Q3 Industry Update

by Wills Hay | 09 Oct 2023

INDUSTRY TRENDS

The third quarter gave way to several significant contract awards and Ukraine updates. MRO, logistics, and base life support were among the major awards. These were spread across Europe, the Middle East, and Asia. Foreign policy shifts from Washington, D.C., have kept Ukraine supporters on edge. The upcoming Presidential election could drastically change America’s posture towards Ukraine's fight for its sovereignty. America’s commitment to allies in the Middle East continues, with Qatar and Saudi Arabia receiving substantial third-quarter influx. Partial funding through the Gulf states comes from Afghan-focused programs. Embassy programs changed hands in several theaters, with Moscow making headlines. Precision Talent Solutions continues to monitor industry trends through active participation in events, programs, and foreign policy discussions.

UKRAINE continues to make headlines with more questions than answers. Following the Ukraine Recovery Conference, AECOM and others came away with MOUs between Ukrainian ministries. Now the question remains: how will it all be funded, and when? As of October 1st, the U.S. has committed roughly $76.8 billion in aid. Sixty-one percent of that sum includes military assistance. Summer saw the release of F-16s for training purposes, and on September 25th, Abram tanks arrived in Ukraine. Most aid comes from U.S. Army stock transfers, intelligence sharing, training services, continuity of government financing, energy infrastructure support, and humanitarian supplies. As we head into the winter months, energy and infrastructure remain significant concerns in Ukraine. On May 26th, Raytheon received approval to sell the National Advanced Surface-to-Air Missile System (NASAMS) for an estimated cost of $285 million. USAID is hiring an Audit and Risk Management Analyst to support the Office of the Inspector General. This person will be based in Kyiv. National elections in Poland and the United States threaten to impact the support level of Ukraine. It is doubtful the U.S. will allow the Department of Defense (DOD) contractors in-country in 2024. The diplomatic mission has fully relocated back to Kyiv from Poland. This move signifies increasing confidence in the security situation in Kyiv.

AFGHANISTAN remains a contention as veterans fight hard to keep it in the headlines. The Department of State (DoS) utilized the Logistics Civil Augmentation Program (LOGCAP) V continued Base Life Support (BLS) contract vehicle to support Operation Enduring Welcome for the Afghan Special Immigrant Visa applicants and their families. Vectrus, now V2X, maintains the support logistics contract in Qatar and Kuwait. July 13th, the DoD released a solicitation seeking information on how an interested firm can assist with the employment verification portion of the SIV process for Afghan nationals whom DoD contractors reportedly employed. The Global Friends of Afghanistan recently hosted their 2nd Annual Conference. It remains to be seen if the U.S. government will open diplomatic relations with the Taliban. It is highly unlikely opportunities will exist within Afghanistan in the fourth quarter.

IRAQ maintains a contingent of U.S. forces primarily for training and anti-terrorism efforts. There are several logistics, maintenance, and base life support opportunities. September 28th, the Army Corps of Engineers awarded a $175.5 million Airport Terminal Repair contract to Emaar Al Yawm. Shanica Group won a $799 million contract for North Old Erbil International Airport Building Renovation two days prior. Defense Logistics Agency is still in constant need of fuel and announced a solicitation on June 8th. On June 28th, a Pond–Baker joint venture won the U.S. Army Corps of Engineers Master Planning Single Award Task Order (SATOC) Contract worth $24 million. September 19th, Acuity won a $37 million medical support services contract. Opportunities to support the U.S. footprint in Iraq will likely continue into the 4th quarter.

PACIFIC garnered increased consideration in the second quarter with concern about overinvestment in Ukraine. The U.S. continues to build out its logistical footprint. This includes increased Base Operations Support Services and Defense Logistics Agency contracts. U.S. military views China as its main peer competitor. To overcome the near-term “tyranny of distance,” the Navy has turned to unmanned and autonomous vehicles. On June 30th, the Navy released sources sought notice for Large Diameter Unmanned Undersea Vehicles. This aligns with language from the National Defense Authorization Act of fiscal year 2023 supporting unmanned operations. The government has yet to award a fuels systems Multi-Award Task Order (MATOC) Indefinite Delivery Indefinite Quantity (IDIQ) contract. Arrows Edge LLC won a $200 million IDIQ to provide Maintenance, Repair, and Overhaul (MRO) support for the Fleet Readiness Center. The DoD will likely continue utilizing innovative technology to bridge the geographic gap between the U.S. and China.

MERGERS & ACQUISITIONS in the second quarter focused on innovative technology being added to an old-school contractor. In a surprise turn of events, VSE Corporation and Bernhard Capital Partners canceled their $100 million deal agreed upon this summer. Cisco led the quarter's most significant deal with its acquisition of Splunk for $28 billion. AI and autonomous vehicles saw action with AeroVironment’s purchase of Tomahawk Robotics. Vehicle sustainment giant ManTech International finalized its acquisition of Definitive Logic. Adam Lurie became Chief Executive Officer of Knexus Research through Lurie Investments' acquisition of the artificial intelligence and machine learning company. These examples highlight a trend of companies seeking to shortcut growth in the Tech space by adding an organization with successful past performance to their portfolio.

MAJOR PROGRAMS

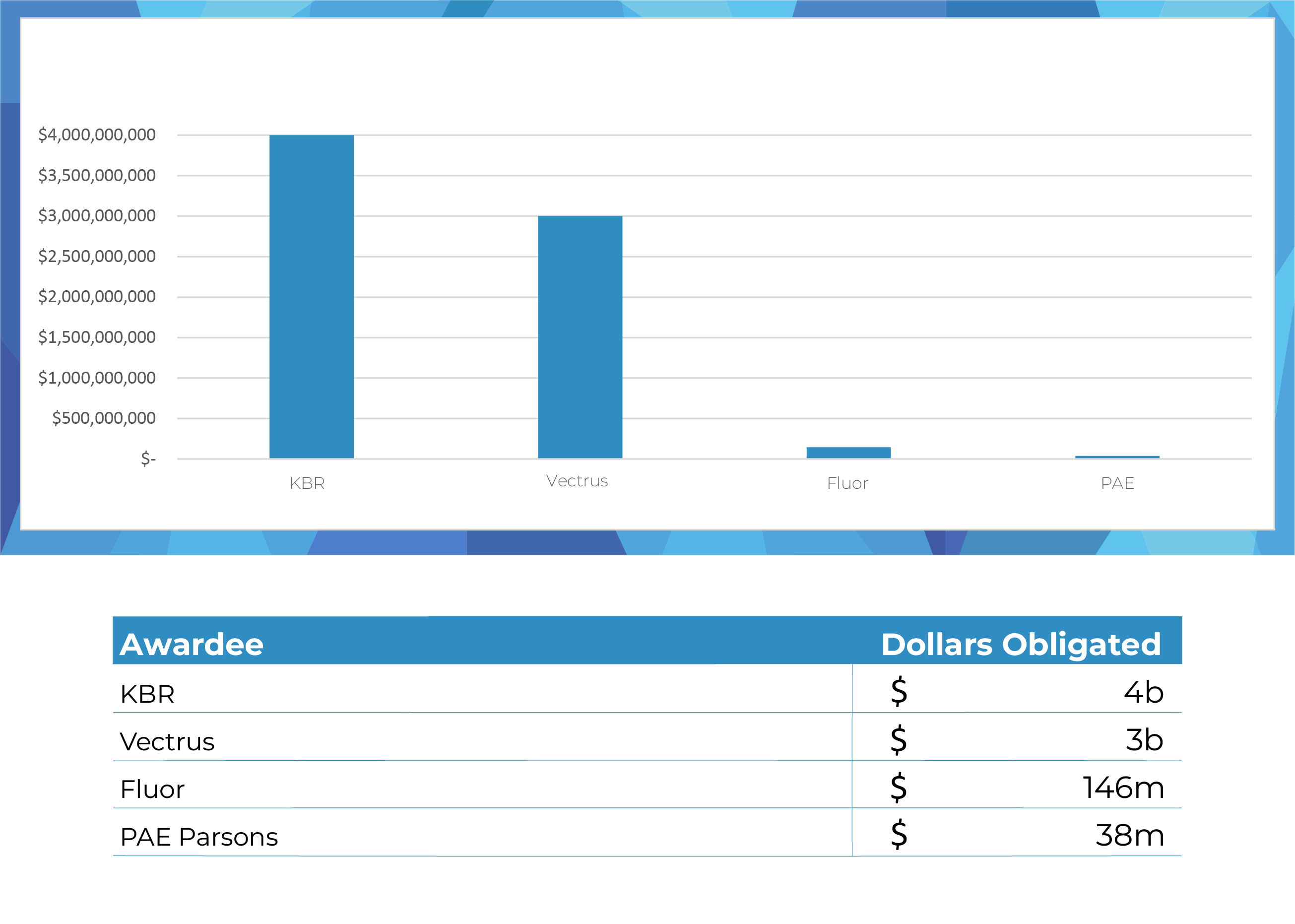

LOGCAP V – The Army Sustainment Command (ASC) is recompeting the performance task orders in the order they were awarded - NORTHCOM, EUCOM, AFRICOM, SOUTHCOM, CENTCOM, and INDOPACOM. This is being coined LOGCAP 5.5 and is expected to drive significant bid & proposal activity starting as early as 2024. U.S. Army Sustainment Command will move future contracted Care of Supplies in Storage Services (COSIS) used to support Army Prepositioned Stock (APS) to the Army’s Logistics Civil Augmentation Program Contract (LOGCAP). V2X, Fluor Corporation, KBR, and Amentum – Parsons Corporation Global Logistics Services maintain the four LOGCAP prime spots. APS COSIS task orders are expected to be competed under these primes in 2023. PTS has deep roots in LOGCAP with extensive operational experience and a deep talent pool, and we are currently supporting multiple primes on the contract.

LOGCAP V 2023 Spending to date*

LOGCAP V 2023 Spending to date*

DiPSS – On June 30th, Relyant Global, IDS International, Futron, Vista Technology, Blueforce, Advanced C4 Solutions, Strategic Operational Solutions, Planate Management, Olgoonik Technical Services, Metrica, and Patriot Group International won Small Business spots on the Diplomatic Platform Support Services (DiPSS) contract vehicle. This IDIQ holds a value of $2.5 billion with five years of performance. OBO has issued another draft Task Order to support the US Embassy in Baghdad. The pending final RFP is expected to combine the Operations Maintenance Support Services (OMSS) and Baghdad Life Support Services (BLiSS) into a single Mission Iraq Support Services program. PTS has extensive experience supporting Embassy programs with Program Management and cleared trades.

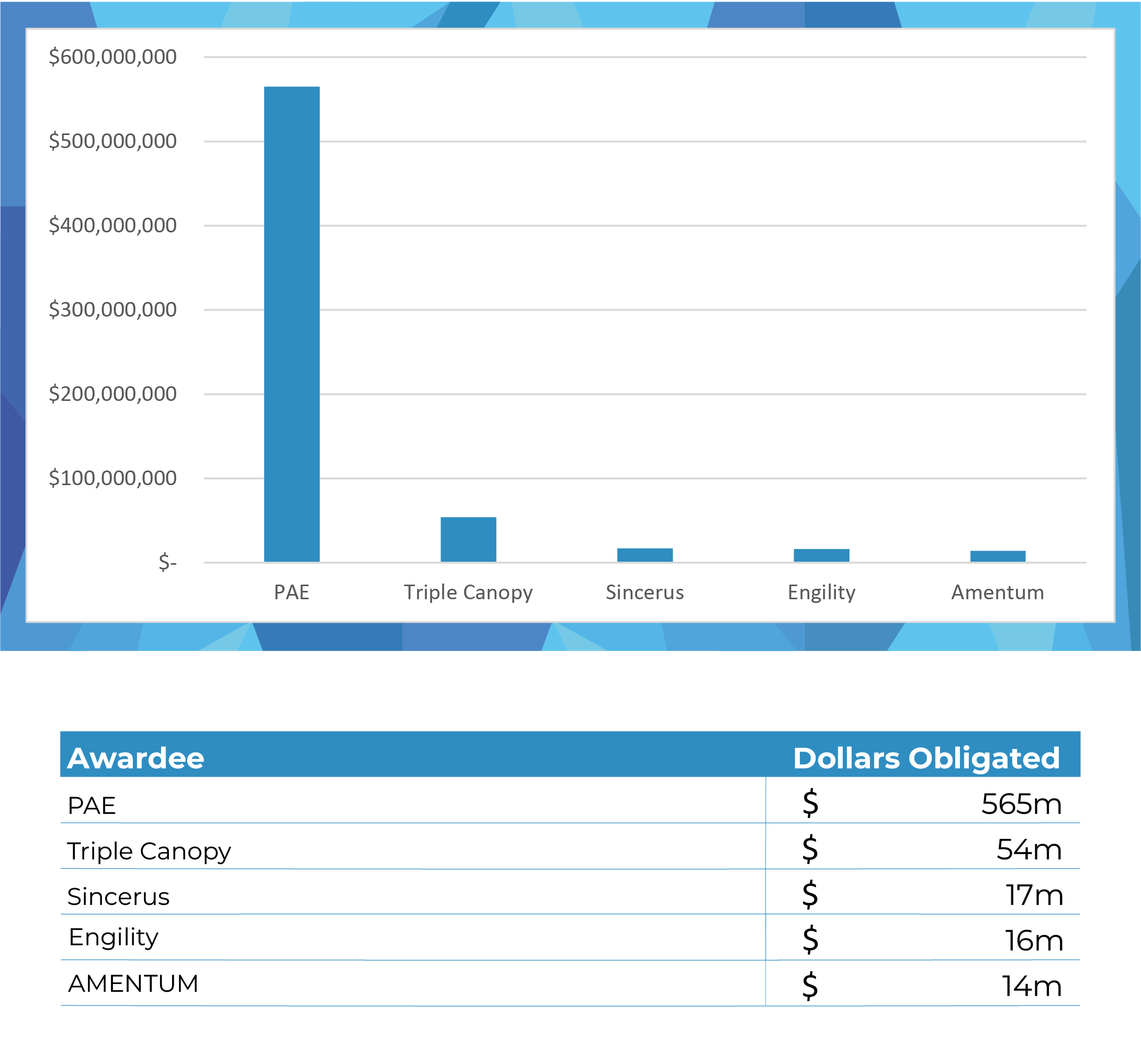

GLOBALCAP – Africa Peacekeeping Operations (AFRICAP) and Global Peace Operations Initiative (GPOI) aim to bolster regional peace, security, and stability. These two DoS programs will now be recompeted under GLOBALCAP. A Request for Proposals dropped July 28th with a due date of November 11th, 2023. The maximum value is expected to be $5 billion with a ten-year limit for a period of performance. Three significant incumbent primes exist Amentum, Sincerus, and Relyant, with Neologis and Relyant serving as the Service-Disabled Veteran Owned Small Business. PTS has supported multiple primes with training and program management talent for DoS contracts.

AFRICAP 2023 Spending to date – Large Businesses*

USAID – USAID is in the acquisition process to award roughly $17 billion in contracts for global health through the Next Generation Global Health Supply Chain (GHSC) vehicle. The award will be the agency’s most significant acquisition in its history. The new version of GHSC seeks to improve past execution through localization and a diversified vendor base. There are eight contracts in the NextGen GHSC initiative. On May 31st, USAID awarded the Control Tower contract to Deloitte for a ten-year $105 million contract. DAI, Crown Agents, Chemonics, and JSI recently won seats on the Comprehensive Technical Assistance award, with Panagora receiving a small business seat. USAID estimates that In-Country Logistics and Procurement Service Agent (PSA) HIV will be awarded in December 2024. The Integrated PSA is expected in December 2023, with the PSA Diagnostics estimated for May 2024. USAID released a revised RFP on June 16th for the Swift 6 IDIQ, estimated at $3+ billion. The government has conducted a preliminary evaluation of proposals submitted for Phase One of the solicitation and advised each firm if they are a viable competitor in the acquisition, inviting them to participate in Phase Two. Proposals are due on November 22, 2023. Precision has supported several aid and development providers with team buildouts and strategic hires to support capturing these critical future awards.

BOS Programs – V2X continues to perform on the Kaiserslautern Total Maintenance Contract while the government sorts through the previous award to Amentum. NAVFAC is preparing to bid out essential BOS programs, including Djibouti, Singapore, and Naples. CONUS BOS Air Force programs are undergoing recompetes, with one significant award in the first quarter. On August 1st, J&J Worldwide Services won a $38 million Operations & Maintenance contract for Lakenheath Air Force Base. According to GovTribe, Amentum received a $19 million task order through a BOS contract for Marine Corps Air Station Iwakuni, Japan. Alutiiq Logistics & Maintenance Services received a $20 million option for their Naval Air Station China Lake contract. On June 1st, V2X won a $17 million task order through its BOS contract with NSA Annapolis and the Naval Academy. Macdill and Maxwell Air Force bases remain under recompete. PTS has supported multiple BOS programs across North America, Europe, Africa, and Asia with Program Management and technical talent.

DHS – The Department of Homeland Security is increasing opportunities for government contractors through immigration support. Amentum recently won a $407 million immigration biometrics contract. FEMA and CISA awarded contracts to Deloitte and Accenture for system management. CBP awarded Leidos a $127 million Travelers Vetting Software through a Blanket Purchase Agreement. DHS’s third iteration of the Program Management, Administration, and Clerical Technical Services (PACTS) III is in the draft RFP stage. This IDIQ will be an aside for service-disabled veteran-owned small businesses, women-owned small businesses, historically underutilized business zones, and 8a businesses. MVM, Inc. currently holds the Unaccompanied Children and Family Unites Transportation Services contract worth $739 million. Only five months remain on the contract, with it currently being in source selection for phase one. PTS has supported clients with talent for Program Management, Case Management, Medical Support, and Capture for programs supporting the Office of Refugee Resettlement.

DTRA – Parsons won a $170 million task order to support DTRA with vulnerability assessment. The Threat Reduction Logistics Services II IDIQ contract solicitation closed on July 12th and has yet to be awarded. It holds a maximum value of $150 million. Culmen International serves as the incumbent. DTRA has a continuing requirement for Combating Weapons of Mass Destruction Research and Technology contracts. The estimated $4 billion IDIQ has yet to be awarded, with SAIC, Northrup Grumman, Alion Science and Technology, Peraton, Leidos, Raytheon, and Applied Research Associates serving as the incumbents. PTS has extensive experience with the niche technical requirements for DTRA programs and has deep pipelines of former military and government personnel.

DLA – The Defense Logistics Agency has a continuing requirement for Subsistence Prime Vendor Support for Iraq, Jordan, Kuwait, and Syria with an estimated $1.2 billion for five years of performance. It is also seeking food support for CONUS SPV, with the place of performance being Washington state. Valiant Integrated Services will continue to help DLA distribute food products to U.S. troops in Southwest Asia / UAE under a $530 million follow-on contract. PTS has deep roots in DLA Prime Vendor/TLS programs with an extensive procurement, supply chain, and Program Management talent network.

AFCAP V – The Air Force Contract Augmentation Program (AFCAP) provides the U.S. Government with a responsive, force multiplier option as the U.S. Government responds to global disorder. It can give contingency planning, deploying, training, and equipping forces along with contingency construction, logistics, commodities, and services. KBR, Inc. secured a U. S. Central Command (USCENTCOM) Support contract from AFCAP V to provide mission-critical labor. The contract has a ceiling value of $69 million and a two-year base period with an eight-month option. Amentum was also awarded a Task Order for emergency repairs following Hurricane Mawar on Guam. PTS has supported multiple AFCAP primes with cleared Engineering, Airfield, and Logistics talent.

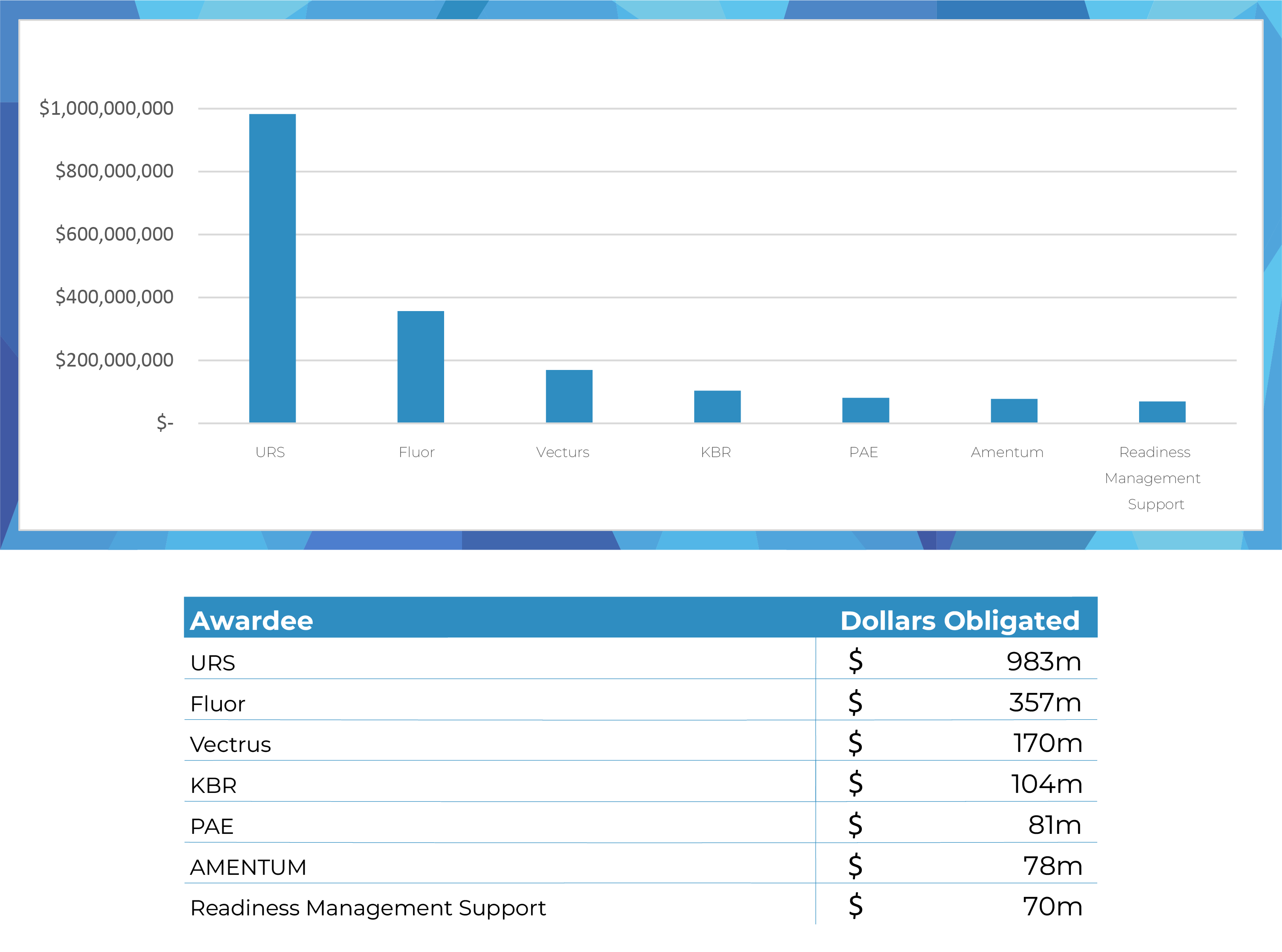

AFCAP V Spending to date – Air Force1

DoS Medical – The Department of State (DoS) Bureau of Medical Services seeks support centralizing oversight of its worldwide medical support platform. The Global Medical Support Services (GMSS) IDIQ contract remains in the Pre-Solicitation phase with an estimated $1.6 billion value. It remains to be seen if the Medical Support Services Iraq (MSSI) will be included in this new MATOC or tucked into DiPSS.

NSPA: The NATO Support and Procurement Agency maintains discretion regarding supporting Ukraine; they actively place regional requirements on contract. NSPA is leveraging its extensive experience in delivering health care solutions, temporary structures, and base-level support to provide multi-national humanitarian-focused contract support when tasked by NATO Nations and HQ. NSPA offers numerous NATO and nationally funded construction contracts throughout Europe. There is a requirement for Camp Support in Poland, demonstrating their commitment to enhancing NATO's capabilities. In collaboration with NATO HQ, NSPA plans and executes short-term and long-term Trust Funded projects, contributing to the alliance's goals and objectives. At the recent International Stability Operations Association Ukraine Conference, our NSPA Consultant, Jim Shields, led a panel discussing "Procurement Support to Ukraine, NATO, and the Region” and “Mobility Challenges.” Panelists underscored renewed coordination efforts to facilitate efficient cross-border transportation. NSPA works closely with Alliance Ministries of Defense to design Host Nation Support contracts. These contracts will provide NATO with regional, flexible convoy support packages that can be executed on short notice, enhancing our collective security. Contact our expert consultant, Jim Shields, for those needing assistance with NSPA projects.

PTS UPDATES

PTS Team – Albania Offsite 2023

PTS continues to invest in our technology as we deploy a new candidate submission portal to enhance our customer experience. This portal spotlights our assessment tool, video interview, career documentation, and candidate panel executive summaries, streamlining our client review experience.

In August, PTS was named #1593 on Inc. 5000’s Fastest Growing Private Companies, which was a climb from last year’s #4676 ranking. PTS continues to grow our team as we seek talented Account Executives to join our family.

As we grow our company, we continue to expand our Executive Search portfolio. This year, we’ve filled CEO, COO, CFO, CHRO, CMO, President, and Managing Director positions for companies ranging from $80 million to $2 billion in annual revenue. These placements occurred in the Defense, Aid & Development, and Diplomacy sectors of government contracting. You can find our current openings at pts.careers or through our LinkedIn page. Tereza Mershon and Aurore Jusufi lead our marketing efforts. They’ve brought PTS to new heights on LinkedIn with a high percentage of growth in the third quarter, leading to our 23,000 followers.

At the beginning of Q3, PTS held our second Senior Executive Networking Event at the Brass Rabbit in Arlington, VA. LTG (Ret.) Mike Howard served as our guest speaker for forty industry executives. The immense success of our third quarter is overshadowed by the greatest achievement of the summer, bringing our entire team together in person for the first time in PTS history.

State of the Talent Landscape:

Winning the war on talent continues to be the critical factor to success in Government Contracting. We continue to see high demand for Business Development professionals with a proven track record of winning. As we investigate 2024, PTS anticipates requirements for bilingual project management talent supporting projects in Eastern Europe and Ukraine. We see intense demand for cyber, intel, and AI technical talent with USG security clearances.

Many Government Contractors are adapting their policies regarding remote, hybrid, and return to office. We are seeing an increased trend in companies requiring employees to come to the office a few days per week. This creates a conundrum for companies that hired fully remote employees during the pandemic. Positions placed inside government agencies have much less flexibility. President Biden is driving government employees back into office. USAID mandates two days a week, while the DC Navy Yard asks for four days, especially for design meetings. Companies must remain current on government expectations and not delay offer letters and onboarding.

Whether you are a hiring manager seeking the best talent for your team or an industry professional looking for the next step in your career, we encourage you to join our community by following us on LinkedIn. Check out our Blog for industry news, career advice, and opportunities.