Industry Year in Review

by Jake Frazer | 08 Jan 2024

PTS is at the heart of the government contracting industry, connecting talent and opportunities. Our extensive experience in the industry, as well as our broad network, gives us a mezzanine view across multiple programs, agencies, and companies. Every quarter, we pause to gather and condense the latest market intelligence for an easy read. This is our annual year in review and some commentary on what we can expect in 2024. Be sure to stay in the know on the latest industry news by following our LinkedIn page or visiting our blog at https://pts.careers/blog.

2023 offered expanded opportunities for government contractors in Europe and the Pacific. Meanwhile, after decades of spotlight, activity was reduced in the Middle East and Central Asia. Russia's aggression against Ukraine has settled into a stalemate on the Eastern Front. President Zelensky continues to make his case for Ukraine in NATO while the US and EU show signs of war fatigue. The focus remained on Ukraine and Taiwan, leaving Afghanistan and Iraq on the sidelines. It remains to be seen if and how the US Government will evacuate the thousands of allied Afghans remaining in Afghanistan and Pakistan. Hamas surprised Israel and the world with a devastating attack on October 7th, creating reverberations throughout the Arab world, continuing to date. Presidential elections in Poland secured a pro-Western government while the world remains on edge with the upcoming US elections. The tyranny of distance continued to be the most significant obstacle in supporting Taiwan. The US is leveraging Army Prepositioned Stocks, innovative technology, and current contract vehicles while the Navy asks the US Congress for more ships. Talent remains a challenge for government contractors of all sizes. Candidates hold the upper hand with companies seeking to bring them back into the office. Precision Talent Solutions expects 2024 to have more opportunities for contractors in Ukraine and the Pacific and remain a candidate’s marketplace.

UKRAINE led the international headlines in 2023, receiving support primarily through equipment transfers and funding for government salaries. The US government encourages DoD contractors to refrain from entering Ukraine, likely to ensure Russia does not have credible information to back its false claims of a proxy war. US-funded defense contractors supporting Ukraine set up shop in Poland, where they perform on- demand Maintenance Repair, Overhaul, and tele-maintenance. Several companies signed Memorandums of Understanding with the Ukrainian government, giving them credibility to work with the Ukrainian ministries. Culmen International, AECOM, Ukraine Focus, Rasmussen Global, CRDF Global, and Internet2.0 all signed MOUs. The British government allows its contractors in-country. BAE System is opening a facility in Ukraine, which AMS will largely support, especially regarding MRO work. As of December 12th, 2023, the US has committed roughly $44.9 billion in security assistance. Ernst & Young recently secured a potentially $9.8 million USAID contract to support the Multi-Agency Donor Coordination Platform. DAI won a $90m delivery order against the One Acquisition Solution for Integrated Services (OASIS) IDIQ contract vehicle to support Democracy, Human Rights, and Governance programs. Opportunities to provide in-country support to Ukraine in 2024 are most likely to come through the Department of State (DoS), the US Agency for International Development (USAID) and/or foreign Ministries of Defense. US DoD opportunities will likely be based in Poland or focused on Foreign Military Sales. USAID has an RFI open for Private Sector Development Ukraine due January 11th and a potential $90m agriculture support contract due January 10th. US Congress is debating a $62b aid package for Ukraine, which will likely pass in the first quarter 2024. PTS is already recruiting technical maintenance expat personnel for operations in Ukraine, and we are building a talent pool of bilingual Ukrainian project management talent to support our customers.

ISRAEL faced an unprecedented terrorist attack from Hamas on October 7th, 2023. Over a thousand Israeli citizens were killed, with hundreds taken hostage. Israel's President, Benjamin Netanyahu, quickly declared war against Hamas, vowing to destroy the militant political organization. SOC maintains Jerusalem's Worldwide Protective Services contract, while several other Private Military Contractors operate in Israel. For weeks following October 7th, government contractors were unable to enter Gaza. MoveOne is now supporting the flow of humanitarian aid into Hamas-controlled Gaza. The US Embassy has several procurement opportunities open on its website. As the conflict continues, logistics and procurement opportunities will likely emerge for Egypt and Israel in 2024.

AFGHANISTAN remains in total control of the Taliban with no prospects for change. In 2023, many veterans of Operation Enduring Freedom sought to place Afghanistan back in the minds of average Americans through Congressional Hearings, Speaking Engagements, and Human Rights Conferences. This failed to bring about any meaningful change. The Afghan society continues to be a dangerous place for women and minorities. The US government advises against traveling or doing business in-country. There are indications that the DOS is seeking to evacuate 100,000 plus allied Afghans to Qatar and other locations. No public opportunities have been announced to support this operation. It is doubtful that 2024 will offer any opportunities to operate in Afghanistan with US government funding.

IRAQ held its 20th anniversary since the invasion of US-led forces. 2023 focused on recompetes and a reduction of contractors in-country. The Amentum-led Embassy program released considerable staff, while the new version of the Diplomatic Platform Support Services contract pushed its RFP to 2026. November 27th, Naval Air Systems Command awarded a $3.2m contract to Insitu, Inc. in support of Iraq Foreign Military Sales Case IQ-P-SBH. USAID recently awarded a $72.9m contract to Chemonics for program support services to strengthen civic participation and social cohesion. DOS has a $2.5 m grant due January 31st, 2024, for Countering WMD Threats in Iraq. Contract opportunities will likely continue into 2024, centering on fuel, logistics, base life support, procurement, and demining. PTS remains engaged with clients supporting mission in Iraq and on anticipated awards.

PACIFIC took second place to Ukraine this year, with the Navy and Marine Corps battling for more priority. If China retakes Taiwan, it will endanger international shipping lanes and the semiconductor industry, likely disrupting the global economy. The US seeks to deter China by strengthening its posture in the Pacific and supporting Taiwan when it’s politically able. The tyranny of distance remains the most significant challenge facing the US military. According to the US Navy, more ships are needed to compete with China. The Navy’s proposed FY2024 budget requests $32.8b in shipbuilding funding for nine new ships. While the Military lobbies Congress for funding and shipyards ramp up production, the US utilizes existing systems to compensate. 2023 saw increased awards for construction contracts across INDOPACOM. MVL won a $68m contract for Medical Facility Construction on the Marshall Islands, and the US Army Corps of Engineers awarded Nishimatsu Construction Co., LTD $125m for Kadena Air Base. CONUS contracts were larger and spread across several places of performance. Thirteen companies recently won spots on $249m IDIQ contract to provide omilitary facility construction and demolition services, and seven companies secured US $495m combined to construct and repair neval bases.

MERGERS & ACQUISITIONS were abundant in 2023, with several prominent names making waves. Versar acquired Louis Berger Services from WSP, creating Versar Global Solutions. Day & Zimmermann purchased Empire Products, Inc. to increase its munition production capabilities. CRDF Global acquired Development Innovations Group to build out its current security assistance and development offerings. Among the large primes, BAE System acquired Ball Aerospace for roughly $5.55b, Honeywell is set to purchase Carrier Global for $4.95b, and Amentum likely made the most significant splash of the year, creating a separate entity to combine with a portion of Jacobs. Seeking to break into the defense market, Jacobs’ Critical Mission Solutions is merging with Amentum to create a new company with a majority owned by Jacobs’s shareholders. AAR Corp recently announced its intention to acquire Triumph Product Support for $725 million to scale its repair capabilities and expand its customer base. Carlyle and Insight Partners have decided to invest in Exiger, a supply chain artificial intelligence-focused company.

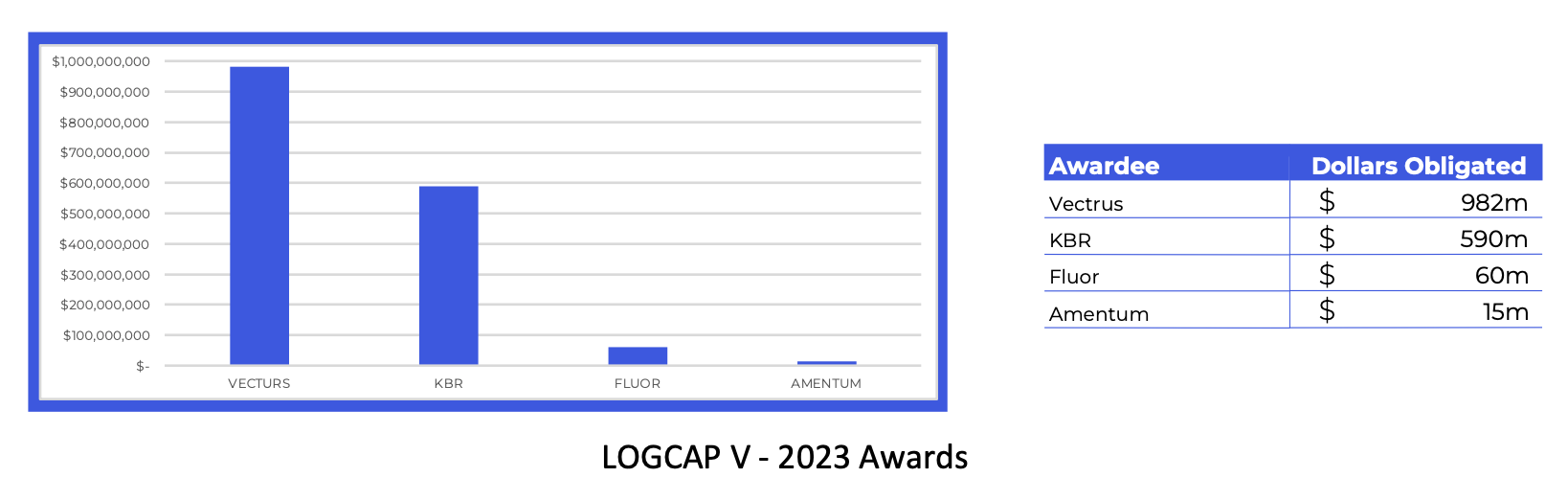

LOGCAP V – The Army Sustainment Command (ASC) is recompeting the performance task orders in the order they were awarded - NORTHCOM, EUCOM, AFRICOM, SOUTHCOM, CENTCOM, and INDOPACOM. US Army Sustainment Command will move future contracted Care of Supplies in Storage Services (COSIS) used to support Army Prepositioned Stock (APS) from the Enhanced Army Global Logistics Enterprise (EAGLE) contracting vehicle to the Army’s Logistics Civil Augmentation Program Contract (LOGCAP). V2X, Fluor Corporation, KBR, and Amentum – Parsons Corporation Global Logistics Services maintain the four LOGCAP prime spots. APS COSIS task orders are being recompeted and still await awards. In 2024, we can expect significant bid & proposal activity around the recompetes of the performance task orders as well as awards on the APS in the first half of the year. PTS has extensive roots in LOGCAP with broad operational experience and a deep talent pool, and we are currently supporting multiple primes on the contract.

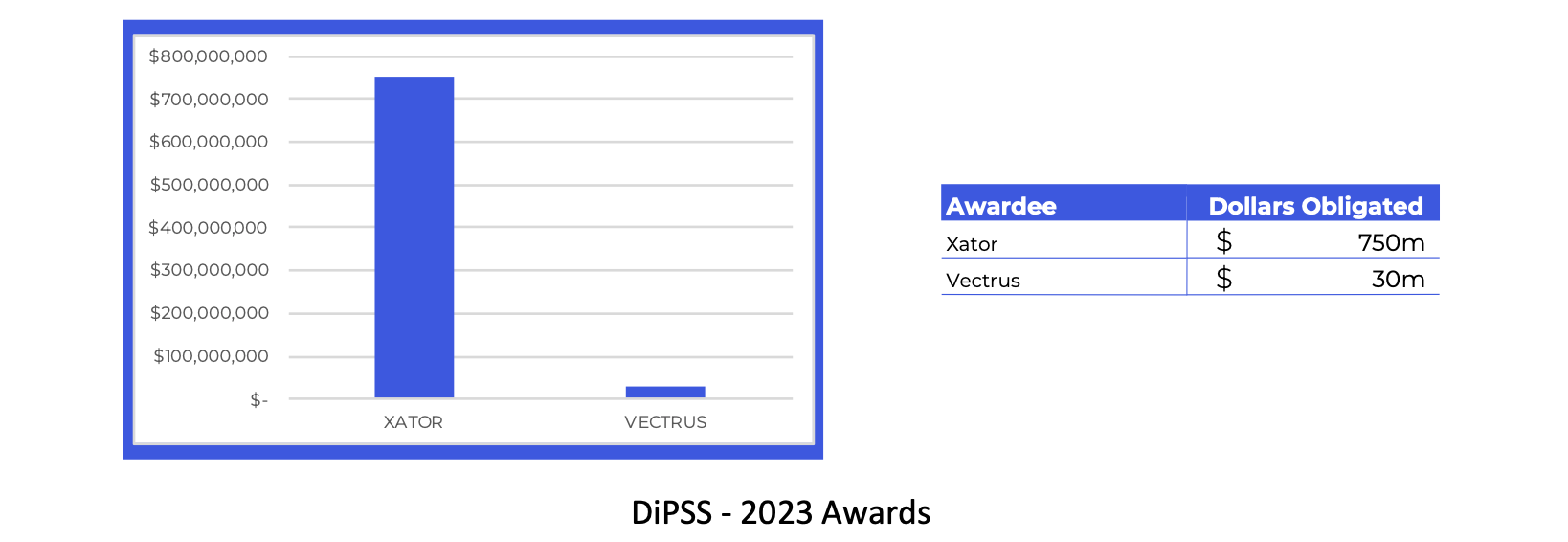

DiPSS – The Diplomatic Platform Support Services contract vehicle received two large task orders in the first half of 2023. Xator won a potential $750m Care Logistical Support Services, and V2X won a potential $156m Community Order Services Section delivery order for Qatar. These contracts are likely designed to support the repatriation of Afghan allies. On June 30th, Relyant Global, IDS International, Futron, Vista Technology, Blueforce, Advanced C4 Solutions, Strategic Operational Solutions, Planate Management, Olgoonik Technical Services, Metrica, and Patriot Group International won Small Business spots on DiPSS. This IDIQ holds a value of $2.5b with five years of performance. Office of Overseas Building Operations (OBO) has issued another draft Task Order to support the US Embassy in Baghdad. The pending final RFP is expected to combine the Operations Maintenance Support Services (OMSS) and Baghdad Life Support Services (BLiSS) into a single Mission Iraq Support Services program. The large business seats RFP release has been pushed back into 2026. PTS has worked extensively around DOS programs and has extensive reach for cleared senior management, PMO, and technical talent.

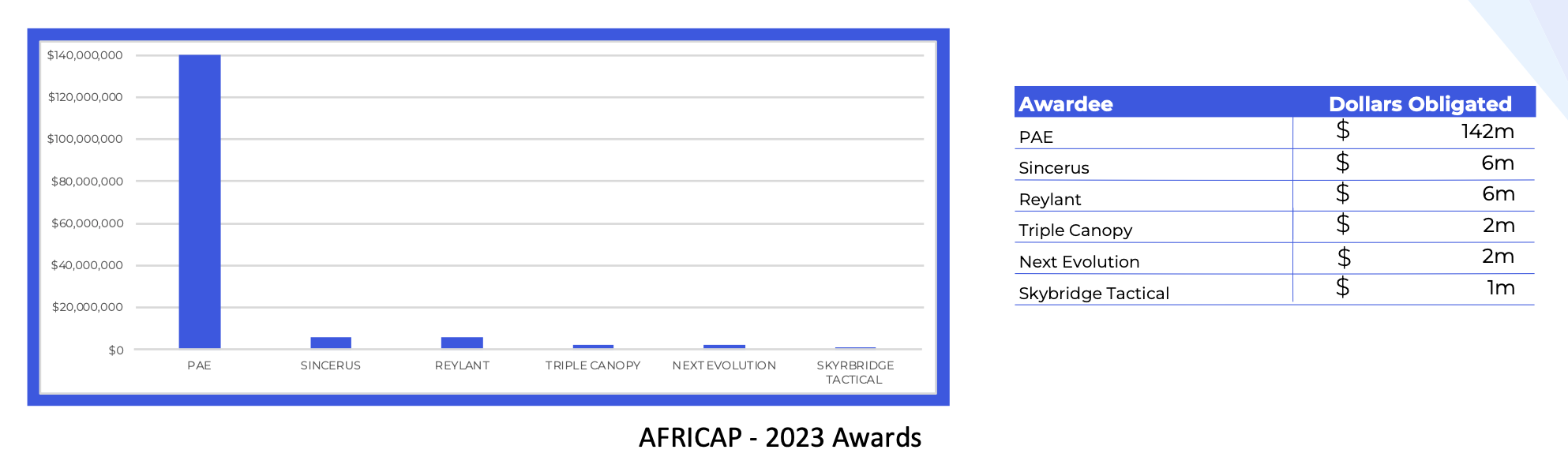

GLOBALCAP – Africa Peacekeeping Operations (AFRICAP) and Global Peace Operations Initiative (GPOI) aim to bolster regional peace, security, and stability. These two DOS programs will now be combined and competed under GLOBALCAP. The RFP dropped on July 28th and has been pushed back several times, with a recent due date of December 14th. The maximum value is expected to be $5b with a ten-year limit for a period of performance. Pulau Corporation, Valiant, Sincerus Global, Triple Canopy, Relyant Global, Next Evolution Water Solutions, and Amentum are the remaining primes. Nine task orders were placed in 2023, all with completion dates expected in 2024, to prepare for the new contract vehicle. The US government estimates an award to take place in April 2024. PTS has worked extensively with most of the primes on AFRICAP and GPOI, so we have reliable reach into this niche talent set.

USAID - In 2023, USAID marked a significant shift towards localization, emphasizing the engagement of local actors and empowering them for community improvement. This approach impacted leadership recruitment and contradicted traditional policy implementation by global players. Localization played a crucial role in stabilizing conflict zones, enhancing the capacity of local entities to respond to instability. Winning USAID contracts in 2024 requires prime proposals with local firms, aligning with the $17 billion global health contracts through the Next Generation Global Health Supply Chain Vehicle.

USAID's procurement landscape includes the recently awarded Control Tower contract to Deloitte and Comprehensive Technical Assistance awards to DAI, Crown Agents, Chemonics, JSI, and Panagora. Future awards, such as In-Country Logistics and PSA HIV, are anticipated in 2024. The SWIFT IDIQ, estimated at $3+ billion in 2024, presents another opportunity. PTS, adept in team buildouts, supports organizations in securing future awards.

Looking ahead to 2024, the USAID market anticipates continued localization emphasis, influencing project design and necessitating deeper relationships with local partners. The phased procurement process and evolving key personnel requirements demand flexibility from successful partners. The Contracting Officer shortage remains a factor, and partners should invest in resources like AidKonekt and Konektid International's consulting services for effective responses to market dynamics. As the industry gears up for proposal responses in early 2024, the Aid Market Podcast provides insights from USAID staff and partners on the evolving trends in the USAID sector.

BOS Programs – V2X continues to perform on the Kaiserslautern Total Maintenance Contract while the government sorts through the previous award to Amentum. V2X, teaming with J&J Worldwide Services, was awarded Naval Station Guantanamo Bay BOS for $196m. On June 1st, NSA Annapolis and the Naval Academy received task orders or increased options from current incumbents (VJFS JV). Akima won a $199m contract for Keesler AFB. KBR won a $36m delivery order for Air Forces in Europeand Africa. Chugach Logistics and Facility Services JV LLC was recently awarded the $113m Laughlin AFB and $249m MacDill AFB contracts. J&J won a bevy of Defense Health Agency Hospital operations & maintenance contracts including: Landstuhl (Germany), Tripler (Hawaii), Lakenheath (UK), Fort Knox and Fort Campbell (Kentucky), Thailand and Spain. Cherokee, Amentum, AECOM, J&J, Culmen, Family Endeavors, Rapid Deployment, Inc., Deployed Resources, and several other smaller companies won seats on the large multi-billion Health and Human Services Influx Facilities Support Services for Unaccompanied Children IDIQ. NAVFAC is preparing to bid out essential BOS programs including: Djibouti, Singapore (released), Naples (released) and Sigonella. CONUS BOS Air Force programs are undergoing recompetes, including Maxwell (released), Sheppard (released), and Fallon. Marine Corps has an upcoming bid on Air Station Iwakuni, Japan. The US Army has several significant small business solicitations being released soon, including Fort Moore (aka Fort Benning), Fort Leonard Wood, Fort Stewart, Fort Carson, Fort Eustis / JB Langley, Fort Huachuca (already released), and Yuma APG (released). PTS has supported multiple BOS programs across North America, Europe, Africa, and Asia with Program Management and technical talent.

DHS – The Department of Homeland Security stayed in the headlines for most of 2023 with the significant increase in activity at the US’s southern border. Republicans demand increased funding for border security to be included in any package with Ukraine aid. Billions of dollars are being spent on DHS immigration services such as: housing, transportation, and identification of migrants. Amentum won a $407m biometrics contract, Leidos received a $981m task order for enterprise IT support, K2-Parsons-Culmen won a $253m radiation portal monitors contract, and General Dynamics secured a $712m task order for IT modernization. These large contracts are a precursor to what will likely be more funding in 2024. DHS recently previewed the Unrestricted Vertical Construction Multiple Award Task Order Contract (MATOC), potentially worth $1.5b. It will likely release its solicitation in mid-January 2024. DHS’s third iteration of the Program Management, Administration, and Clerical Technical Services (PACTS III) is in the draft RFP stage. This IDIQ will be for service-disabled veteran-owned small businesses, women-owned small businesses, historically underutilized business zones, and 8a businesses. PTS has supported primes on multiple DHS projects with technical talent including Case Workers, bi-lingual counselors, and medical staff.

DTRA – The Defense Threat Reduction Agency remains vital for combating terrorism and weapons proliferation. According to GovTribe, DTRA awarded roughly $1b in contracts and $101m in grants for 2023. This funding supports programs across the globe in hostile and friendly environments. DTRA utilized several existing contract vehicles to award five delivery orders over $100m. CACI, Parsons, Booz Allen Hamilton, Nakupuna Solutions, and Applied Research Associates were the recipients. The Threat Reduction Logistics Services II IDIQ contract solicitation remains in the draft solicitation phase. It holds a maximum value of $150m. Culmen International serves as the incumbent. DTRA has a continuing requirement for Combating Weapons of Mass Destruction Research and Technology contracts. The estimated $4b IDIQ has yet to be awarded, with SAIC, Northrup Grumman, Alion Science and Technology, Peraton, Leidos, Raytheon, and Applied Research Associates serving as the incumbents. PTS has extensive experience with the niche technical requirements for DTRA programs and has deep pipelines of former military and government personnel.

DLA – The Defense Logistics Agency $500m Subsistence Prime Vendor award to Valiant continues to be subject of protest. GAO is expected to resolve this protest by March 14, 2024. DLA will likely issue the following awards in Q1 of 2024: SPV Japan, Singapore, Philippines, Diego Garcia, and Australia being a new territory in this program; CONUS MRO TLS awards for six regions and twelve zones; and MRO CENTCOM. DLA expects to release several RFPs in 2024, including re-solicitations for SPV Kuwait, Iraq, Jordan, Syria, and West Africa in Q1. PTS has deep roots in DLA Prime Vendor TLS programs with an extensive procurement, supply chain, and Program Management talent network.

AFCAP V – The Air Force Contract Augmentation Program has, for years, provided the US government a tool to respond to global disorder through contingency planning, logistics and on-demand construction. In 2023, four Task Orders were awarded to KBR, Amentum, and IAP. They were all focused on INDOPACOM and totaled roughly $770m, including cleared guard services and emergency hurricane repair work. PTS has supported multiple AFCAP primes with cleared Engineering, Airfield, and Logistics talent.

DOS Medical – The DOS Bureau of Medical Services seeks support centralizing oversight of its worldwide medical support platform. The Global Medical Support Services (GMSS) IDIQ contract holds an estimated $1.6b value with a solicitation date of June 2023 and an anticipated award in December 2023. It remains to be seen if the Medical Support Services Iraq (MSSI) will be included in this new MATOC or tucked into DiPSS.

NSPA Year in Review:

NSPA maintains discretion regarding supporting Ukraine; they actively place regional requirements on contract. They leverage extensive experience delivering health care solutions, temporary structures, and base-level support to provide multi-national humanitarian-focused contract support when tasked by NATO Nations and HQ. NSPA offers numerous NATO and nationally funded construction contracts throughout Europe. There is a requirement for Camp Support in Poland to demonstrate its commitment to enhancing NATO's capabilities.

While the recent few years have seen a steady stream of small to medium-size Construction projects, primarily in the Baltics and Kosovo, NSPA is anticipating an influx of larger projects spread across NATO Countries in 2024 & 2025. During the ISOA NATO event in Brussels, NSPA’s Operations Support Procurement Chief clarified that they seek larger construction firms to register and bid on upcoming projects. To entice large Defense Construction firms to engage in these complex infrastructure projects, NSPA is improving their “Best Value” solicitation procedures in 2024.

2024 will be another high-volume year for the NATO Operational Logistics Support Partnership (OLSP) of 26 Nations. The Partnership is overseen by a team of NSPA expert Technical & Procurement Offices and who are working closely with Alliance Ministries of Defense to design Host Nation Support contracts following the HNS conference in 2023. If the Partnership Board approves the Statement of Work in March, interested companies should look for this brand-new requirement to be published as an FBO before NATO’s summer break. Additionally, building on the success of their Global Fuel & Global Food multiple award contracts, the OLSP team is actively staffing a Global Base Services RFP, which will be published in 2024. NSPA is on track to offer a wide range of international contracts again in 2024, and industry teams should be prepared now. The NSPA e-Procurement portal is scheduled to undergo a series of upgrades. In Jan 2024, registered companies must validate their existing account information on the e-Procurement portal. Contact our expert consultant, Jim Shields, to identify 2024NSPA projects that match your firm’s capabilities and strategic growth priorities.

Precision Talent Solutions Year in Review

Precision Talent Solutions has reached several milestones in 2023 and has more innovations for 2024:

Website: We unveiled our new website, pts.careers, which provides a comprehensive view of our services, team, and past performance. Candidates and customers can now reach out through our website, where they’ll connect to a PTS team member to see how we may best serve their needs. We also have an active blog with industry news and career support.

100 Testimonials: We are also keen to share the voices of our customers and candidates, and we are proud to have collected our 100th testimonial. This direct feedback from those we have worked with closely highlights the attention to detail and deep care we show each stakeholder involved in our process.

Senior Industry Leaders’ Networking: PTS hosted several industry networking events throughout the year in Warsaw, Brussels, Abu Dhabi, and Washington DC. Two of our events in the DC area included guest speakers former EUCOM DCOM LTG (r) Mike Howard, who gave a great synopsis of where countries stand on Ukraine, and EUCOM J4 RADML (r) Duke Heinz, who gave an excellent overview of logistics and contracting challenges in Europe.

Growing the Family: PTS has continued adding top talent to our team, including new Account Executives, Recruiters, and Sourcers. We are always looking for talented individuals to join our team. We are recruiting a Sales Director based in the DC area and are always looking for Account Executives to lead our projects. These positions are entirely remote, allowing individuals to work from home. We have also recently promoted Andy MacWilliams to the PTS senior leadership team as the Chief Innovation Officer, where he will focus on leading the company to leverage technology, Artificial Intelligence, and industry best practices to propel PTS forward.

Candidate Concierge: We believe in treating our candidates like customers, and we are investing in our ability to support our candidates as they navigate career transitions. We always do what we can to help our candidates with career advice, resume reviews, and helping with connections. In 2024, we will formalize this offering as a service to provide to our candidates so they can get the level of support that they need for their careers.

RTO: Return To Office vs Hybrid vs Remote? That is the question that many companies have been dealing with since the COVID-19 thaw. The long-term impact of these decisions on talent remains to be seen as companies are forced to deal with tradeoffs. Because of our unique mezzanine view of the industry, PTS is uniquely positioned to help our customers navigate these tradeoffs to find solutions that fit their needs.

Business Development Talent: We continue to see increased demand for top Business Development talent as companies posture for future growth. Some companies are moving to an Account Executive model with senior client-facing experts focused on customers, while other companies are moving to decentralized BD capabilities in the business units. Proven Capture talent remains in great demand, and Solutions Architects are increasingly required to bridge the technical gap with the end customers.

The Next Generation: We also see a changing of the guard on deployed talent that support overseas, remote operations. Many from the generation in the boom days of LOGCAP are no longer interested in long term deployments. Companies are now struggling to develop the next generation of field leaders. As a Veteran Owned Small Business, PTS is seeking to help bridge this gap by helping customers engage Junior Military Officers (JMO’s) to feed their leadership development programs.

We hope that you enjoyed reading our recap of 2023 and have some perspective for opportunities in 2024. As we can see, it is a busy time in our industry with foreign policy rapidly evolving and the contractual landscape in constant flux. No matter the geography, agency, or contract, the critical factor for success is based on having the best people on your team. We have built PTS with the sole focus of helping to connect talent and opportunities across the GovCon industry. We leverage over 400 years of cumulative industry experience and cutting edge technology to ensure the best fit for both our candidates and our customers. We are at the heart of the industry and very much a part of your mission. Whether you are leader in your company looking for top talent or a professional looking for your next career move, feel free to reach out to us a info@pts.careers so we can have an introductory discussion. Best of luck in 2024!