Q2 Industry Update

by Wills Hay | 10 Jul 2023

INDUSTRY TRENDS

America’s foreign policy continues to dictate near-term government expenditure overseas, mainly focusing on Ukraine. Ukraine started a large-scale offensive after stockpiling weapons and creating battalions of NATO-trained Ukrainian troops. After two years of inactivity related to Afghanistan, the U.S. government seeks to partner with contractors to evacuate over 150,000 Afghans left in-country. Western presence in Iraq remains limited, with the focal points being Erbil and Baghdad. The forthcoming awarding of the Iraq Task Order on the Diplomatic Platform Support Services contract in the third quarter of this year is poised to substantially affect Iraq's contracting landscape. Private Equity continues to play a pivotal role within the defense Acquisition space. The government contracting industry focuses on LOGCAP and USAID’s GHSC, with a keen interest in whether any contenders will emerge to challenge KBR, Fluor, Vectrus, Amentum, and Chemonics. Anticipated developments involving these significant Indefinite Delivery Indefinite Quantity (IDIQ) contracts should unfold in the third and fourth quarters, closely monitored by PTS.

UKRAINE continues to counter Russia while feuds unfold between Putin’s inner circle. The leader of Wagner PMC led a mutiny at the end of June, driving his forces from Ukraine through southeast Russia, before being waved off through negotiations with Belarusian President Lukashenko. At the London Ukraine Recovery Conference, the EU organizations signed six agreements for a €50 billion Ukraine Facility and €800 million in investments. This is only a small fraction of the estimated trillion dollars needed for reconstruction. In the short term, the United States continues to provide finance and equipment. USAID and the Department of State are doling out contracts in-country, while the Department of Defense provides equipment rather than supporting projects. Bizzell Corporation won a contract to supply the Ukrainian military with 100 Field Accommodation Dugouts for its border services. There is a requirement for a Pro-Integrity project worth upwards of $99 million with an estimated solicitation date of October 2023. Ukraine is fighting corruption through digital transformation. They were the first country to place all relevant personal documents for individuals online through the Diia app. Chemonics continues implementing the Partnership Fund for a Resilient Ukraine through the Foreign Commonwealth Development Office. Tetra Tech is managing the largest USAID energy and DOS demining contracts in-country. DevWorks International seeks major donor partners interested in creating a Ukraine agricultural processing cluster together with MoveUkraine and Fruktova Zirka LLC. The biggest needs in Ukraine are ammunition, de-mining, medical treatment of soldiers, housing, and agriculture. The interest remains small for US contractors with no history of working in Ukraine. USAID mostly chooses contractors or INGOs who have worked there for over a decade.

AFGHANISTAN remains a priority for the US government, seeking to support the relocation of roughly 150,000 vetted Afghans through the Special Immigrant Visa program. Health and Human Services awarded Parsons Corporation a seat on a $75 billion IDIQ contract to support influx care facility services. HHS is expected to work with the Department of State to facilitate the movement of personnel from Afghanistan to Qatar, where they will be sorted to European bases or the continental US.

IRAQ expects to receive three large awards in 2023, directly affecting the US diplomatic mission. The US Army Corps of Engineers released an amendment to the Master Planning Single Award Task Order Contract worth $24 million. It’s now expected to be awarded in July 2023. DOS announced that a new notional schedule will be provided for the DiPSS Mission Iraq Support Services (MISS) Task Order. The original release was scheduled for July 2023, with an award expected in December 2023. The DOS Medical Service Support Iraq II, worth $500 million, has been canceled. The current intention is to recompete on DiPSS pending market research. Future sources sought notices will be posted on sam.gov. The award was made to SOS International in February 2022, but in March 2022, the Agency issued a Stop Work Order. USAID seeks to support the Government of Iraq entities for an estimated $50-$100 million contract estimated to be awarded in July 2023.

PACIFIC remains on the backburner with Ukraine reconstruction conversations beginning. Several contracts are being issued for supply chain, facility maintenance, and fleet readiness. Arrow’s Edge LLC won a $200 million USN contract to support Fleet Readiness. Department of the Army, US Army Corps of Engineers (USACE), Japan Engineer District, requires Architect-Engineer services with U.S. Firms and Joint Ventures for U.S. and Host Nation Construction Projects in Japan. The IDIQ value tops off at $150 billion, with an estimated solicitation of October 2023.

MERGERS & ACQUISITIONS in the second quarter focused on digital services and ship fabrication. IBM Consulting completed its largest acquisition to date by purchasing digital services provider Octo Consulting. The transaction is valued at $1.25 billion, with 1,500 employees moving to IBM. Trident Maritime Systems acquired Custom Alloy Corporation's assets to enhance what it can offer the USN. Carlyle and private equity firm Stellex Capital Management completed the sale of Titan Acquisition Holdings, a bi-coastal ship repair services and fabrication company, to an affiliate of Lone Star Funds. Arlington Capital acquired Pegasus Steel LLC, a maker of complex fabricated steel structures for submarines, aircraft carriers, and other naval systems. CDW purchased Enquizit, an Amazon Web Services cloud services provider, to the public sector. Through a $100 million deal, Bernhard Capital Partners acquired VSE Corporation. Akima has finalized its purchase of Pinnacle Solutions to expand into the defense training and simulation business.

MAJOR PROGRAMS

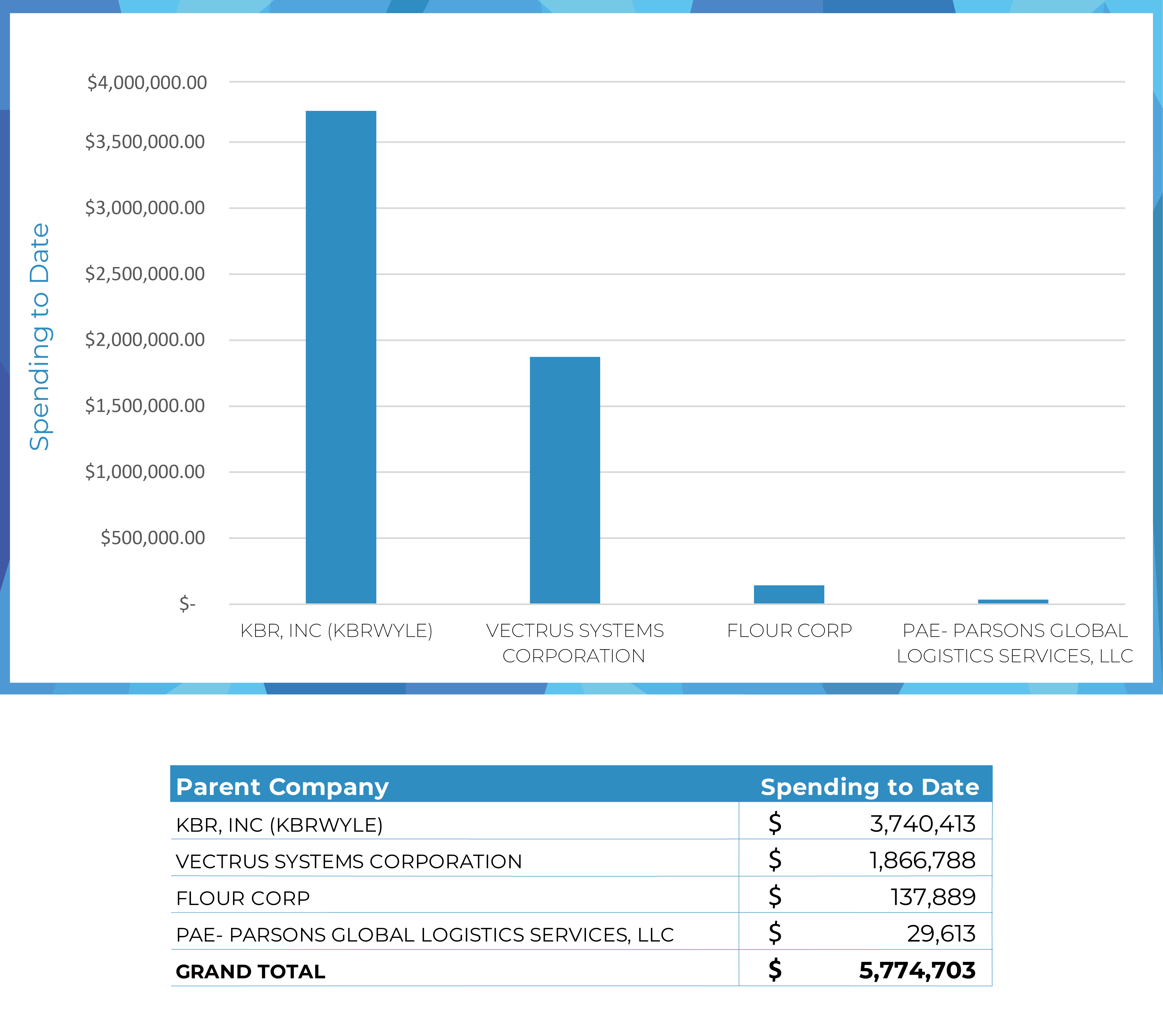

LOGCAP V – U.S. Army Sustainment Command will move contracted Care of Supplies in Storage Services (COSIS) used to support Army Prepositioned Stock (APS) from the Enhanced Army Global Logistics Enterprise basic ordering agreement (EAGLE BOA) to the Army’s Logistics Civil Augmentation Program Contract (LOGCAP). V2X, Fluor, KBR, and Amentum – Parsons maintain the four LOGCAP prime spots. APS COSIS task orders will be competed under these primes in 2023. PTS has roots in LOGCAP with extensive operational experience and a deep talent pool.

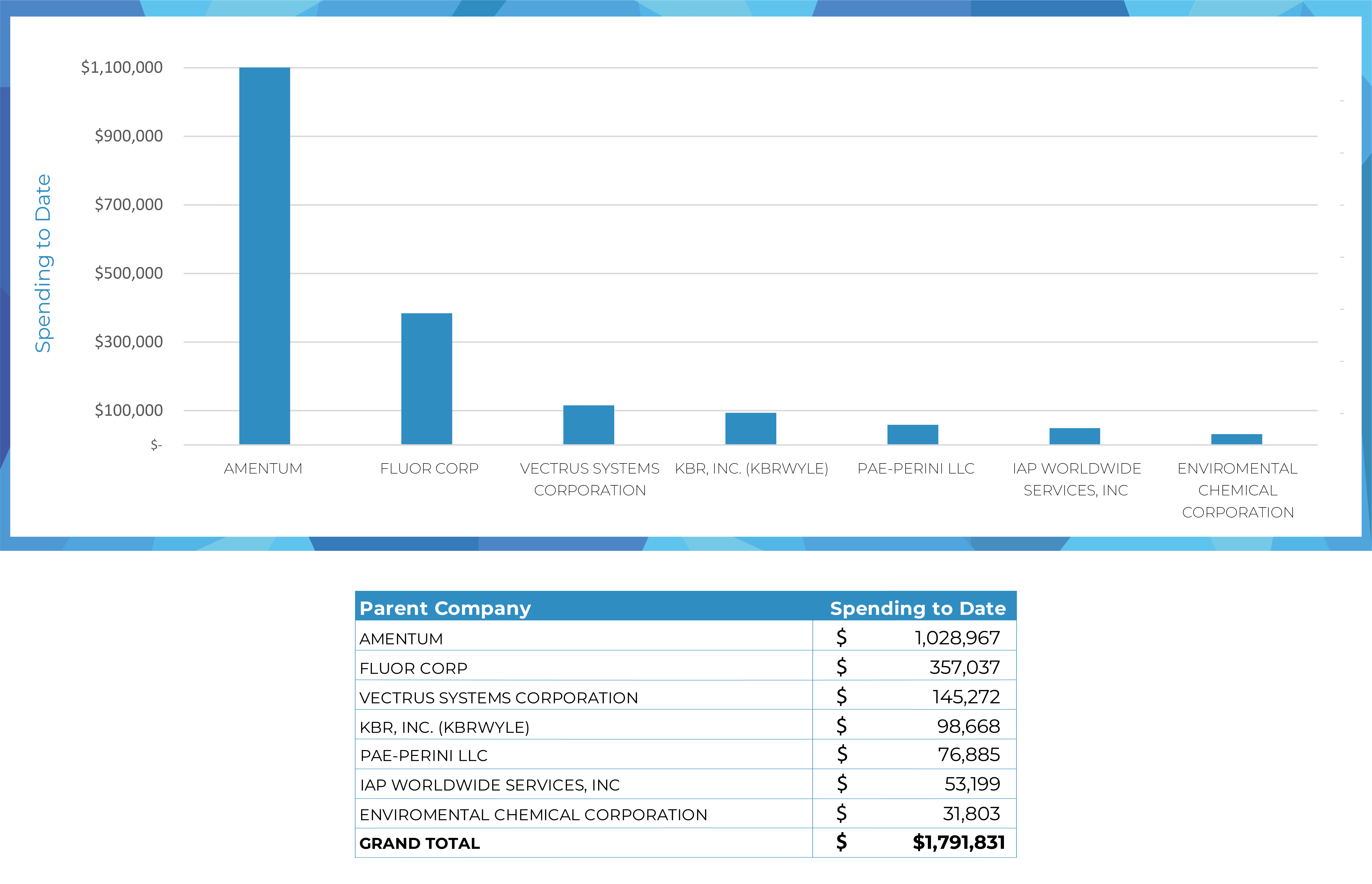

EAGLE II - Multiple vendors currently fulfill the Department of the Army, Army Sustainment Command's requirement for various services under the Enhanced Army Global Logistics Enterprise (EAGLE) Program. The Department of the Army, Army Materiel Command (AMC), and Army Sustainment Command (ASC) have an annual requirement for EAGLE Program. The total estimated is $913,000,000. SAM.Gov states that the Contracting Office released the Solicitation on June 29, 2023, with Proposals due July 31, 2023.

DiPSS – The Diplomatic Platform Support Services Total Small Business Set Aside award expects to be announced in July 2023. This IDIQ holds a value of $2.5 billion with five years of performance. DOS issued another draft of the DiPSS Mission Iraq Support Services (MISS) Task Order to support the US Embassy in Baghdad. The pending final RFP combines the Operations Maintenance Support Services (OMSS) and Baghdad Life Support Services (BLiSS) into a single Mission Iraq Support Services program. PTS has supported Embassy programs with Program Management and cleared trades.

GLOBALCAP – Africa Peacekeeping Operations (AFRICAP) and Global Peace Operations Initiative (GPOI) aim to bolster regional peace, security, and stability. These two DOS programs will now be recompeted under GLOBALCAP. Most recent estimates place August 2023 as the solicitation date, with an award in December 2023. The maximum value is expected to be $5 billion with a ten-year limit for a period of performance. PTS has supported multiple primes with DOS & Africa experts, training SMEs, program management talent, and Key Personnel requirements.

USAID – USAID has begun awarding its multi-billion-dollar Next Generation Global Health Supply Chain (GHSC) vehicle. On May 31st, Deloitte won the Control Tower contract worth $105 million for ten years. Deloitte will now support the management and implementation of the NextGen GHSC between multiple primes. Comprehensive Technical Assistance is expected to be awarded in July 2023, In-Country Logistics in September 2023, Integrated PSA and PSA HIV in December 2023, and PSA Diagnostics awarded in May 2024. GHSC seeks to replace the large award currently implemented by Chemonics to deliver USAID health programs worldwide. The Support Which Implements Fast Transitions (SWIFT) 6 IDIQ is designed to support US foreign policy objectives by catalyzing local initiatives. This large IDIQ of $3 billion should be awarded in August 2024. Chemonics International, Creative Associates International, DAI Global, Democracy International, Dexis Interactive, DT Global, Family Health International, and Management Systems International have won spots on the Programming for Peacebuilding and Prevention (P4P2) $800 million IDIQ to help USAID improve development outcomes in countries affected by conflict, fragility, and violence. Precision has supported several aid and development providers with team buildouts and strategic hires to support capturing these critical awards.

BOS Programs – The Total Maintenance Contract for Kaiserslautern will continue with V2X until the decision on Amentum’s award is adjudicated, with a decision estimated in November 2023. KBR’s Diego Garcia contract worth $550 million is expected to be recompeted in the fourth quarter of 2024. A similar contract worth $115 million is up for re-compete in Guam with an estimated solicitation date of January 2024. Naval Facilities Engineering Systems Command (NAVFAC) Pacific, Services Contracts Division is seeking information on establishing a follow-on contract for the Global Contingency Services IDIQ Contract. This contract sits in the Pre-RFP phase, with an expected solicitation August 2023. The contract is valued at $1.7 billion. CONUS BOS Air Force programs are undergoing recompetes, with one significant award in the first quarter. MacDill Air Force base is expected to be awarded in August 2023, Tyndall Air Force base in November 2023, and Maxwell Air Force base in July 2024. PTS has supported multiple BOS programs across North America, Europe, Africa, and Asia with Program Management and technical talent.

DHS – Department of Homeland Security (DHS) continues its IT modernization push. The Program Management, Administration, and Clerical Technical Services (PACTS) III sits in the Pre-RFP phase with an expected award date of August 2024. Along with IT modernization, DHS offers construction opportunities on the southern border. US Army Corps of Engineers requires Vertical Construction Services to support DHS programs in Texas, Arizona, New Mexico, and California. The contract has an expected award date of December 2023 with a $1.5 billion value. PTS has supported clients with talent for Program Management, Capture, and the Office of Refugee Resettlement (ORR).

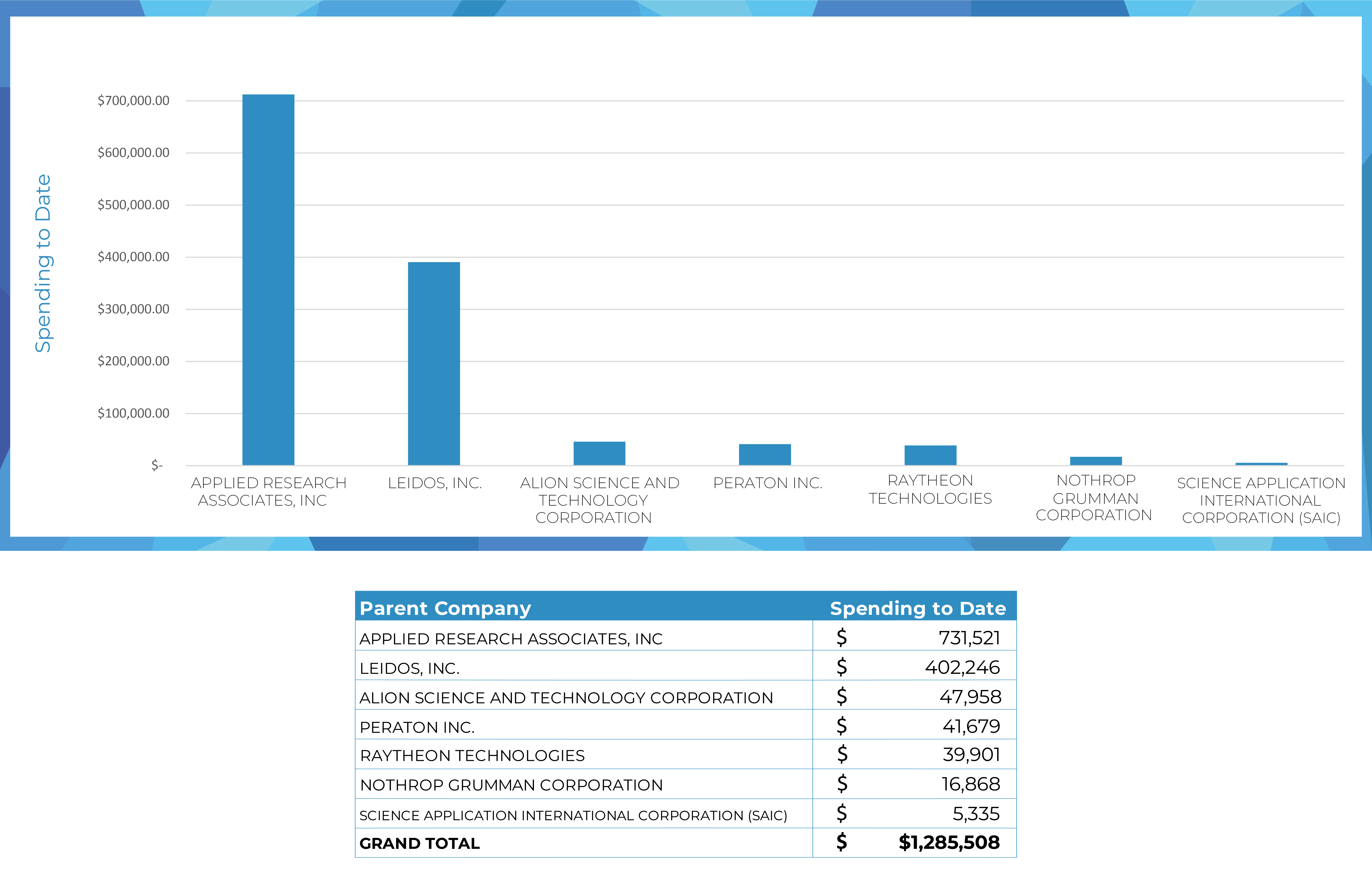

DTRA – Defense Threat Reductions Agency (DTRA) requires logistical support. The Threat Reduction Logistics Services II IDIQ contract has an expected award of December 2023. The contract’s maximum value has been raised to $325 million. Culmen International serves as the incumbent. DTRA has a continuing requirement for Combating Weapons of Mass Destruction Research and Technology contracts. The estimated $4 billion IDIQ will likely be awarded in November 2023. SAIC, Northrup Grumman, Alion Science and Technology, Peraton, Leidos, Raytheon, and Applied Research Associates serve as the incumbents. PTS understands the niche technical requirements for DTRA programs and has deep pipelines of former military and government personnel.

DLA – Defense Logistics Agency (DLA) requires OCONUS Subsistence Prime Vendor Support for Iraq, Jordan, Kuwait, and Syria with an estimated solicitation date of September 2023. The award is estimated at $1.2 billion, with KGL Food Services WLL serving as the incumbent. DLA requires C4ISR Tailored Logistics Support (TLS) valued at $30 million annually for an unspecified number of years. The RFP is expected to release in August 2023. PTS has deep roots in DLA Prime Vendor and TLS programs with an extensive procurement, supply chain, and Program Management talent network.

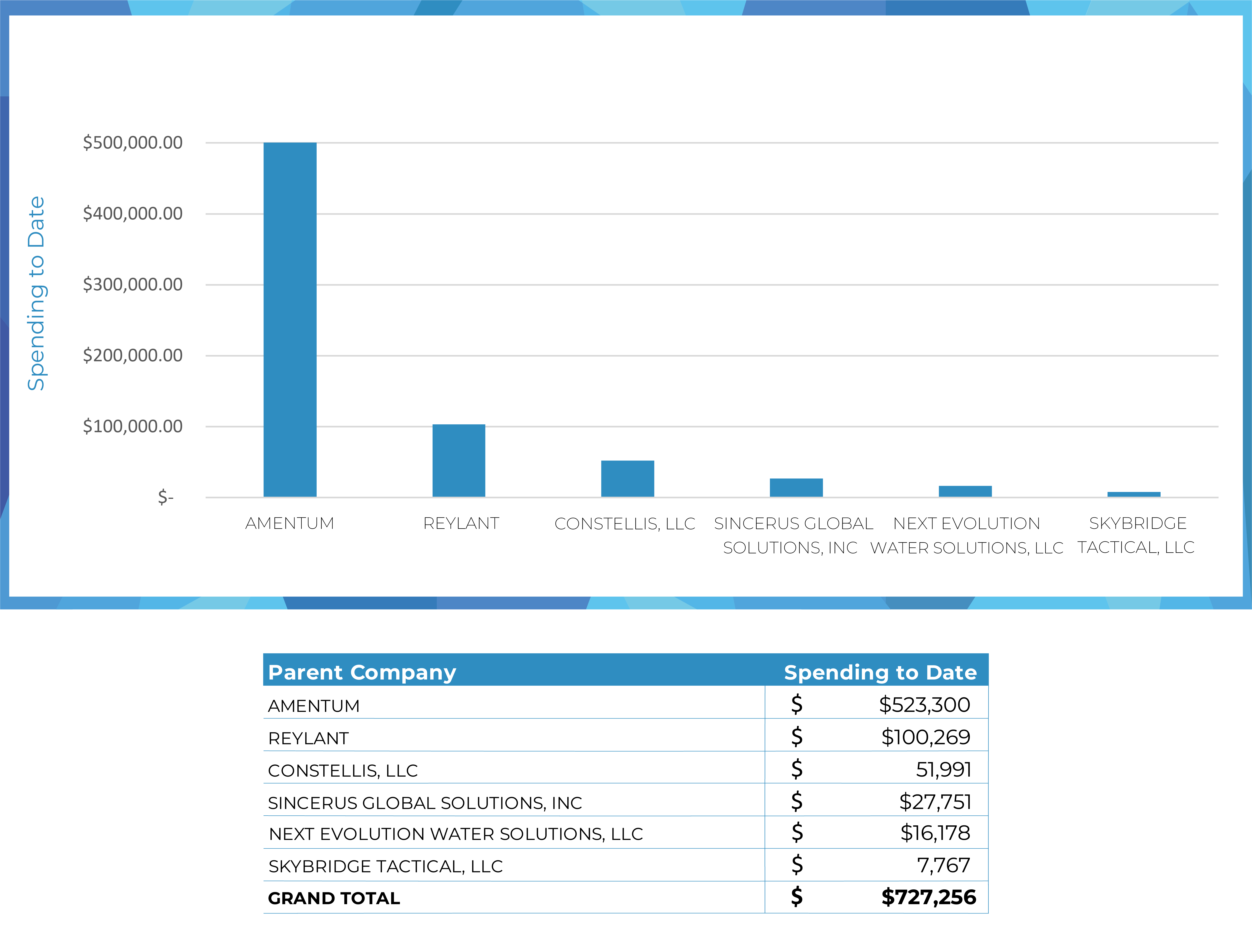

AFCAP V – The Air Force continues to look for opportunities to shift its organic “blue suiter” footprint while leveraging the Air Force Contract Augmentation Program (AFCAP) to provide contracted support. PTS has supported multiple AFCAP primes with Engineering, Airfield, and Logistics talent. Amentum recently received an Urgent & Compelling task order for engineering repair support in Guam. IAP and KBR won similar task orders for cleared escorts. PTS has supported multiple AFCAP primes with Engineering, Airfield, and Logistics talent.

ELITE – The Department of the Army, Army Forces Command, has a continuing requirement for European and African Theater Communications and IT Support. A Request for Information was released in April 2023 with an estimated Request for Proposal date of August 2023. The contract requires Communication and Information Technology Services, with CACI serving as the incumbent of the $1.1 billion contract.

DOS Medical – Department of State (DOS) Bureau of Medical Services seeks support centralizing oversight of its worldwide medical support platform. The Global Medical Support Services (GMSS) IDIQ contract holds an estimated $1.6 billion value with a solicitation date of July 2023 and an anticipated award in December 2023. It remains to be seen if the Medical Support Services Iraq (MSSI) will be included in this new MATOC or tucked into DiPSS.

NATO/NSPA: In June, the Consortium of 25+ Nations that comprise NATO’s Operational Logistics Support Partnership convened a Host Nation Support Industry at NSPA in Capellen, Luxembourg. This signals a serious new initiative to close national gaps with standard logistic solutions that can meet emerging crises' needs and timelines. Unique focus areas include Convoy Support Centers and Deployable Infrastructure for Arctic Climate conditions. Traditional support suppliers to the US Military should be alert to a shift by USEUCOM and USAEUR to leverage NSPA contracting capabilities. With a tentative RFP date of 24 July, NSPA will offer a new QA contract to inspect around 100 types of miscellaneous Army Combat Vehicles, Tactical Vehicles, and Ground Support Equipment. This requirement serves the USAREUR-AF 21st Theatre Support Command. The primary place of performance is Kaiserslautern, Vilseck/Grafenwoehr, Germany, and other locations within Europe. In July, we can also expect the release of an RFP for Architectural & Engineering Services at a Lubliniec Military Base in Poland. The contract for Multimodal Strategic Transportation Services within Europe will be released. NSPA’s Medical Team continues actively promoting new projects this summer with RFPs for Deployable Medical Treatment Facilities (for Italy) and Fire Protection & Emergency Medical Services (Bondsteel, Kosovo). A requirement for Contracted Logistic Support (CLS) for Medical Treatment Facilities (Deployable Role 2 Basic, Modular Biocontainment Complex) is expected in September. For military training providers, NSPA’s Aviation Support Programs have announced both rotary wing and NATO MRTT flight training contract opportunities for release this summer. Contact Jim Shields (jim@pts.careers) to learn how your company can fulfill these NATO requirements.

Precision Talent Solutions’ UPDATES

Last quarter, PTS launched our new website on www.pts.careers. It provides a complete roundup of our offerings, experience, and industry updates. PTS keeps our clients and candidates informed through a mixture of newsletters, program updates, and blog posts. We employ our new website to highlight the following:

- Testimonials

Dan Corbett, CEO of Valiant Integrated Services, “Precision Talent Solutions is the best of the best. I've had the pleasure of working with them for over a decade now, helping us recruit various key personnel, including proposal leads, PMs, executives, and others. They are experts at finding the highly talented unicorns in our industry. A huge thanks to Jake Frazer and the entire PTS team for their partnership over the years!”

- C-Suite Offerings

PTS provides a fully retained, highly consultative search to bring you top industry talent. We partner closely with executive stakeholders for C-Suite roles to understand the positions' rationale and translate that understanding into a comprehensive search.

- Teammates

We approach team building with the desire to create a diverse ecosystem of experiences that aligns with the needs of our candidates and customers. We carefully select professionals with extensive backgrounds in operations, business development, shared services, and talent acquisition to provide depth and perspective. Our team includes Program Managers, Human Resources Executives, Solutions Architects, Information Technology Technicians, Project Control Specialists, Finance Managers, Site Managers, Special Project Coordinators, and Senior Operations Coordinators. The functional, geographical, and ethnic diversity allows us to understand better our customers' requirements and the qualifications of our candidates to ensure we get the best fit.

PTS Sponsored Events

Precision Talent Solutions hosted its inaugural Senior Industry Leaders Networking Event on June 21st at the Brass Rabbit. We welcomed 45 executives from across the government contracting industry. LTG (Ret.) Michael Howard was our guest speaker, sharing his insights on Ukraine and the contracting landscape. PTS loves bringing the industry together, and we look forward to our next Senior Industry Leaders Networking Event on the heels of AUSA.

*Senior Industry Leaders Networking Event - June 21st, Brass Rabbit

Industry-Related Events:

- Intelligence & National Security Summit – 7/13

- International Defence Industry Fair – 7/25

- ISOA Ukraine Conference – 9/12

- Armored Vehicles Eastern Europe – 9/26

- AUSA Annual Meeting & Exposition – 10/9

- PSC Defense Conference – 10/19

State of the Talent Landscape:

Precision Talent Solutions holds a unique perspective on the government contracting job market. We work diligently to match talented individuals with prospective employers. Our vantage point provides a nuanced understanding of the talent landscape. Within the second quarter, we saw an increase in Business Development roles. We assess this trend will carry into the third quarter as going organizations position themselves for growth.

Multiple factors go into a hiring decision. Organizations may have an immediate need or see one on the horizon. For government contractors, it is essential to keep their opportunity pipelines stocked. PTS receives constant requests to find business development talent to mine and win these opportunities. Capture Manager, Director of Business Development, Proposal Writer, Key Personnel Recruiter, Account Executive, Chief Growth Officer, Vice President of Business Development, and similar growth roles come across our desks weekly.

While we work with organizations to find talent, we work equally hard to ensure job seekers find their desired match. The first half of 2023 had companies begin the break from remote work. We’ve seen it slowly creep back into a mandated two or three days in the office. This trend follows President Biden’s stated desire for all federal employees from remote work. PTS recognizes the challenge this place on HR departments. We understand both parties' desires and work diligently to find common ground. Whether you’re an organization seeking growth in business development or a professional looking for a new opportunity Precision Talent Solutions is here to help.

Contact our Chief Growth Officer, Michael Stambaugh, michael@pts.careers, to learn how we can help you navigate the talent landscape.

DHS, HHS, DOS, DOD, LOGCAP, USAID, DLA