAP V contract, initiated in June 2020, provides various support services in contingency planning, force deployment, training and equipping, emergency construction, logistics, commodities, and other related services. As of now, 65 task orders have been released under this contract. The contract spans 8 years with a combined ceiling budget of $6.4 billion, with the year 2024 marking the midway point. This contract is shared by 6 prime contractors (Amentum consolidated from 8 initial awards). PTS has played a significant role in supporting multiple AFCAP primes by providing engineering, airfield, and logistics talent.

PTS UPDATES

Precision Talent Solutions has had an eventful and promising start to 2024, marked by significant achievements and strategic initiatives.

Promotions and New Leadership: Andrew MacWilliams, formerly a Senior Account Executive, has been promoted to the role of Chief Innovation Officer(CINO). In his new capacity, he spearheads efforts to drive innovation within the company. Reflecting on his new role, Andy emphasized PTS’s commitment to excellence and staying ahead in a competitive market. He stated, “PTS is committed to being ahead of the demanding job market and working harder and smarter than the competition to provide the very best talent solutions for an industry working to keep our nation safe and healthy.”

Additionally, PTS welcomed Bibiana Raisas the Director of Business Development. Bibiana brings nearly two decades of experience in the GovCon industry and expressed enthusiasm about collaborating with PTS to drive transformative growth. She commented, “Drawing from nearly two decades of experience in the GovCon industry, I look forward to engaging with existing and prospective GovCon clients, ensuring they are equipped with top-tier C-suite, executive, and program talent to drive their performance excellence.”

Furthermore, to bolster our team’s capabilities, we are thrilled to announce the addition of two accomplished Account Executives, Ryan Owens and Robyn Cronin. Their expertise and dedication will further strengthen our ability to deliver exceptional services and solutions to our valued clients.

Participation in Industry Events: PTS actively participated in the CEL conference in Warsaw as one of the sponsors. This engagement provided valuable networking opportunities with industry colleagues, friends, and prospective candidates, contributing to fostering meaningful connections within the industry.

Rollout of GOVCON Career Concierge: The GovCon industry’s professionals seek a trusted partner to guide them through career transitions and PTS stands ready to support them. Positioned at the industry’s forefront, we offer a comprehensive suite of tools and an extensive network to facilitate this process. Building on years of assisting countless candidates informally, PTS introduced the Candidate Concierge service during Q1 beta testing. This service aims to provide tailored support for individuals navigating career shifts, offering assistance ranging from resume refinement to targeted company exploration. With over 20 participants in the beta phase, feedback has been overwhelmingly positive. One participant noted, “Jake and his team provide exceptional guidance! Highly recommended for anyone seeking career advice or coaching. Their insights are actionable, responses prompt, and advice world-class.” As we gear up for an official Q2 launch, this initiative underscores PTS’s unwavering dedication to meeting candidate needs and delivering outstanding talent solutions. Scan for more information!

As PTS looks forward to the rest of 2024, the company remains focused on driving innovation, expanding its team, strengthening industry partnerships, and delivering unparalleled value to its clients and candidates alike.

Industry-Related Events:

- SID Annual Conference - 4/26

- PSC Annual Conference – 4/28

- AFCEA TechNet Cyber – 6/25

- AWS Summit – 6/26

- AFCEA TechNet International Expo & Forum – 6/6